Vintage video game investing targets a niche market driven by nostalgia and the rising demand for rare cartridges and consoles, often yielding high returns within short periods due to limited supply and passionate collectors. Antique toy investing focuses on age-old playthings made from materials like tin and wood, appealing to collectors valuing historical craftsmanship and provenance, typically appreciating steadily over time. Explore the unique opportunities and risks in each investment avenue to make informed decisions.

Why it is important

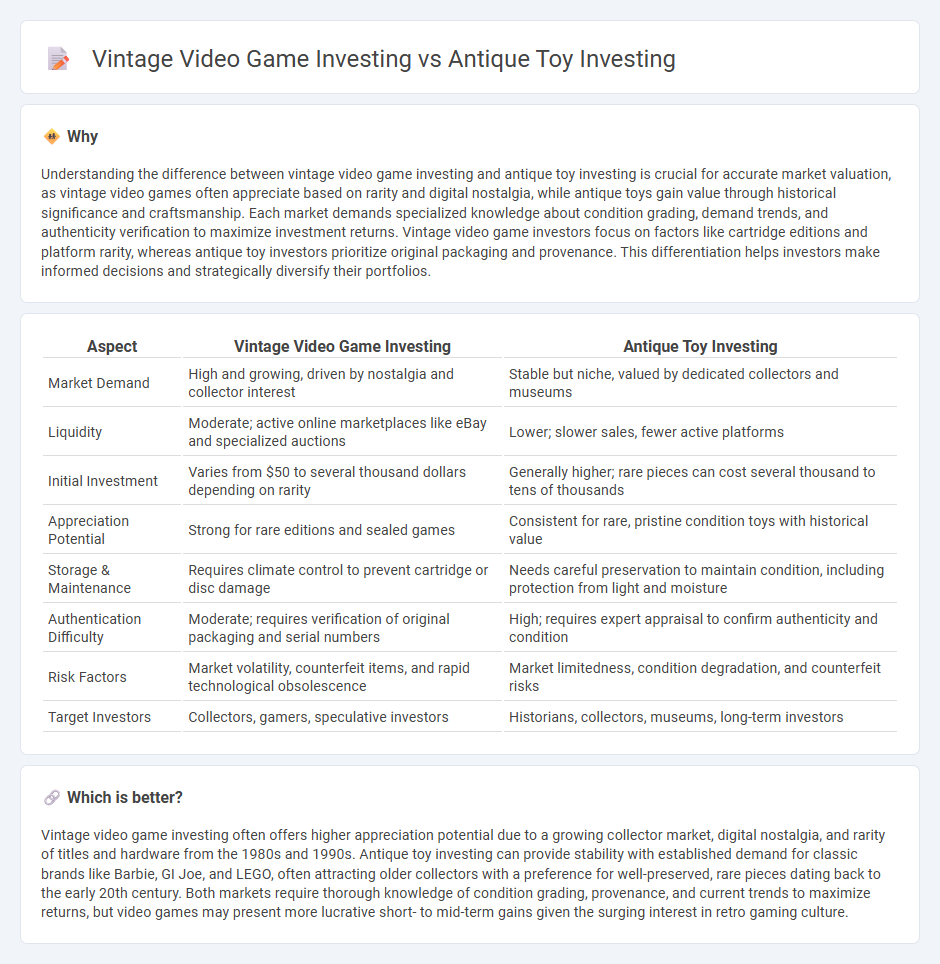

Understanding the difference between vintage video game investing and antique toy investing is crucial for accurate market valuation, as vintage video games often appreciate based on rarity and digital nostalgia, while antique toys gain value through historical significance and craftsmanship. Each market demands specialized knowledge about condition grading, demand trends, and authenticity verification to maximize investment returns. Vintage video game investors focus on factors like cartridge editions and platform rarity, whereas antique toy investors prioritize original packaging and provenance. This differentiation helps investors make informed decisions and strategically diversify their portfolios.

Comparison Table

| Aspect | Vintage Video Game Investing | Antique Toy Investing |

|---|---|---|

| Market Demand | High and growing, driven by nostalgia and collector interest | Stable but niche, valued by dedicated collectors and museums |

| Liquidity | Moderate; active online marketplaces like eBay and specialized auctions | Lower; slower sales, fewer active platforms |

| Initial Investment | Varies from $50 to several thousand dollars depending on rarity | Generally higher; rare pieces can cost several thousand to tens of thousands |

| Appreciation Potential | Strong for rare editions and sealed games | Consistent for rare, pristine condition toys with historical value |

| Storage & Maintenance | Requires climate control to prevent cartridge or disc damage | Needs careful preservation to maintain condition, including protection from light and moisture |

| Authentication Difficulty | Moderate; requires verification of original packaging and serial numbers | High; requires expert appraisal to confirm authenticity and condition |

| Risk Factors | Market volatility, counterfeit items, and rapid technological obsolescence | Market limitedness, condition degradation, and counterfeit risks |

| Target Investors | Collectors, gamers, speculative investors | Historians, collectors, museums, long-term investors |

Which is better?

Vintage video game investing often offers higher appreciation potential due to a growing collector market, digital nostalgia, and rarity of titles and hardware from the 1980s and 1990s. Antique toy investing can provide stability with established demand for classic brands like Barbie, GI Joe, and LEGO, often attracting older collectors with a preference for well-preserved, rare pieces dating back to the early 20th century. Both markets require thorough knowledge of condition grading, provenance, and current trends to maximize returns, but video games may present more lucrative short- to mid-term gains given the surging interest in retro gaming culture.

Connection

Vintage video game investing and antique toy investing share a common foundation in nostalgia-driven market demand, where collectors value rare and well-preserved items from past decades. Both markets rely on scarcity, condition, and cultural significance to determine investment potential and price appreciation. These similarities create opportunities for investors to diversify portfolios by targeting collectible assets with enduring appeal and strong community engagement.

Key Terms

Antique toy investing:

Antique toy investing capitalizes on rare, well-preserved items from the late 19th to mid-20th century, such as tin wind-up toys, cast-iron banks, and original Barbie dolls, often fetching substantial returns due to their historical significance and scarcity. Provenance, condition grading, and manufacturer reputation significantly influence value, with collectors prioritizing brands like Steiff, Marklin, and early Mattel products. Explore our detailed guide to master antique toy valuations and uncover investment opportunities.

Provenance

Antique toy investing emphasizes provenance through detailed historical documentation and original packaging, which significantly enhance collectible value. Vintage video game investing prioritizes cartridge authenticity, console compatibility, and verifiable gameplay history to establish provenance. Explore in-depth strategies to authenticate and maximize investment returns in both markets.

Rarity

Antique toys often hold value due to their exceptional rarity, with limited productions and unique craftsmanship dating back over a century, making them highly coveted by collectors. Vintage video games gain worth primarily through scarcity of original cartridges, rare editions, and unopened packaging from the 1980s and 1990s, fueling strong demand in niche gaming communities. Explore the distinctive rarity factors and market dynamics shaping investment potential in both antique toys and vintage video games.

Source and External Links

10 Toys That Could Make a Good Investment - SmartAsset - Antique toy investing often focuses on vintage action figures, limited edition dolls, and rare LEGO sets that appreciate significantly in value over time, especially if kept in their original packaging, with examples like a mint-condition Boba Fett action figure selling for nearly $186,000.

Vintage Toy Appraisal Guide: From Keepsakes to Collectibles - Investing in antique toys requires understanding their rarity, craftsmanship, and evidence like manufacturing marks; professional grading can enhance value assessment even without the original packaging, and informed research and expert advice improve investment success.

Antique Toys, Vintage Toys, and One-Of-A-Kind Toys as an Investment - The highest value antique toys are often those in unopened, original packaging, particularly rare finds from attics or closed stores, with limited editions and exceptional condition driving their collectible and investment worth.

dowidth.com

dowidth.com