Royalty streaming involves acquiring rights to future revenue streams from intellectual property or natural resources, offering consistent income without operational control. Private equity investments focus on acquiring equity stakes in private companies, aiming for value appreciation through active management and eventual exit strategies. Explore these investment strategies to understand their risk profiles and potential returns.

Why it is important

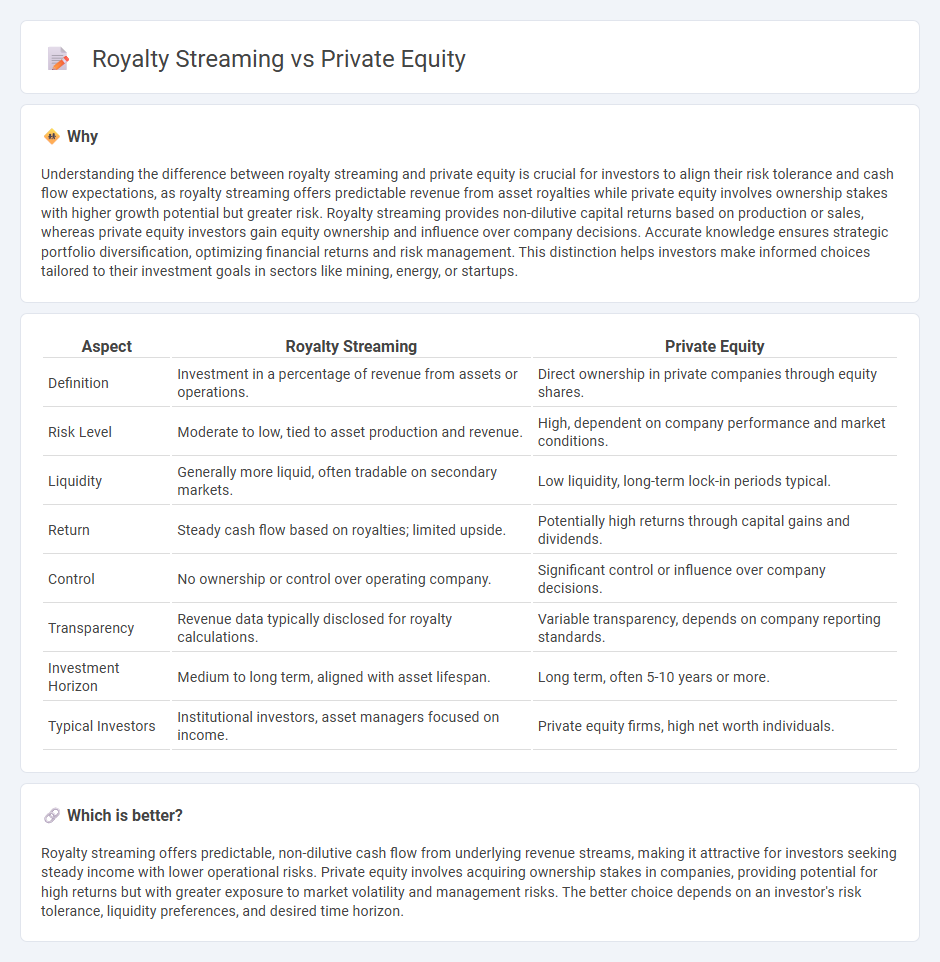

Understanding the difference between royalty streaming and private equity is crucial for investors to align their risk tolerance and cash flow expectations, as royalty streaming offers predictable revenue from asset royalties while private equity involves ownership stakes with higher growth potential but greater risk. Royalty streaming provides non-dilutive capital returns based on production or sales, whereas private equity investors gain equity ownership and influence over company decisions. Accurate knowledge ensures strategic portfolio diversification, optimizing financial returns and risk management. This distinction helps investors make informed choices tailored to their investment goals in sectors like mining, energy, or startups.

Comparison Table

| Aspect | Royalty Streaming | Private Equity |

|---|---|---|

| Definition | Investment in a percentage of revenue from assets or operations. | Direct ownership in private companies through equity shares. |

| Risk Level | Moderate to low, tied to asset production and revenue. | High, dependent on company performance and market conditions. |

| Liquidity | Generally more liquid, often tradable on secondary markets. | Low liquidity, long-term lock-in periods typical. |

| Return | Steady cash flow based on royalties; limited upside. | Potentially high returns through capital gains and dividends. |

| Control | No ownership or control over operating company. | Significant control or influence over company decisions. |

| Transparency | Revenue data typically disclosed for royalty calculations. | Variable transparency, depends on company reporting standards. |

| Investment Horizon | Medium to long term, aligned with asset lifespan. | Long term, often 5-10 years or more. |

| Typical Investors | Institutional investors, asset managers focused on income. | Private equity firms, high net worth individuals. |

Which is better?

Royalty streaming offers predictable, non-dilutive cash flow from underlying revenue streams, making it attractive for investors seeking steady income with lower operational risks. Private equity involves acquiring ownership stakes in companies, providing potential for high returns but with greater exposure to market volatility and management risks. The better choice depends on an investor's risk tolerance, liquidity preferences, and desired time horizon.

Connection

Royalty streaming and private equity intersect through their shared focus on generating steady income streams by acquiring rights or equity stakes in businesses. Royalty streaming involves purchasing the rights to a percentage of revenue or profits from assets like intellectual property or natural resources, while private equity invests directly in companies to influence growth and profitability. Both strategies provide investors with diversified exposure and potential for capital appreciation by leveraging operational efficiencies and market opportunities.

Key Terms

Ownership Equity

Private equity involves acquiring ownership equity by purchasing shares or stakes in a company, granting investors voting rights and potential dividends based on company performance. In contrast, royalty streaming provides investors with a passive income stream derived from a percentage of revenue or production without ownership or control over the company. Explore deeper insights into how ownership equity impacts investor rights and returns in both models.

Royalty Payment

Royalty streaming involves upfront capital investment in exchange for a percentage of future revenue generated by an asset, providing consistent royalty payments without equity ownership risks. Private equity investments, conversely, require buying equity stakes, exposing investors to company performance fluctuations and potential control over operations. Explore the nuances of royalty payment structures and strategic benefits to understand which investment aligns best with your financial goals.

Exit Strategy

Private equity exit strategies typically involve selling portfolio companies through initial public offerings (IPOs), mergers, or acquisitions to realize returns within a 5-10 year horizon. Royalty streaming exit approaches focus on monetizing ongoing royalty payments, often through securitization or secondary market sales, enabling liquidity without relinquishing asset control. Explore detailed comparisons of these exit strategies to optimize investment decisions and maximize returns.

Source and External Links

Private equity - Wikipedia - Private equity (PE) involves purchasing stock in private companies (not publicly traded) through investment funds managed by general partners who raise capital from institutional limited partners to generate returns via strategies like revenue growth and margin expansion, typically over a 4-7 year horizon.

What is Private Equity? - BVCA - Private equity is medium to long-term financing acquiring equity stakes in mature companies to drive sustainable growth through active management collaboration, operational improvements, and governance enhancements, generally holding investments for 4-7 years before exit.

Private Equity: What You Need to Know - KKR - Private equity fund managers invest in non-public companies with strategies such as strengthening management, improving operations, and optimizing capital structure to generate returns and diversify beyond shrinking public markets.

dowidth.com

dowidth.com