Music royalties investment offers consistent, long-term cash flows derived from copyrighted music assets, providing a unique alternative to traditional private equity, which involves equity stakes in private companies with higher risk and variable returns. Unlike private equity's dependence on operational performance and exit events, music royalties generate income from established intellectual property, often exhibiting lower correlation with broader market fluctuations. Explore deeper insights to understand which investment aligns best with your portfolio goals.

Why it is important

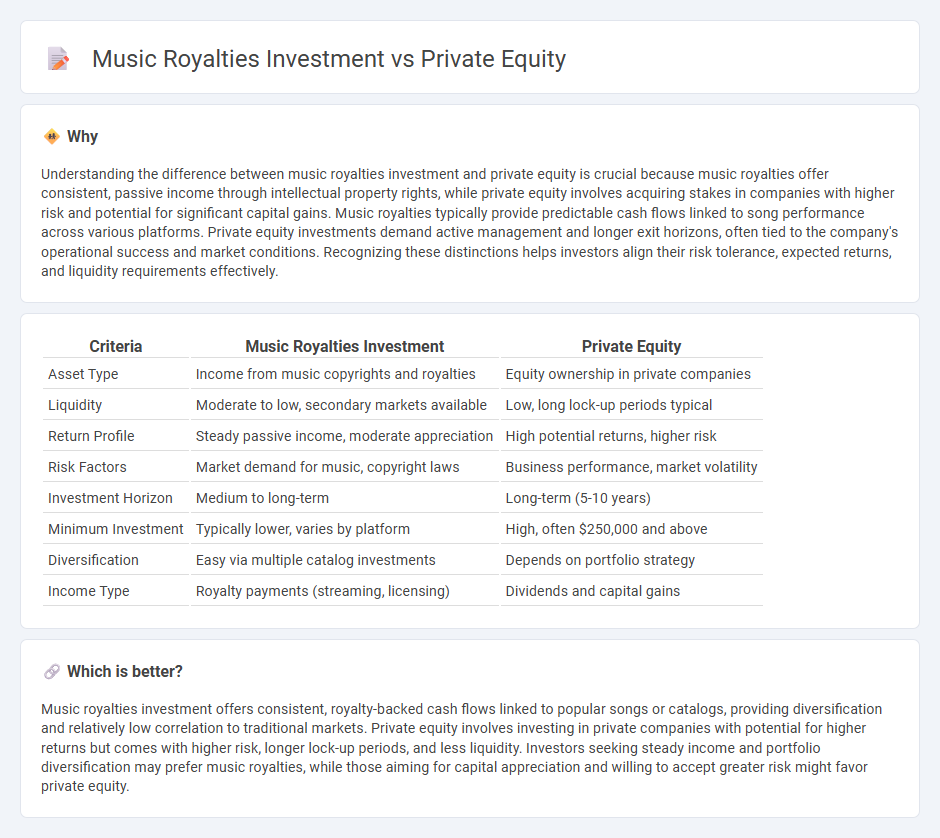

Understanding the difference between music royalties investment and private equity is crucial because music royalties offer consistent, passive income through intellectual property rights, while private equity involves acquiring stakes in companies with higher risk and potential for significant capital gains. Music royalties typically provide predictable cash flows linked to song performance across various platforms. Private equity investments demand active management and longer exit horizons, often tied to the company's operational success and market conditions. Recognizing these distinctions helps investors align their risk tolerance, expected returns, and liquidity requirements effectively.

Comparison Table

| Criteria | Music Royalties Investment | Private Equity |

|---|---|---|

| Asset Type | Income from music copyrights and royalties | Equity ownership in private companies |

| Liquidity | Moderate to low, secondary markets available | Low, long lock-up periods typical |

| Return Profile | Steady passive income, moderate appreciation | High potential returns, higher risk |

| Risk Factors | Market demand for music, copyright laws | Business performance, market volatility |

| Investment Horizon | Medium to long-term | Long-term (5-10 years) |

| Minimum Investment | Typically lower, varies by platform | High, often $250,000 and above |

| Diversification | Easy via multiple catalog investments | Depends on portfolio strategy |

| Income Type | Royalty payments (streaming, licensing) | Dividends and capital gains |

Which is better?

Music royalties investment offers consistent, royalty-backed cash flows linked to popular songs or catalogs, providing diversification and relatively low correlation to traditional markets. Private equity involves investing in private companies with potential for higher returns but comes with higher risk, longer lock-up periods, and less liquidity. Investors seeking steady income and portfolio diversification may prefer music royalties, while those aiming for capital appreciation and willing to accept greater risk might favor private equity.

Connection

Music royalties investment offers steady cash flow by acquiring rights to music catalogs, which complements private equity's approach of investing in undervalued assets for long-term growth. Private equity funds increasingly diversify portfolios by including music royalties, leveraging predictable royalty income to enhance returns and mitigate traditional market risks. This synergy enables investors to benefit from both the stable income of royalties and the capital appreciation potential of private equity ventures.

Key Terms

Ownership stake

Private equity investments grant ownership stakes in companies, allowing investors to influence business decisions and benefit from company growth and profits. Music royalties investments provide a share of revenue generated from music rights, offering ongoing income without direct control over the artist or catalog. Explore the key differences to determine which investment aligns best with your financial goals.

Revenue streams

Private equity investments generate revenue primarily through capital gains, dividends, and management fees derived from ownership stakes in private companies with potential for business growth and profitability. Music royalties investment produces income from licensing agreements, streaming services, and public performance rights, offering a more consistent and passive revenue stream tied to the usage and popularity of musical works. Explore the distinct income models and risk profiles of these asset classes to determine which aligns best with your investment goals.

Liquidity

Private equity investments often require extended lock-up periods, limiting liquidity and making quick capital access difficult. Music royalties typically provide more consistent cash flow with quicker liquidity options through secondary markets. Explore our detailed guide to discover which investment suits your liquidity needs best.

Source and External Links

Private equity - Wikipedia - Private equity involves investment managers raising funds from institutional investors to buy equity stakes in private companies, using equity and debt to generate returns primarily through revenue growth, margin expansion, cash flow, and valuation multiple expansion over typically a 4-7 year horizon.

What is Private Equity? - BVCA - Private equity is medium- to long-term finance providing equity stakes in unquoted companies, supporting business growth through close collaboration with management and active ownership, usually holding investments for four to seven years before exiting.

Private Equity Funds | Investor.gov - Private equity funds pool investors' money to acquire controlling interests in companies and actively manage their growth, typically with long-term investment horizons of 10 or more years, and are not publicly registered or subject to disclosure requirements.

dowidth.com

dowidth.com