Patent monetization transforms intellectual property into revenue streams by selling or licensing patents, providing immediate capital or ongoing income. Royalty financing offers funds in exchange for future royalty payments, aligning investor returns directly with the commercial success of an innovation. Explore the distinct financial strategies and benefits of patent monetization versus royalty financing to optimize your investment decisions.

Why it is important

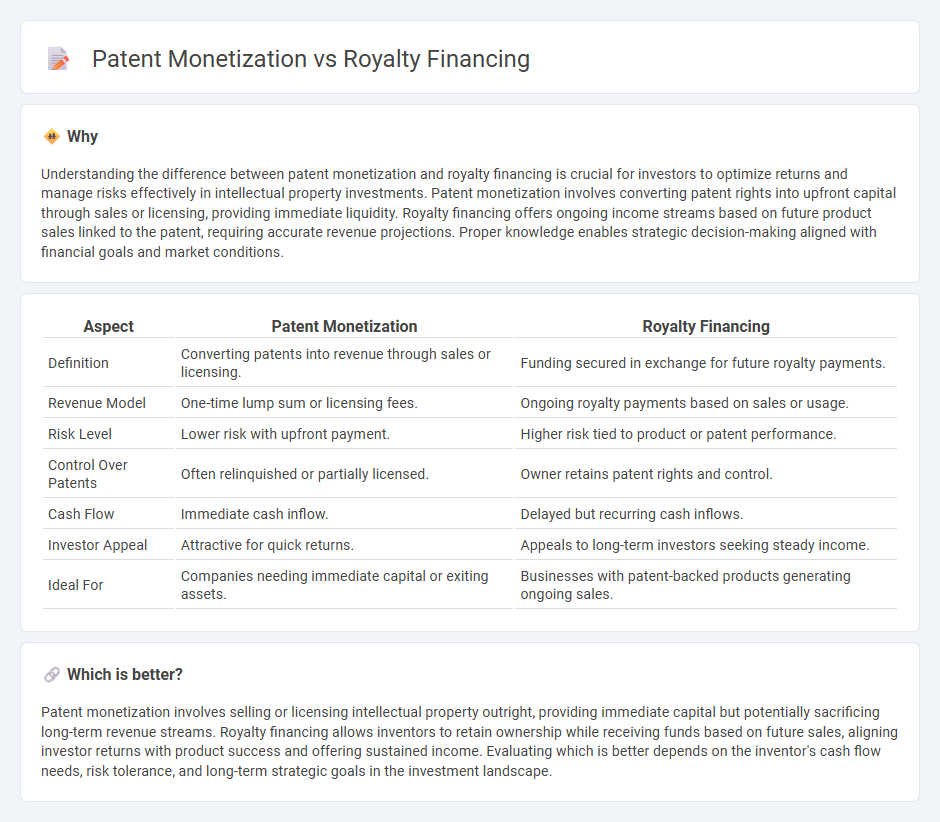

Understanding the difference between patent monetization and royalty financing is crucial for investors to optimize returns and manage risks effectively in intellectual property investments. Patent monetization involves converting patent rights into upfront capital through sales or licensing, providing immediate liquidity. Royalty financing offers ongoing income streams based on future product sales linked to the patent, requiring accurate revenue projections. Proper knowledge enables strategic decision-making aligned with financial goals and market conditions.

Comparison Table

| Aspect | Patent Monetization | Royalty Financing |

|---|---|---|

| Definition | Converting patents into revenue through sales or licensing. | Funding secured in exchange for future royalty payments. |

| Revenue Model | One-time lump sum or licensing fees. | Ongoing royalty payments based on sales or usage. |

| Risk Level | Lower risk with upfront payment. | Higher risk tied to product or patent performance. |

| Control Over Patents | Often relinquished or partially licensed. | Owner retains patent rights and control. |

| Cash Flow | Immediate cash inflow. | Delayed but recurring cash inflows. |

| Investor Appeal | Attractive for quick returns. | Appeals to long-term investors seeking steady income. |

| Ideal For | Companies needing immediate capital or exiting assets. | Businesses with patent-backed products generating ongoing sales. |

Which is better?

Patent monetization involves selling or licensing intellectual property outright, providing immediate capital but potentially sacrificing long-term revenue streams. Royalty financing allows inventors to retain ownership while receiving funds based on future sales, aligning investor returns with product success and offering sustained income. Evaluating which is better depends on the inventor's cash flow needs, risk tolerance, and long-term strategic goals in the investment landscape.

Connection

Patent monetization transforms intellectual property into revenue streams by licensing or selling rights, while royalty financing provides upfront capital in exchange for a percentage of future patent-generated income. Both strategies enable inventors and companies to unlock the financial value of patents without relinquishing ownership. Integrating these approaches optimizes cash flow and enhances investment potential within the innovation ecosystem.

Key Terms

Revenue Share

Royalty financing involves investors providing capital to companies in exchange for a percentage of future revenue generated by products or services, aligning investor returns directly with sales performance. Patent monetization focuses on leveraging intellectual property rights to generate income through licensing deals, sales, or strategic partnerships, often resulting in a more fixed or upfront revenue structure. Discover how these approaches impact your business's revenue share and long-term financial strategy.

Intellectual Property Rights

Royalty financing leverages Intellectual Property Rights (IPR) by providing capital in exchange for a percentage of future revenue generated from patented technologies, enabling firms to fund innovation without diluting equity. Patent monetization involves actively licensing, selling, or enforcing patents to generate direct income, maximizing the commercial value of intellectual property assets. Explore detailed strategies and legal frameworks to optimize IP-based financial outcomes.

Licensing Agreement

Royalty financing involves securing capital by pledging future royalty revenues from intellectual property, whereas patent monetization through licensing agreements entails granting rights to third parties to use the patent in exchange for fees or royalties. Licensing agreements are pivotal, outlining terms such as scope, duration, royalty rates, and exclusivity, directly impacting the monetization success and legal protections. Explore the nuances of licensing agreements to optimize your patent's financial potential and secure strategic IP partnerships.

Source and External Links

Royalty Financing: Unlocking Value in the Life Sciences - Royalty financing is a form of capital raising where a company receives funds upfront in exchange for a small percentage of its future revenues or cash flows, providing a flexible alternative to traditional debt or equity financing without diluting ownership.

Royalty Financing: A New Source of Capital in Mining, Tech and Beyond - This financing method involves a lump sum investment in return for a share of future revenues or profits, benefiting companies that want capital but wish to avoid dilution of control, increasingly popular in tech and life sciences industries.

Royalty Financing: An Appealing Alternative to Traditional Life Sciences Funding - Royalty financing offers investors quicker returns compared to equity by receiving a percentage of future product sales or existing royalty streams, while providing biotech firms and nonprofits a way to fund development or monetize royalty rights.

dowidth.com

dowidth.com