Fractionalized art investment offers access to high-value artworks by allowing investors to purchase shares of pieces, enhancing liquidity and diversification compared to traditional art collecting. Sports memorabilia investing centers on acquiring rare items like autographed jerseys or game-used equipment, often driven by fan passion and market demand. Explore the unique benefits and risk profiles of these investment avenues to determine which aligns with your portfolio goals.

Why it is important

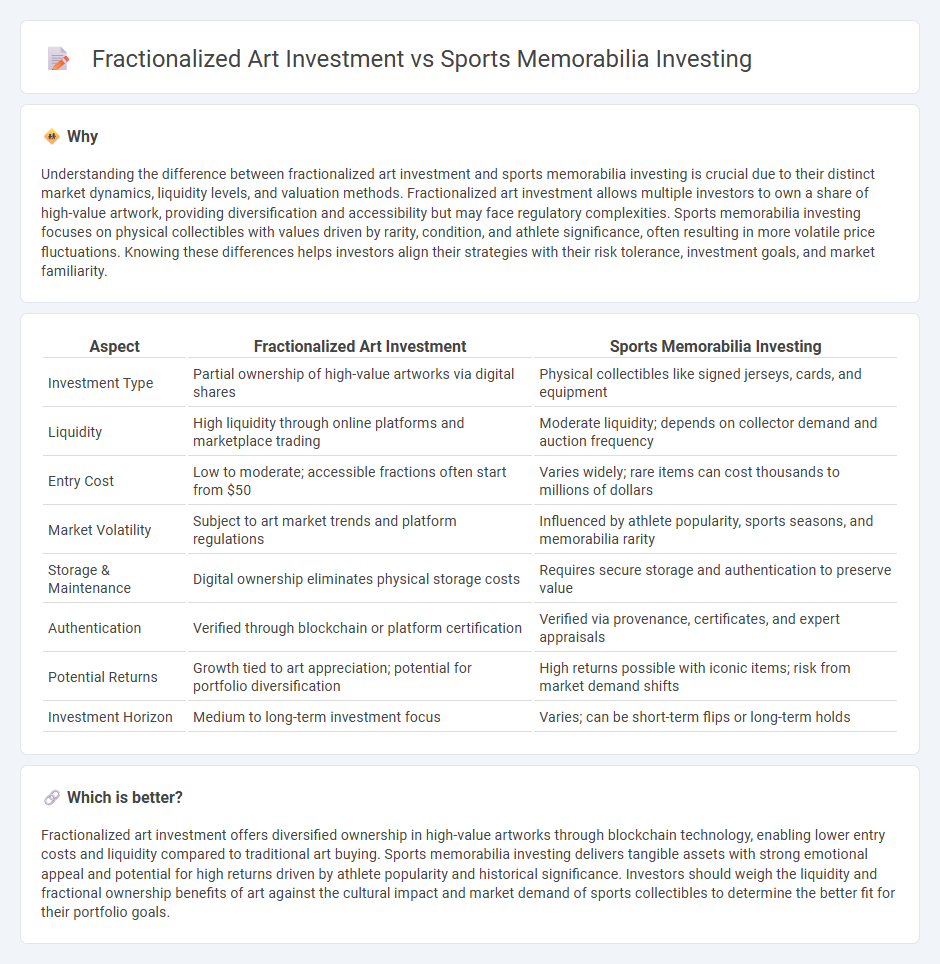

Understanding the difference between fractionalized art investment and sports memorabilia investing is crucial due to their distinct market dynamics, liquidity levels, and valuation methods. Fractionalized art investment allows multiple investors to own a share of high-value artwork, providing diversification and accessibility but may face regulatory complexities. Sports memorabilia investing focuses on physical collectibles with values driven by rarity, condition, and athlete significance, often resulting in more volatile price fluctuations. Knowing these differences helps investors align their strategies with their risk tolerance, investment goals, and market familiarity.

Comparison Table

| Aspect | Fractionalized Art Investment | Sports Memorabilia Investing |

|---|---|---|

| Investment Type | Partial ownership of high-value artworks via digital shares | Physical collectibles like signed jerseys, cards, and equipment |

| Liquidity | High liquidity through online platforms and marketplace trading | Moderate liquidity; depends on collector demand and auction frequency |

| Entry Cost | Low to moderate; accessible fractions often start from $50 | Varies widely; rare items can cost thousands to millions of dollars |

| Market Volatility | Subject to art market trends and platform regulations | Influenced by athlete popularity, sports seasons, and memorabilia rarity |

| Storage & Maintenance | Digital ownership eliminates physical storage costs | Requires secure storage and authentication to preserve value |

| Authentication | Verified through blockchain or platform certification | Verified via provenance, certificates, and expert appraisals |

| Potential Returns | Growth tied to art appreciation; potential for portfolio diversification | High returns possible with iconic items; risk from market demand shifts |

| Investment Horizon | Medium to long-term investment focus | Varies; can be short-term flips or long-term holds |

Which is better?

Fractionalized art investment offers diversified ownership in high-value artworks through blockchain technology, enabling lower entry costs and liquidity compared to traditional art buying. Sports memorabilia investing delivers tangible assets with strong emotional appeal and potential for high returns driven by athlete popularity and historical significance. Investors should weigh the liquidity and fractional ownership benefits of art against the cultural impact and market demand of sports collectibles to determine the better fit for their portfolio goals.

Connection

Fractionalized art investment and sports memorabilia investing both leverage the concept of dividing high-value assets into smaller, tradable shares to lower entry barriers for diverse investors. These investment methods capitalize on the growing market demand for alternative assets, enabling fractional ownership and liquidity in traditionally illiquid markets. Technology platforms and blockchain increasingly facilitate secure transactions and transparent provenance tracking, enhancing investor confidence and market accessibility.

Key Terms

Authenticity

Authenticity plays a crucial role in sports memorabilia investing, where verified provenance, certified signatures, and third-party grading services ensure genuine value and prevent counterfeiting. Fractionalized art investment relies on blockchain technology and smart contracts to guarantee ownership authenticity and provenance transparency, reducing fraud risks in high-value assets. Explore how authenticity measures impact trust and value in these investment markets.

Liquidity

Sports memorabilia investing generally offers higher liquidity due to the active secondary markets and frequent auctions where collectors readily buy and sell items such as signed jerseys and rare cards. Fractionalized art investment, while growing, often faces liquidity constraints because shares in high-value artworks depend on market platforms and buyer interest, which can be less frequent and less predictable. Explore detailed comparisons to understand which investment aligns best with your liquidity needs.

Ownership structure

Sports memorabilia investing grants full ownership of physical collectibles, enabling direct control, display, and sale of rare items like signed jerseys or championship trophies. Fractionalized art investment divides ownership of high-value artworks into shares, allowing multiple investors to hold a stake without possessing the physical piece, often facilitated through blockchain technology for transparency. Discover more about how ownership structures impact investment strategies and risk management in these asset classes.

Source and External Links

How to Invest in Sports Memorabilia - Investing in sports memorabilia involves focusing on authenticated, historically significant items like autographed jerseys or rare cards, which can appreciate substantially, as seen with Babe Ruth's jersey selling for over $24 million, but requires careful research and strategy often with financial advisor guidance.

Why You Should Invest In Sports Memorabilia - Sports memorabilia encompasses autographs, game-used equipment, and rare trading cards, and while the market can be volatile, strategic investment in authenticated, high-quality items can yield significant returns and blend emotional appeal with financial gain.

Sports memorabilia market overview | Rally - The sports memorabilia market is robust, valued over $15 billion annually, with iconic items like Michael Jordan's game-worn sneakers and Mickey Mantle's jersey showing notable appreciation, reflecting strong demand and growing community interest.

dowidth.com

dowidth.com