Tangible asset tokenization involves converting physical assets like real estate or art into digital tokens, enabling fractional ownership and enhanced liquidity on blockchain platforms. Non-fungible tokens (NFTs) represent unique digital items such as digital art, collectibles, or virtual goods, each with distinct properties that cannot be exchanged on a one-to-one basis. Explore the differences between these innovative investment vehicles to understand their potential impact on your portfolio.

Why it is important

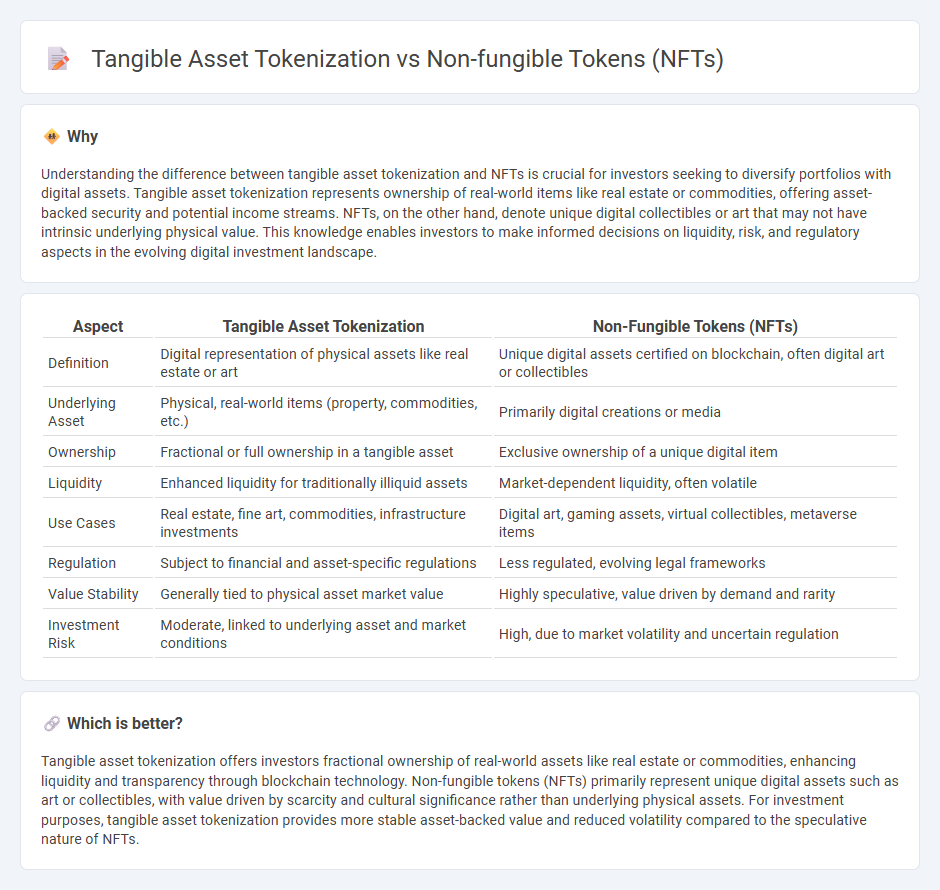

Understanding the difference between tangible asset tokenization and NFTs is crucial for investors seeking to diversify portfolios with digital assets. Tangible asset tokenization represents ownership of real-world items like real estate or commodities, offering asset-backed security and potential income streams. NFTs, on the other hand, denote unique digital collectibles or art that may not have intrinsic underlying physical value. This knowledge enables investors to make informed decisions on liquidity, risk, and regulatory aspects in the evolving digital investment landscape.

Comparison Table

| Aspect | Tangible Asset Tokenization | Non-Fungible Tokens (NFTs) |

|---|---|---|

| Definition | Digital representation of physical assets like real estate or art | Unique digital assets certified on blockchain, often digital art or collectibles |

| Underlying Asset | Physical, real-world items (property, commodities, etc.) | Primarily digital creations or media |

| Ownership | Fractional or full ownership in a tangible asset | Exclusive ownership of a unique digital item |

| Liquidity | Enhanced liquidity for traditionally illiquid assets | Market-dependent liquidity, often volatile |

| Use Cases | Real estate, fine art, commodities, infrastructure investments | Digital art, gaming assets, virtual collectibles, metaverse items |

| Regulation | Subject to financial and asset-specific regulations | Less regulated, evolving legal frameworks |

| Value Stability | Generally tied to physical asset market value | Highly speculative, value driven by demand and rarity |

| Investment Risk | Moderate, linked to underlying asset and market conditions | High, due to market volatility and uncertain regulation |

Which is better?

Tangible asset tokenization offers investors fractional ownership of real-world assets like real estate or commodities, enhancing liquidity and transparency through blockchain technology. Non-fungible tokens (NFTs) primarily represent unique digital assets such as art or collectibles, with value driven by scarcity and cultural significance rather than underlying physical assets. For investment purposes, tangible asset tokenization provides more stable asset-backed value and reduced volatility compared to the speculative nature of NFTs.

Connection

Tangible asset tokenization transforms physical assets like real estate, art, and commodities into digital tokens on a blockchain, enhancing liquidity and accessibility. Non-fungible tokens (NFTs) represent unique digital ownership certificates tied to individual tangible assets, ensuring provenance and indivisibility. Both technologies leverage decentralized ledgers to provide secure, transparent, and tradable representations of real-world investments.

Key Terms

Ownership rights

Non-fungible tokens (NFTs) represent unique digital assets with verifiable ownership secured by blockchain technology, ensuring exclusivity and provenance. Tangible asset tokenization involves creating digital tokens linked to real-world physical assets, granting fractional ownership and easier transferability while maintaining legal rights over the underlying item. Explore the evolving landscape of digital ownership rights and how these innovations redefine asset management.

Liquidity

Non-fungible tokens (NFTs) represent unique digital assets with limited liquidity due to their distinctness and niche markets, whereas tangible asset tokenization converts physical assets like real estate or art into digital tokens, often enhancing liquidity by enabling fractional ownership and easier transferability. The liquidity of tokenized tangible assets benefits from broader investor interest and regulatory frameworks facilitating secondary market trading. Explore in-depth comparisons to understand how liquidity dynamics impact investment strategies in both NFT and tangible asset tokenization markets.

Asset provenance

Non-fungible tokens (NFTs) provide a unique digital certificate of ownership and provenance for digital assets, ensuring authenticity and traceability through blockchain technology. Tangible asset tokenization digitizes ownership of physical assets like real estate or art, enabling fractional ownership while preserving verifiable provenance on a decentralized ledger. Discover how these technologies enhance asset provenance and transform ownership verification.

Source and External Links

Non-fungible token - Wikipedia - NFTs are unique digital identifiers recorded on a blockchain, certifying ownership and authenticity of digital or linked assets, and cannot be copied, substituted, or subdivided.

What is a non-fungible token (NFT)? - Coinbase - NFTs are unique cryptoassets used to authenticate ownership of digital items like art, photos, and virtual goods, and each token is distinct from others--unlike cryptocurrencies, which are interchangeable.

What are NFTs? A beginner's guide to non-fungible tokens - NFTs are digital assets on a blockchain that link ownership to unique physical or digital items, popular for art and collectibles but highly speculative and not a form of currency.

dowidth.com

dowidth.com