Hedge fund replication uses quantitative models to mimic hedge fund returns with lower fees and greater transparency compared to traditional mutual funds, which actively manage diversified portfolios aiming for steady growth. Mutual funds offer broad market exposure and regulatory oversight, while hedge fund replication focuses on achieving hedge fund-like performance through systematic strategies. Explore the advantages and distinctions of hedge fund replication and mutual funds to make informed investment decisions.

Why it is important

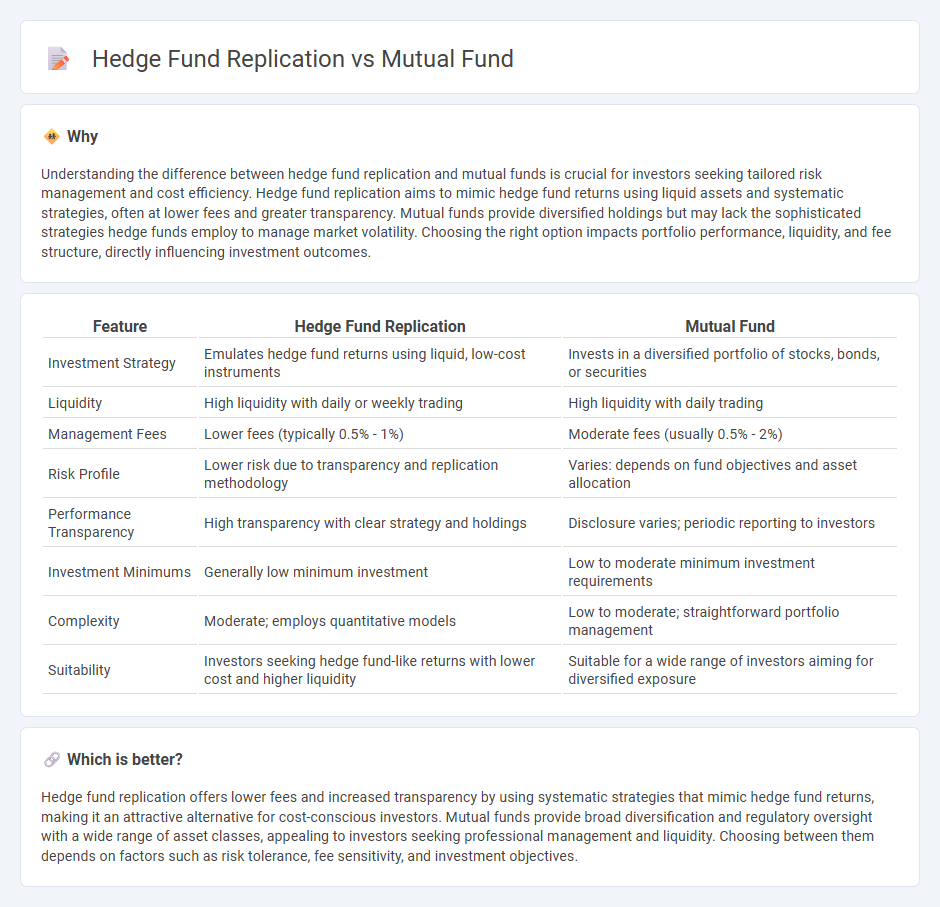

Understanding the difference between hedge fund replication and mutual funds is crucial for investors seeking tailored risk management and cost efficiency. Hedge fund replication aims to mimic hedge fund returns using liquid assets and systematic strategies, often at lower fees and greater transparency. Mutual funds provide diversified holdings but may lack the sophisticated strategies hedge funds employ to manage market volatility. Choosing the right option impacts portfolio performance, liquidity, and fee structure, directly influencing investment outcomes.

Comparison Table

| Feature | Hedge Fund Replication | Mutual Fund |

|---|---|---|

| Investment Strategy | Emulates hedge fund returns using liquid, low-cost instruments | Invests in a diversified portfolio of stocks, bonds, or securities |

| Liquidity | High liquidity with daily or weekly trading | High liquidity with daily trading |

| Management Fees | Lower fees (typically 0.5% - 1%) | Moderate fees (usually 0.5% - 2%) |

| Risk Profile | Lower risk due to transparency and replication methodology | Varies: depends on fund objectives and asset allocation |

| Performance Transparency | High transparency with clear strategy and holdings | Disclosure varies; periodic reporting to investors |

| Investment Minimums | Generally low minimum investment | Low to moderate minimum investment requirements |

| Complexity | Moderate; employs quantitative models | Low to moderate; straightforward portfolio management |

| Suitability | Investors seeking hedge fund-like returns with lower cost and higher liquidity | Suitable for a wide range of investors aiming for diversified exposure |

Which is better?

Hedge fund replication offers lower fees and increased transparency by using systematic strategies that mimic hedge fund returns, making it an attractive alternative for cost-conscious investors. Mutual funds provide broad diversification and regulatory oversight with a wide range of asset classes, appealing to investors seeking professional management and liquidity. Choosing between them depends on factors such as risk tolerance, fee sensitivity, and investment objectives.

Connection

Hedge fund replication strategies aim to mimic the risk-return profile of hedge funds using liquid and transparent instruments, often through mutual funds designed with similar investment approaches. Mutual funds employing replication techniques provide investors access to hedge fund-like exposures with lower fees and improved liquidity compared to direct hedge fund investments. This connection leverages quantitative models and diversified asset allocation to capture alpha while reducing operational complexity for retail investors.

Key Terms

Benchmark Index

Mutual fund replication aims to closely track the performance of a benchmark index by holding a diversified portfolio that mirrors index components, minimizing tracking error and management costs. Hedge fund replication uses quantitative models and factor-based strategies to simulate hedge fund returns, often focusing on risk premia associated with benchmark indices rather than direct security replication. Explore the distinct approaches and advantages of mutual fund and hedge fund replication to better understand portfolio management strategies.

Fee Structure

Mutual funds typically charge an annual expense ratio ranging from 0.5% to 2%, with no performance fees, making them more cost-effective for average investors. Hedge funds often impose management fees around 2% of assets under management and performance fees of 20% on profits, reflecting their active management and higher risk strategies. Explore detailed comparisons to understand which fee structure aligns best with your investment goals.

Liquidity

Mutual fund replication strategies emphasize high liquidity by investing in easily tradable securities to match benchmark performance closely, ensuring investors can redeem shares promptly. Hedge fund replication often involves using liquid derivative instruments and long-short equity positions to mimic hedge fund returns while maintaining flexibility and risk management. Explore detailed comparisons to understand how liquidity impacts fund structure and investor access.

Source and External Links

Mutual Funds | Investor.gov - A mutual fund is an SEC-registered open-end investment company that pools money from many investors to invest in a diversified portfolio of stocks, bonds, and other securities, managed by professional investment advisers, offering benefits like diversification, liquidity, and professional management.

Mutual fund - Wikipedia - Mutual funds pool money from investors to purchase securities and are classified by principal investments such as stock, bond, or hybrid funds, with structures including open-end funds and are regulated to provide transparency on performance and fees.

Understanding mutual funds - Charles Schwab - Mutual funds allow investors to pool money to buy stocks, bonds, and other assets with professional management, diversified investment strategies, and lower transaction costs, making them an accessible and convenient investment choice.

dowidth.com

dowidth.com