Psychedelic stocks represent the emerging market in mental health treatments, driven by the growing acceptance of psychedelic therapies and regulatory advancements. Cryptocurrencies offer a decentralized digital asset class characterized by high volatility, blockchain technology, and widespread adoption in finance and beyond. Explore the distinct investment opportunities and risks associated with psychedelic stocks and cryptocurrencies to make informed decisions.

Why it is important

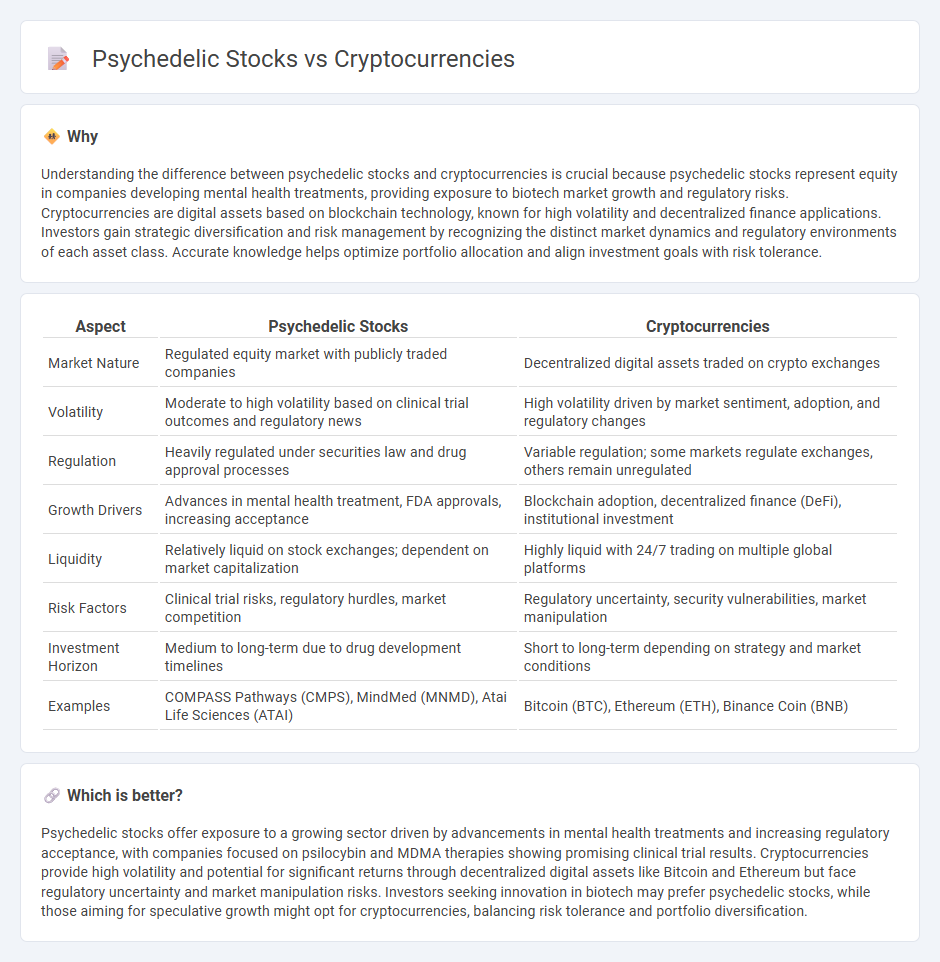

Understanding the difference between psychedelic stocks and cryptocurrencies is crucial because psychedelic stocks represent equity in companies developing mental health treatments, providing exposure to biotech market growth and regulatory risks. Cryptocurrencies are digital assets based on blockchain technology, known for high volatility and decentralized finance applications. Investors gain strategic diversification and risk management by recognizing the distinct market dynamics and regulatory environments of each asset class. Accurate knowledge helps optimize portfolio allocation and align investment goals with risk tolerance.

Comparison Table

| Aspect | Psychedelic Stocks | Cryptocurrencies |

|---|---|---|

| Market Nature | Regulated equity market with publicly traded companies | Decentralized digital assets traded on crypto exchanges |

| Volatility | Moderate to high volatility based on clinical trial outcomes and regulatory news | High volatility driven by market sentiment, adoption, and regulatory changes |

| Regulation | Heavily regulated under securities law and drug approval processes | Variable regulation; some markets regulate exchanges, others remain unregulated |

| Growth Drivers | Advances in mental health treatment, FDA approvals, increasing acceptance | Blockchain adoption, decentralized finance (DeFi), institutional investment |

| Liquidity | Relatively liquid on stock exchanges; dependent on market capitalization | Highly liquid with 24/7 trading on multiple global platforms |

| Risk Factors | Clinical trial risks, regulatory hurdles, market competition | Regulatory uncertainty, security vulnerabilities, market manipulation |

| Investment Horizon | Medium to long-term due to drug development timelines | Short to long-term depending on strategy and market conditions |

| Examples | COMPASS Pathways (CMPS), MindMed (MNMD), Atai Life Sciences (ATAI) | Bitcoin (BTC), Ethereum (ETH), Binance Coin (BNB) |

Which is better?

Psychedelic stocks offer exposure to a growing sector driven by advancements in mental health treatments and increasing regulatory acceptance, with companies focused on psilocybin and MDMA therapies showing promising clinical trial results. Cryptocurrencies provide high volatility and potential for significant returns through decentralized digital assets like Bitcoin and Ethereum but face regulatory uncertainty and market manipulation risks. Investors seeking innovation in biotech may prefer psychedelic stocks, while those aiming for speculative growth might opt for cryptocurrencies, balancing risk tolerance and portfolio diversification.

Connection

Psychedelic stocks and cryptocurrencies are connected through their shared appeal to speculative investors seeking high-risk, high-reward opportunities in emerging markets. Both sectors leverage cutting-edge innovation and regulatory changes to attract capital, with companies exploring novel applications such as mental health treatments and decentralized finance. Market volatility and investor sentiment in these industries often correlate, driven by broader trends in technological disruption and shifting legal frameworks.

Key Terms

Volatility

Cryptocurrencies exhibit extreme volatility with price swings often exceeding 10% daily, driven by market sentiment, regulatory news, and technological developments, whereas psychedelic stocks show moderate volatility influenced by clinical trial results, FDA approvals, and shifting investor interest in mental health therapies. The crypto market's 24/7 trading and decentralized nature amplify rapid fluctuations compared to the more regulated and sector-specific movements of psychedelics. Explore the nuances of volatility in these two emerging asset classes to optimize your investment strategy.

Regulation

Cryptocurrencies face evolving regulatory landscapes with agencies like the SEC and FinCEN enforcing compliance to curb fraud and ensure market integrity, impacting trading and investment strategies. Psychedelic stocks encounter complex approval processes from the FDA and DEA, with shifting legal frameworks influencing research, development, and commercialization opportunities. Explore the regulatory nuances shaping these alternative investment sectors to make informed decisions.

Market Adoption

Cryptocurrency market adoption continues to accelerate with increasing institutional investments and expanding use cases in decentralized finance and digital payments. Psychedelic stocks show growing interest driven by emerging clinical trials and evolving regulatory frameworks emphasizing mental health treatments. Explore deeper insights into market dynamics and future growth potential in both sectors.

Source and External Links

What is Cryptocurrency and How Does it Work? - Cryptocurrency is a digital payment system that uses cryptography to secure transactions and operates independently of central banks, with all transactions recorded on a public ledger called a blockchain.

Cryptocurrency - A cryptocurrency is a decentralized digital currency that relies on a distributed ledger (blockchain) for transaction verification and does not require a central authority like a government or bank.

What is Cryptocurrency and How Does It Work? - Cryptocurrencies are internet-based digital assets that use blockchain technology to create a secure, unalterable public ledger of all transactions without the need for a central clearing authority.

dowidth.com

dowidth.com