Sneaker flipping involves buying limited-edition sneakers at retail prices and reselling them for substantial profits in secondary markets, leveraging trends and brand hype. Wine investing focuses on acquiring rare or vintage wines that appreciate over time, offering potential wealth growth through market demand and aging processes. Explore the advantages and risks of sneaker flipping versus wine investing to determine which aligns better with your investment goals.

Why it is important

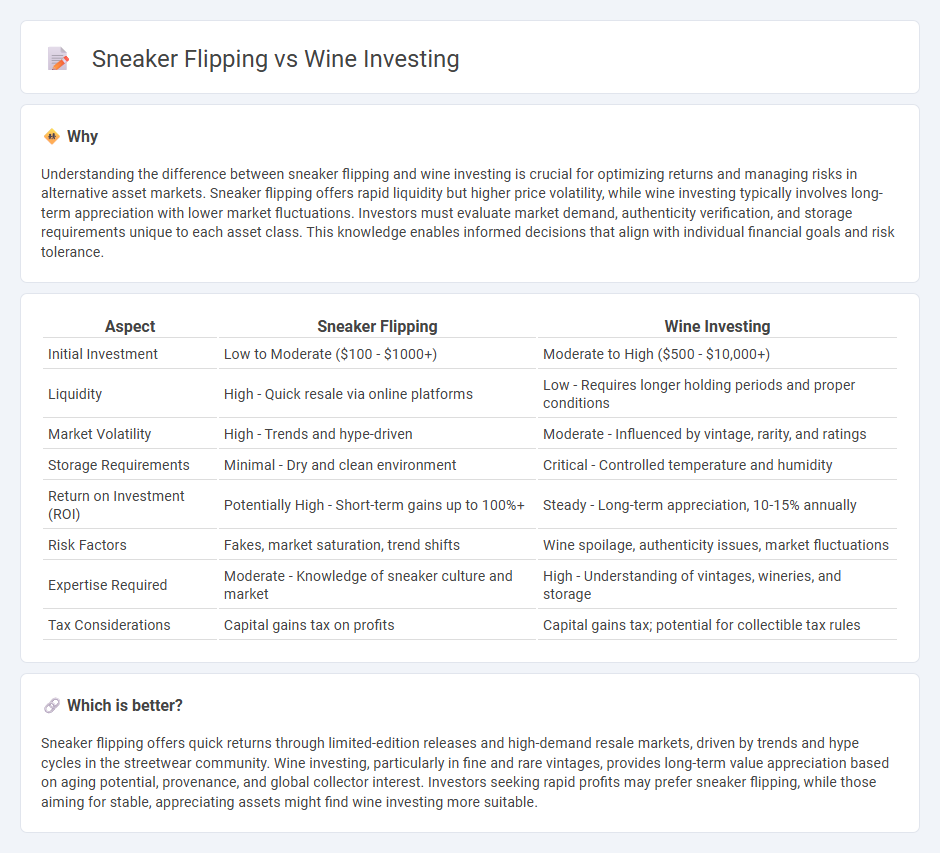

Understanding the difference between sneaker flipping and wine investing is crucial for optimizing returns and managing risks in alternative asset markets. Sneaker flipping offers rapid liquidity but higher price volatility, while wine investing typically involves long-term appreciation with lower market fluctuations. Investors must evaluate market demand, authenticity verification, and storage requirements unique to each asset class. This knowledge enables informed decisions that align with individual financial goals and risk tolerance.

Comparison Table

| Aspect | Sneaker Flipping | Wine Investing |

|---|---|---|

| Initial Investment | Low to Moderate ($100 - $1000+) | Moderate to High ($500 - $10,000+) |

| Liquidity | High - Quick resale via online platforms | Low - Requires longer holding periods and proper conditions |

| Market Volatility | High - Trends and hype-driven | Moderate - Influenced by vintage, rarity, and ratings |

| Storage Requirements | Minimal - Dry and clean environment | Critical - Controlled temperature and humidity |

| Return on Investment (ROI) | Potentially High - Short-term gains up to 100%+ | Steady - Long-term appreciation, 10-15% annually |

| Risk Factors | Fakes, market saturation, trend shifts | Wine spoilage, authenticity issues, market fluctuations |

| Expertise Required | Moderate - Knowledge of sneaker culture and market | High - Understanding of vintages, wineries, and storage |

| Tax Considerations | Capital gains tax on profits | Capital gains tax; potential for collectible tax rules |

Which is better?

Sneaker flipping offers quick returns through limited-edition releases and high-demand resale markets, driven by trends and hype cycles in the streetwear community. Wine investing, particularly in fine and rare vintages, provides long-term value appreciation based on aging potential, provenance, and global collector interest. Investors seeking rapid profits may prefer sneaker flipping, while those aiming for stable, appreciating assets might find wine investing more suitable.

Connection

Sneaker flipping and wine investing both capitalize on the principles of market scarcity and cultural trends to generate substantial returns. Limited-edition sneakers and rare vintage wines appreciate in value due to high demand, authenticity, and condition, making them attractive alternative investment assets. Both markets require expertise to identify promising items, understand market cycles, and navigate resale platforms for optimal profitability.

Key Terms

Appreciation

Wine investing offers potential appreciation through the aging process, enhancing flavor complexity and market value over time. Sneaker flipping capitalizes on limited releases and trending designs, driving quick appreciation through demand spikes. Explore the dynamics of these unique markets to understand how to maximize your investment returns.

Liquidity

Wine investing offers moderate liquidity, with the ability to sell bottles through auctions, retailers, or private collectors, but transactions often require time for verification and shipping. Sneaker flipping presents higher liquidity, as limited-edition sneakers can be quickly resold on platforms like StockX and GOAT, sometimes within days or hours of release. Explore the nuances of liquidity in alternative asset markets to optimize your investment strategy.

Authenticity

Authenticity plays a crucial role in both wine investing and sneaker flipping, significantly impacting value and resale potential. Expert verification methods, such as provenance documentation for fine wines and certified authentication for limited-edition sneakers, help mitigate counterfeit risks and ensure buyer confidence. Explore comprehensive strategies to master authenticity in these dynamic markets.

Source and External Links

Understanding Online Wine Investments And Investing Platforms - Online platforms like Cru Wine offer managed wine portfolios with professional storage, averaging 11.8% annual returns, and emphasize diversification across regions and varietals to manage risk.

Getting Started with Wine Investments | Wine Folly - The most sought-after investment wines are fine Bordeaux and Grand Cru Burgundy, but flagship wines from Napa and Champagne also hold value, with provenance and proper storage being critical to maintaining and realizing returns.

Evaluating the Investment Performance of Fine Wine: Returns and Insights - Fine wine has delivered average annual returns of 10% since 1988, with more consistent and stable results over holding periods of at least five years, and market downturns often presenting buying opportunities.

dowidth.com

dowidth.com