Virtual land real estate offers investors the chance to own digital property within metaverse platforms, providing unique opportunities for branding and monetization in emerging digital economies. Venture capital involves funding early-stage startups with high growth potential, focusing on equity stakes and long-term returns across diverse industries. Explore the distinct dynamics and advantages of virtual land investment compared to venture capital to optimize your portfolio strategy.

Why it is important

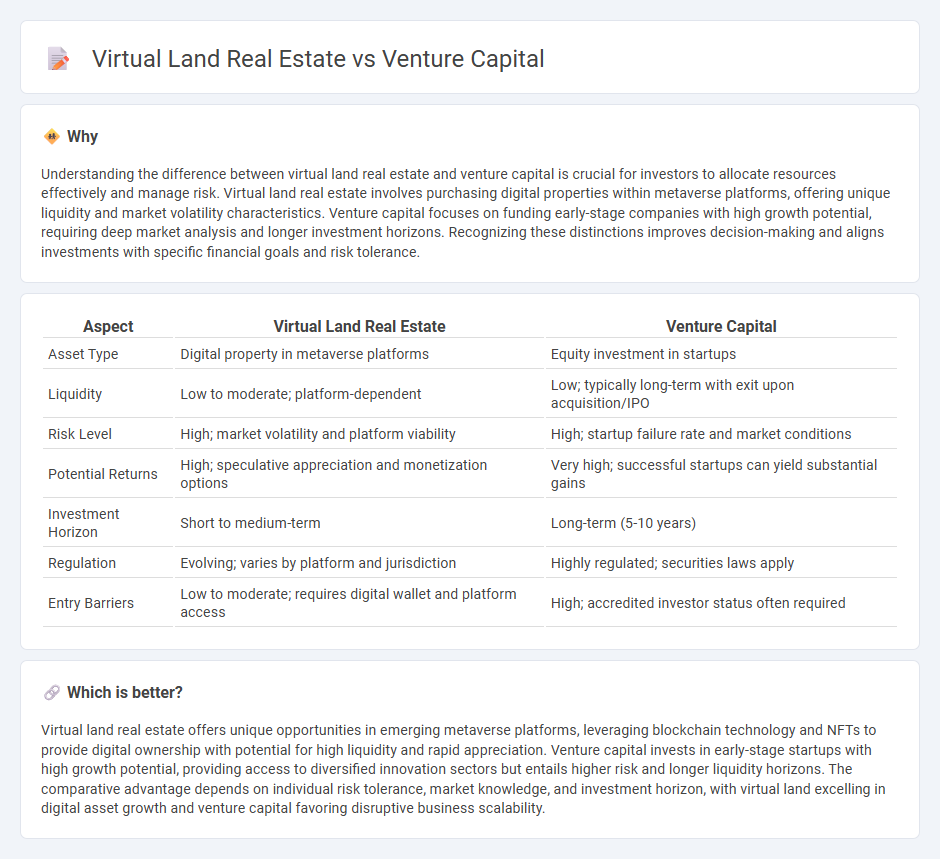

Understanding the difference between virtual land real estate and venture capital is crucial for investors to allocate resources effectively and manage risk. Virtual land real estate involves purchasing digital properties within metaverse platforms, offering unique liquidity and market volatility characteristics. Venture capital focuses on funding early-stage companies with high growth potential, requiring deep market analysis and longer investment horizons. Recognizing these distinctions improves decision-making and aligns investments with specific financial goals and risk tolerance.

Comparison Table

| Aspect | Virtual Land Real Estate | Venture Capital |

|---|---|---|

| Asset Type | Digital property in metaverse platforms | Equity investment in startups |

| Liquidity | Low to moderate; platform-dependent | Low; typically long-term with exit upon acquisition/IPO |

| Risk Level | High; market volatility and platform viability | High; startup failure rate and market conditions |

| Potential Returns | High; speculative appreciation and monetization options | Very high; successful startups can yield substantial gains |

| Investment Horizon | Short to medium-term | Long-term (5-10 years) |

| Regulation | Evolving; varies by platform and jurisdiction | Highly regulated; securities laws apply |

| Entry Barriers | Low to moderate; requires digital wallet and platform access | High; accredited investor status often required |

Which is better?

Virtual land real estate offers unique opportunities in emerging metaverse platforms, leveraging blockchain technology and NFTs to provide digital ownership with potential for high liquidity and rapid appreciation. Venture capital invests in early-stage startups with high growth potential, providing access to diversified innovation sectors but entails higher risk and longer liquidity horizons. The comparative advantage depends on individual risk tolerance, market knowledge, and investment horizon, with virtual land excelling in digital asset growth and venture capital favoring disruptive business scalability.

Connection

Virtual land real estate represents a digital asset class where investors buy, sell, and develop parcels within metaverse platforms, attracting venture capital due to its growth potential and innovative use of blockchain technology. Venture capital firms fund startups that create immersive virtual environments and marketplaces, driving adoption and value appreciation for digital land. This synergy fosters a transformative investment ecosystem blending technology, real estate, and finance sectors.

Key Terms

Venture Capital:

Venture capital involves investing in early-stage startups with high growth potential, providing not only funding but also strategic support and mentorship to accelerate business development. Key metrics include valuation, equity stake, and exit strategies like IPOs or acquisitions, targeting sectors such as technology, healthcare, and fintech. Explore in-depth insights on venture capital strategies and trends to optimize your investment portfolio.

Equity Stake

Venture capital investment typically involves acquiring an equity stake in startups or growing companies, granting investors partial ownership and potential influence on company decisions. Virtual land real estate investment allows buyers to own digital plots within decentralized metaverse platforms, which can be monetized or traded but generally do not confer equity in the platform itself. Explore the differences in ownership models and financial returns between these investment opportunities to make informed decisions.

Startup

Venture capital fuels startup growth through equity investment, providing crucial funding, mentorship, and network access that accelerates market entry and product development. Virtual land real estate in metaverse platforms represents a novel asset class where startups can establish digital presence, engage users, and create unique brand experiences, potentially generating new revenue streams. Explore how combining venture capital with virtual real estate investments can unlock innovative opportunities for startup scalability and market differentiation.

Source and External Links

What is Venture Capital? - Venture capital is funding that turns ideas and research into high-growth companies by making high-risk, long-term equity investments in innovative startups, providing strategic support and creating significant economic impact like jobs and market-leading companies.

Fund your business | U.S. Small Business Administration - Venture capital is a form of funding for high-growth companies where investors provide capital in exchange for equity and an active role, focusing on startups with growth potential, taking higher risks for potentially higher returns.

What is Venture Capital? - Venture capital finances startups with innovative technologies and high growth potential through equity investments, with investors taking a long-term perspective and a portfolio approach to balance risk and return.

dowidth.com

dowidth.com