Watch investment communities offer direct insights from passionate collectors, enabling members to exchange real-time market trends and rare timepiece opportunities. Mutual funds pool capital from multiple investors to strategically invest in a diversified portfolio, managed by financial experts to minimize risk and maximize returns. Explore the unique benefits and risks of these investment avenues to determine which aligns best with your financial goals.

Why it is important

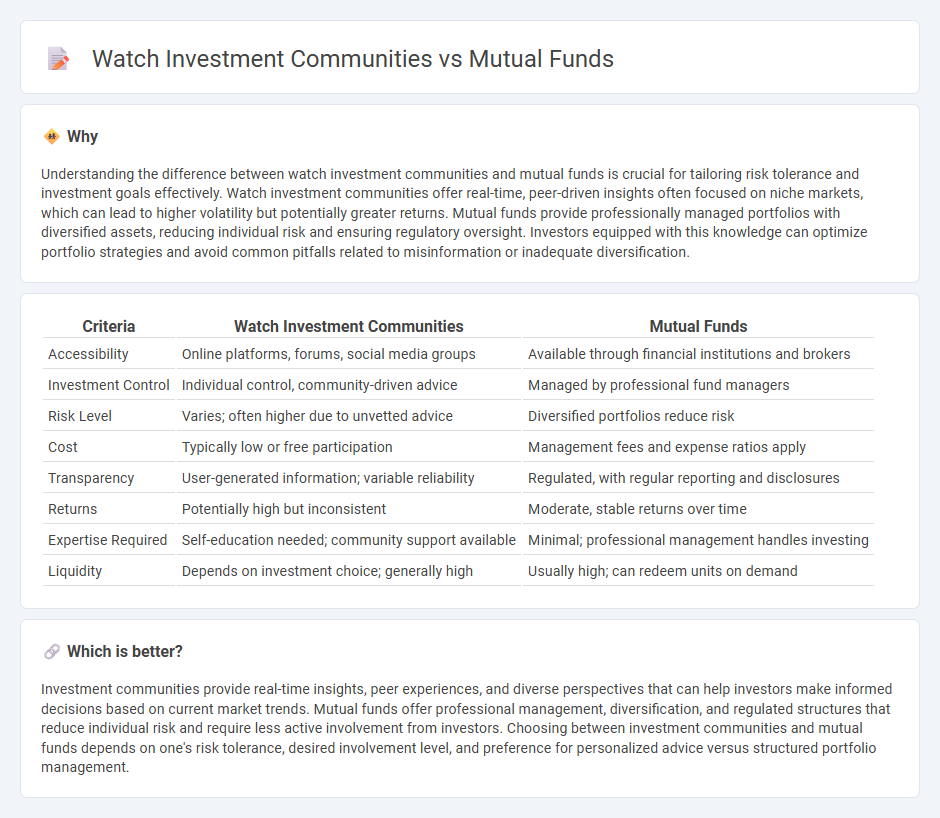

Understanding the difference between watch investment communities and mutual funds is crucial for tailoring risk tolerance and investment goals effectively. Watch investment communities offer real-time, peer-driven insights often focused on niche markets, which can lead to higher volatility but potentially greater returns. Mutual funds provide professionally managed portfolios with diversified assets, reducing individual risk and ensuring regulatory oversight. Investors equipped with this knowledge can optimize portfolio strategies and avoid common pitfalls related to misinformation or inadequate diversification.

Comparison Table

| Criteria | Watch Investment Communities | Mutual Funds |

|---|---|---|

| Accessibility | Online platforms, forums, social media groups | Available through financial institutions and brokers |

| Investment Control | Individual control, community-driven advice | Managed by professional fund managers |

| Risk Level | Varies; often higher due to unvetted advice | Diversified portfolios reduce risk |

| Cost | Typically low or free participation | Management fees and expense ratios apply |

| Transparency | User-generated information; variable reliability | Regulated, with regular reporting and disclosures |

| Returns | Potentially high but inconsistent | Moderate, stable returns over time |

| Expertise Required | Self-education needed; community support available | Minimal; professional management handles investing |

| Liquidity | Depends on investment choice; generally high | Usually high; can redeem units on demand |

Which is better?

Investment communities provide real-time insights, peer experiences, and diverse perspectives that can help investors make informed decisions based on current market trends. Mutual funds offer professional management, diversification, and regulated structures that reduce individual risk and require less active involvement from investors. Choosing between investment communities and mutual funds depends on one's risk tolerance, desired involvement level, and preference for personalized advice versus structured portfolio management.

Connection

Investment communities provide platforms for sharing insights and strategies, enhancing the collective knowledge about mutual fund performance and market trends. Mutual funds benefit from these communities as investors exchange real-time data, reviews, and risk assessments, which inform better decision-making and portfolio management. The dynamic interaction between investors in these communities fosters transparency and confidence, boosting mutual fund participation and growth.

Key Terms

Diversification

Mutual funds offer extensive diversification by pooling resources to invest in a broad range of assets, reducing individual risk while enhancing portfolio stability. Watch investment communities, though more niche, provide insights and collective expertise that can help identify valuable timepieces with potential appreciation, creating specialized diversification within alternative assets. Explore more to understand how blending conventional and alternative investments can optimize your portfolio's diversification strategy.

Asset Liquidity

Mutual funds offer high asset liquidity, allowing investors to buy or sell shares on any business day at the fund's net asset value, providing flexibility and quick access to cash. In contrast, watch investment communities deal in physical luxury timepieces, where liquidity depends on market demand and can involve longer transaction times and higher costs due to appraisal and authentication processes. Explore the dynamics of asset liquidity in these investment avenues to make informed financial decisions.

Risk Assessment

Mutual funds offer professional risk assessment through diversified portfolios managed by experienced fund managers optimizing asset allocation to minimize risk exposure. In contrast, investment communities rely on collective insights and peer analysis, which can vary in reliability and depth, potentially increasing risk due to subjective decision-making. Explore more about how risk is managed differently in these investment approaches.

Source and External Links

Mutual Funds | Investor.gov - A mutual fund is an SEC-registered open-end investment company that pools money from many investors to invest in stocks, bonds, and other securities, managed professionally to provide diversification, liquidity, and low minimum investments.

Mutual fund - Wikipedia - Mutual funds are investment funds pooling money from many investors to buy securities with various classifications like money market, bond, stock, or hybrid funds, offering professional management, diversification, and liquidity while incurring fees and expenses.

Understanding mutual funds - Charles Schwab - Mutual funds allow investors to pool money to buy a diversified mix of investments managed by professionals, offering convenience, lower transaction costs, and access to a broad range of asset classes and strategies.

dowidth.com

dowidth.com