Investment communities offer personalized insights driven by diverse member experiences, while robo-advisors use algorithm-based strategies for automated portfolio management, optimizing for risk and return. These platforms cater to different investor preferences, balancing human interaction and technology efficiency. Explore more to determine which investment approach aligns best with your financial goals.

Why it is important

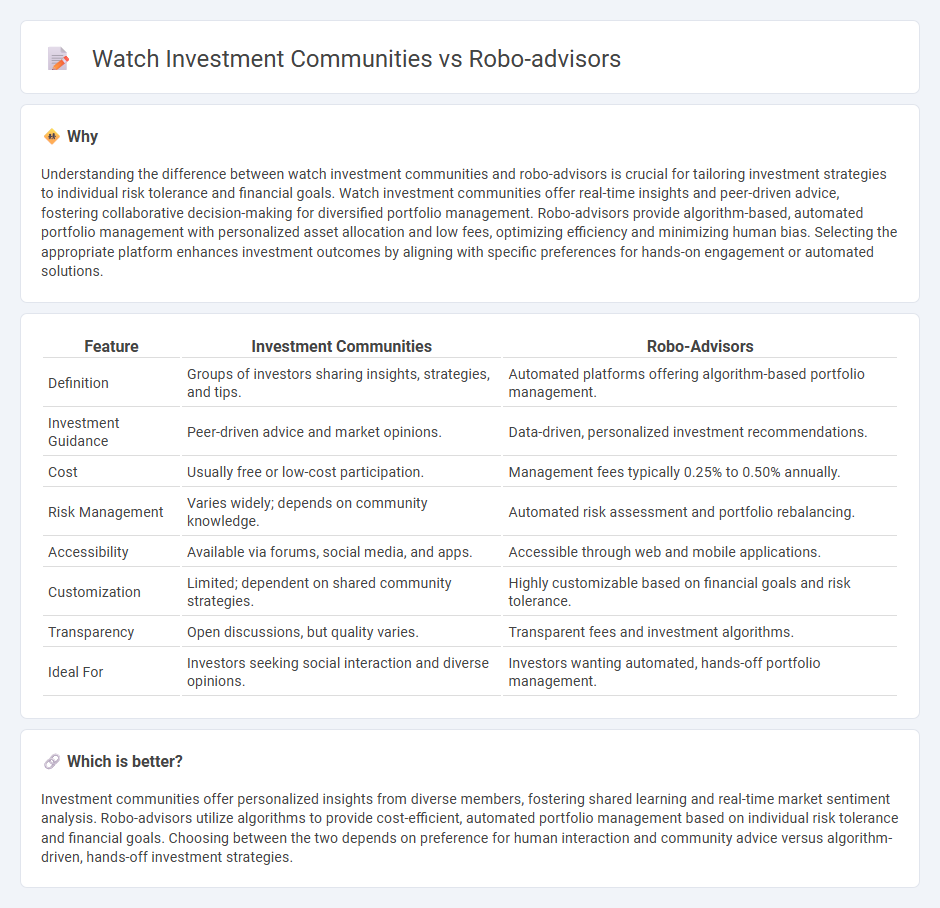

Understanding the difference between watch investment communities and robo-advisors is crucial for tailoring investment strategies to individual risk tolerance and financial goals. Watch investment communities offer real-time insights and peer-driven advice, fostering collaborative decision-making for diversified portfolio management. Robo-advisors provide algorithm-based, automated portfolio management with personalized asset allocation and low fees, optimizing efficiency and minimizing human bias. Selecting the appropriate platform enhances investment outcomes by aligning with specific preferences for hands-on engagement or automated solutions.

Comparison Table

| Feature | Investment Communities | Robo-Advisors |

|---|---|---|

| Definition | Groups of investors sharing insights, strategies, and tips. | Automated platforms offering algorithm-based portfolio management. |

| Investment Guidance | Peer-driven advice and market opinions. | Data-driven, personalized investment recommendations. |

| Cost | Usually free or low-cost participation. | Management fees typically 0.25% to 0.50% annually. |

| Risk Management | Varies widely; depends on community knowledge. | Automated risk assessment and portfolio rebalancing. |

| Accessibility | Available via forums, social media, and apps. | Accessible through web and mobile applications. |

| Customization | Limited; dependent on shared community strategies. | Highly customizable based on financial goals and risk tolerance. |

| Transparency | Open discussions, but quality varies. | Transparent fees and investment algorithms. |

| Ideal For | Investors seeking social interaction and diverse opinions. | Investors wanting automated, hands-off portfolio management. |

Which is better?

Investment communities offer personalized insights from diverse members, fostering shared learning and real-time market sentiment analysis. Robo-advisors utilize algorithms to provide cost-efficient, automated portfolio management based on individual risk tolerance and financial goals. Choosing between the two depends on preference for human interaction and community advice versus algorithm-driven, hands-off investment strategies.

Connection

Investment communities foster collective intelligence by sharing insights, strategies, and market trends that enhance decision-making for individual investors. Robo-advisors leverage these community-driven data inputs and algorithms to provide personalized portfolio management with optimized asset allocation and risk assessment. This integration streamlines investment processes while promoting informed, data-backed financial choices.

Key Terms

Automation

Robo-advisors leverage advanced algorithms and AI to provide automated portfolio management and personalized investment strategies with minimal human intervention. Watch investment communities rely on crowd-sourced insights and peer discussions but lack the seamless automation and real-time rebalancing offered by robo-advisors. Discover how automation in robo-advisors can optimize your investment performance by learning more about their cutting-edge technology.

Social Sentiment

Robo-advisors use algorithms to optimize investments based on market data and personal risk profiles, while investment communities prioritize social sentiment and user-generated insights to influence decision-making. Platforms like StockTwits and Reddit's WallStreetBets enable traders to gauge real-time market sentiment, often leading to volatile but potentially rewarding opportunities. Explore how combining robo-advisory tools with social sentiment analysis can enhance your investment strategy.

Portfolio Diversification

Robo-advisors utilize advanced algorithms to automatically balance portfolio diversification across various asset classes, minimizing risk and optimizing returns based on individual investor profiles. Investment communities rely on collective wisdom and crowd-sourced insights to identify diverse opportunities but may lack the systematic rebalancing precision offered by robo-advisors. Explore how combining algorithm-driven strategies with community insights can enhance portfolio diversification and investment outcomes.

Source and External Links

Robo-advisor - Robo-advisors are digital financial advisors that use algorithms to provide personalized investment management online, with low human intervention, offering automated asset allocation based on clients' risk tolerance and financial goals.

What is a robo advisor? | Robo advisory services - Robo-advisors provide affordable automated investing services by collecting client information on risk tolerance and goals, then constructing and managing a diversified investment portfolio, often with lower fees than traditional advisors.

Best Robo-Advisors In July 2025 - Robo-advisors automate portfolio construction, ongoing rebalancing, and tax-loss harvesting, giving investors access to cost-efficient, professional asset management via online platforms or apps.

dowidth.com

dowidth.com