Royalty streaming involves securing a percentage of revenue from a project's production without direct ownership, reducing upfront risks compared to traditional financing methods. Project finance entails funding large-scale ventures through complex debt and equity structures, with repayment tied to the project's cash flow and assets. Explore these investment strategies to understand their unique benefits and risk profiles.

Why it is important

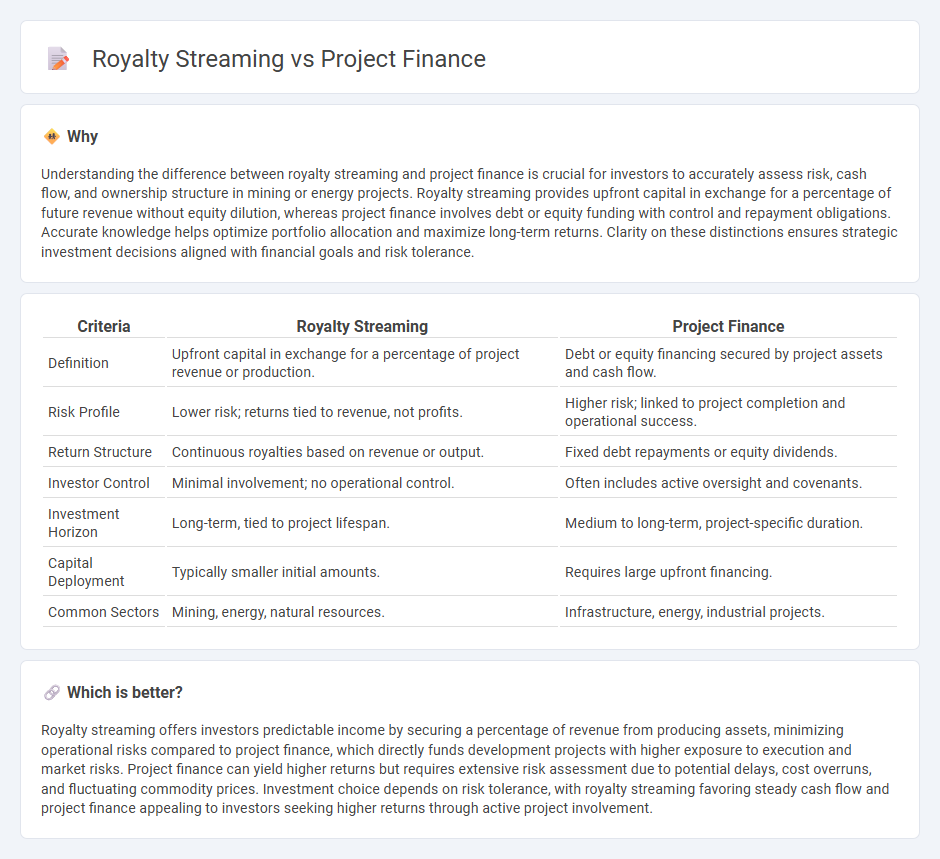

Understanding the difference between royalty streaming and project finance is crucial for investors to accurately assess risk, cash flow, and ownership structure in mining or energy projects. Royalty streaming provides upfront capital in exchange for a percentage of future revenue without equity dilution, whereas project finance involves debt or equity funding with control and repayment obligations. Accurate knowledge helps optimize portfolio allocation and maximize long-term returns. Clarity on these distinctions ensures strategic investment decisions aligned with financial goals and risk tolerance.

Comparison Table

| Criteria | Royalty Streaming | Project Finance |

|---|---|---|

| Definition | Upfront capital in exchange for a percentage of project revenue or production. | Debt or equity financing secured by project assets and cash flow. |

| Risk Profile | Lower risk; returns tied to revenue, not profits. | Higher risk; linked to project completion and operational success. |

| Return Structure | Continuous royalties based on revenue or output. | Fixed debt repayments or equity dividends. |

| Investor Control | Minimal involvement; no operational control. | Often includes active oversight and covenants. |

| Investment Horizon | Long-term, tied to project lifespan. | Medium to long-term, project-specific duration. |

| Capital Deployment | Typically smaller initial amounts. | Requires large upfront financing. |

| Common Sectors | Mining, energy, natural resources. | Infrastructure, energy, industrial projects. |

Which is better?

Royalty streaming offers investors predictable income by securing a percentage of revenue from producing assets, minimizing operational risks compared to project finance, which directly funds development projects with higher exposure to execution and market risks. Project finance can yield higher returns but requires extensive risk assessment due to potential delays, cost overruns, and fluctuating commodity prices. Investment choice depends on risk tolerance, with royalty streaming favoring steady cash flow and project finance appealing to investors seeking higher returns through active project involvement.

Connection

Royalty streaming provides a financing model where investors receive a percentage of revenue or production from a project, aligning closely with project finance structures that fund large-scale ventures through non-recourse loans secured by project assets. Both royalty streaming and project finance reduce risk exposure by enabling cash flow-based investment returns tied to the project's operational success. This connection facilitates capital inflows into resource-intensive industries like mining and energy, optimizing investment strategies through structured revenue streams and asset-backed financing.

Key Terms

Project finance:

Project finance involves the long-term funding of infrastructure and industrial projects using a non-recourse or limited recourse financial structure where project assets and cash flows serve as collateral. Key features include high capital intensity, risk mitigation through contractual agreements, and reliance on detailed feasibility studies to ensure return on investment. Explore more to understand the intricacies of project finance and its advantages over alternative financing methods.

Special Purpose Vehicle (SPV)

Project finance structures a Special Purpose Vehicle (SPV) to isolate financial risk and manage large-scale infrastructure or energy projects through non-recourse or limited recourse debt. Royalty streaming involves creating an SPV that funds upfront capital to a project in exchange for a percentage of future revenue or production, providing a stable cash flow without equity dilution. Discover how SPVs optimize risks and returns in project finance and royalty streaming models.

Non-recourse/limited recourse debt

Project finance typically involves non-recourse or limited recourse debt structures where lenders are repaid solely from the project's cash flows, limiting exposure to the project's assets and sponsors. Royalty streaming agreements provide upfront capital in exchange for a percentage of future revenue without incurring debt, thus avoiding traditional lending risks and obligations. Explore the differences and strategic benefits of each financing method to determine the best fit for your capital needs.

Source and External Links

Project finance - Wikipedia - Project finance is long-term financing for infrastructure and industrial projects based on the project's cash flows rather than the sponsors' balance sheets, often involving non-recourse loans secured by project assets and executed through a special purpose entity to isolate risk from sponsors.

Project Finance - Key Concepts - Public Private Partnership - Project finance offers off-balance-sheet financing that protects shareholders' credit and shifts risk to lenders, typically involving complex contractual arrangements and allowing governments and shareholders to preserve fiscal space and debt capacity.

Project Finance Jobs: Recruiting, The Job, Salaries, Hours, and ... - In project finance careers, professionals advise or lend funds for infrastructure deals, focusing on financial modeling, deal structuring, raising financing from banks, and assessing downside risks through scenario analysis and contract clauses.

dowidth.com

dowidth.com