Royalty rights investing offers investors a percentage of sales revenue from intellectual property without direct company involvement, while revenue-based financing provides capital in exchange for a fixed percentage of ongoing gross revenue until a predetermined return is reached. Royalty rights focus on intellectual property assets such as patents and trademarks, generating passive income, whereas revenue-based financing targets operational business revenue streams with flexible repayment terms linked to cash flow. Explore detailed comparisons to determine the optimal investment strategy for your portfolio goals.

Why it is important

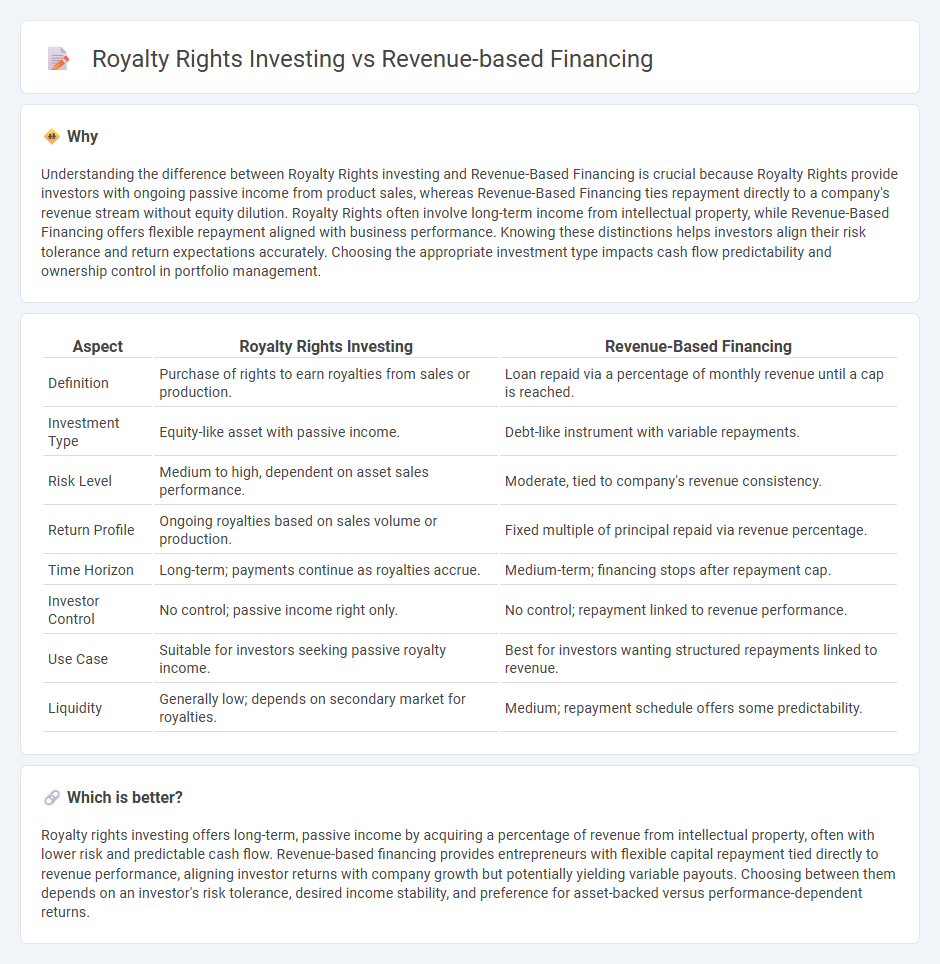

Understanding the difference between Royalty Rights investing and Revenue-Based Financing is crucial because Royalty Rights provide investors with ongoing passive income from product sales, whereas Revenue-Based Financing ties repayment directly to a company's revenue stream without equity dilution. Royalty Rights often involve long-term income from intellectual property, while Revenue-Based Financing offers flexible repayment aligned with business performance. Knowing these distinctions helps investors align their risk tolerance and return expectations accurately. Choosing the appropriate investment type impacts cash flow predictability and ownership control in portfolio management.

Comparison Table

| Aspect | Royalty Rights Investing | Revenue-Based Financing |

|---|---|---|

| Definition | Purchase of rights to earn royalties from sales or production. | Loan repaid via a percentage of monthly revenue until a cap is reached. |

| Investment Type | Equity-like asset with passive income. | Debt-like instrument with variable repayments. |

| Risk Level | Medium to high, dependent on asset sales performance. | Moderate, tied to company's revenue consistency. |

| Return Profile | Ongoing royalties based on sales volume or production. | Fixed multiple of principal repaid via revenue percentage. |

| Time Horizon | Long-term; payments continue as royalties accrue. | Medium-term; financing stops after repayment cap. |

| Investor Control | No control; passive income right only. | No control; repayment linked to revenue performance. |

| Use Case | Suitable for investors seeking passive royalty income. | Best for investors wanting structured repayments linked to revenue. |

| Liquidity | Generally low; depends on secondary market for royalties. | Medium; repayment schedule offers some predictability. |

Which is better?

Royalty rights investing offers long-term, passive income by acquiring a percentage of revenue from intellectual property, often with lower risk and predictable cash flow. Revenue-based financing provides entrepreneurs with flexible capital repayment tied directly to revenue performance, aligning investor returns with company growth but potentially yielding variable payouts. Choosing between them depends on an investor's risk tolerance, desired income stability, and preference for asset-backed versus performance-dependent returns.

Connection

Royalty rights investing and revenue-based financing both provide alternative funding methods where investors receive a percentage of future revenue or sales in return for upfront capital. These models align investor returns with the business's actual performance, reducing reliance on traditional debt or equity financing. The connection lies in their shared structure of repayments tied directly to revenue streams, offering flexible investment opportunities with variable payouts linked to company growth.

Key Terms

Repayment Structure

Revenue-based financing structures repayments as a percentage of the company's ongoing gross revenues, ensuring payments fluctuate with business performance and continue until a predetermined cap is reached. Royalty rights investing involves receiving a fixed percentage of revenues from specific products or intellectual property, with payments linked directly to the commercial success of those assets. Explore in-depth contrasts between these repayment models to understand which aligns best with your investment strategy.

Ownership/Equity

Revenue-based financing provides capital in exchange for a percentage of future revenue without diluting ownership or equity in the company. Royalty rights investing involves purchasing the rights to a portion of a company's future revenue, often linked to specific assets, without taking an equity stake. Explore the differences and benefits of each to find the best fit for your investment strategy.

Revenue Share

Revenue-based financing (RBF) provides capital to businesses in exchange for a percentage of future revenues until a predetermined amount is repaid, creating a flexible repayment structure aligned with business performance. Royalty rights investing involves purchasing rights to ongoing income streams from intellectual property or mineral rights, generating passive income based on sales or production. Explore detailed comparisons and benefits of revenue share models to optimize investment strategies.

Source and External Links

Revenue-Based Financing - Overview, How It Works - Revenue-based financing is a capital-raising method where investors receive a percentage of a company's gross revenues in exchange for capital, offering an alternative to equity and debt financing without equity dilution or collateral requirements.

Revenue-based financing - Wikipedia - This financing involves investment capital provided to businesses in exchange for fixed-percentage royalties on ongoing gross revenues until a multiple of the initial capital is repaid, enabling companies to retain full ownership and control.

What is Revenue-Based Financing? Pros and Cons (2025) - Shopify - Investors provide capital in return for a set percentage of monthly revenues, with repayments continuing until a predetermined repayment cap (typically 1.2 to 3 times the loan) is reached, offering flexible payments tied directly to revenue performance.

dowidth.com

dowidth.com