The secondaries market offers investors liquidity by enabling the buying and selling of pre-existing private equity stakes, often providing access to diversified portfolios with reduced holding periods. Distressed assets involve investing in companies or securities experiencing financial or operational distress, typically offering higher risk but potentially greater returns through restructuring or turnaround strategies. Explore more to understand how these investment avenues can fit your portfolio objectives and risk appetite.

Why it is important

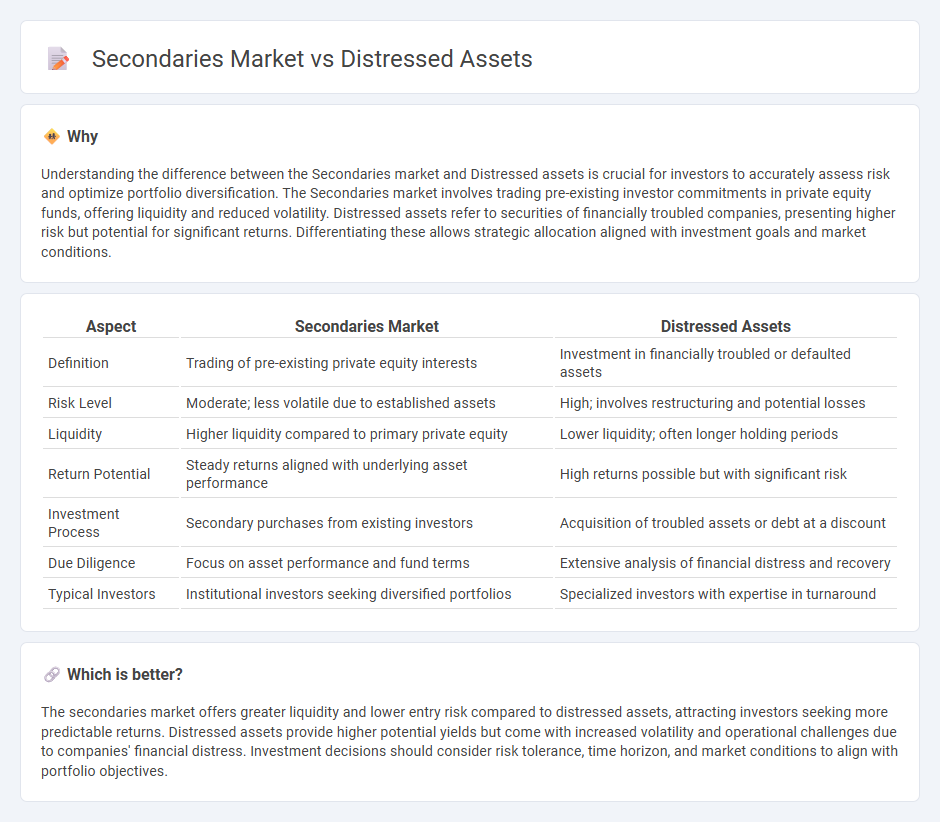

Understanding the difference between the Secondaries market and Distressed assets is crucial for investors to accurately assess risk and optimize portfolio diversification. The Secondaries market involves trading pre-existing investor commitments in private equity funds, offering liquidity and reduced volatility. Distressed assets refer to securities of financially troubled companies, presenting higher risk but potential for significant returns. Differentiating these allows strategic allocation aligned with investment goals and market conditions.

Comparison Table

| Aspect | Secondaries Market | Distressed Assets |

|---|---|---|

| Definition | Trading of pre-existing private equity interests | Investment in financially troubled or defaulted assets |

| Risk Level | Moderate; less volatile due to established assets | High; involves restructuring and potential losses |

| Liquidity | Higher liquidity compared to primary private equity | Lower liquidity; often longer holding periods |

| Return Potential | Steady returns aligned with underlying asset performance | High returns possible but with significant risk |

| Investment Process | Secondary purchases from existing investors | Acquisition of troubled assets or debt at a discount |

| Due Diligence | Focus on asset performance and fund terms | Extensive analysis of financial distress and recovery |

| Typical Investors | Institutional investors seeking diversified portfolios | Specialized investors with expertise in turnaround |

Which is better?

The secondaries market offers greater liquidity and lower entry risk compared to distressed assets, attracting investors seeking more predictable returns. Distressed assets provide higher potential yields but come with increased volatility and operational challenges due to companies' financial distress. Investment decisions should consider risk tolerance, time horizon, and market conditions to align with portfolio objectives.

Connection

The secondaries market involves the trading of pre-existing investor commitments in private equity, hedge funds, and other alternative assets, providing liquidity to stakeholders. Distressed assets often become available in secondary transactions when investors seek to offload troubled or underperforming investments, creating opportunities for buyers focused on turnaround strategies. This intersection allows buyers to acquire stakes in distressed portfolios at discounted valuations through established secondary market platforms, enhancing risk-adjusted returns.

Key Terms

Default Risk

Distressed assets involve securities of companies facing significant financial or operational distress, which inherently carry a higher default risk due to the issuer's weakened ability to meet debt obligations. The secondaries market, however, primarily facilitates the trading of pre-existing private equity or hedge fund stakes, where default risk is influenced by the underlying asset performance and the remaining investment period rather than immediate insolvency. To explore detailed risk mitigation strategies and valuation techniques in these markets, learn more about distressed assets and secondaries insights.

Liquidity

Distressed assets often exhibit low liquidity due to their impaired financial condition and potential legal complexities, making transactions lengthy and risk-prone. In contrast, the secondaries market provides enhanced liquidity by enabling investors to buy and sell pre-existing stakes in funds, facilitating quicker capital redeployment. Explore further to understand how liquidity dynamics impact investment strategies in these markets.

Pricing Mechanisms

Distressed assets are typically priced based on discounted cash flow analyses reflecting high risk and uncertainty, whereas secondaries market transactions rely on supply-demand dynamics and market sentiment to determine pricing. Pricing in distressed assets often incorporates recovery rates and default probabilities, while secondaries prices consider fund performance, remaining life, and liquidity premiums. Explore the nuances of these pricing mechanisms to better understand investment strategies in alternative markets.

Source and External Links

What Are Distressed Assets? - Distressed assets are properties or equity sold at a significantly reduced price because the owner is under financial pressure, often due to bankruptcy or foreclosure, and require careful legal review before investment.

US Distressed Investing: A Guide - Distressed assets have depressed intrinsic value due to financial or operational distress, offering investors opportunities to buy cheaply with potential for significant upside as the assets recover.

Distressed securities - Distressed securities are financial instruments from companies or entities in distress or default, often bought at deep discounts by institutional investors aiming for high returns through restructuring or turnaround strategies.

dowidth.com

dowidth.com