Sports card fractionalization offers investors accessible entry points with smaller capital and liquidity through shared ownership of high-value cards, leveraging blockchain technology for verifiable provenance. Antique vehicle investing demands significant upfront capital, ongoing maintenance, and expertise but can yield substantial appreciation driven by rarity and historical significance. Explore the unique benefits and challenges of these investment avenues to determine which suits your portfolio goals.

Why it is important

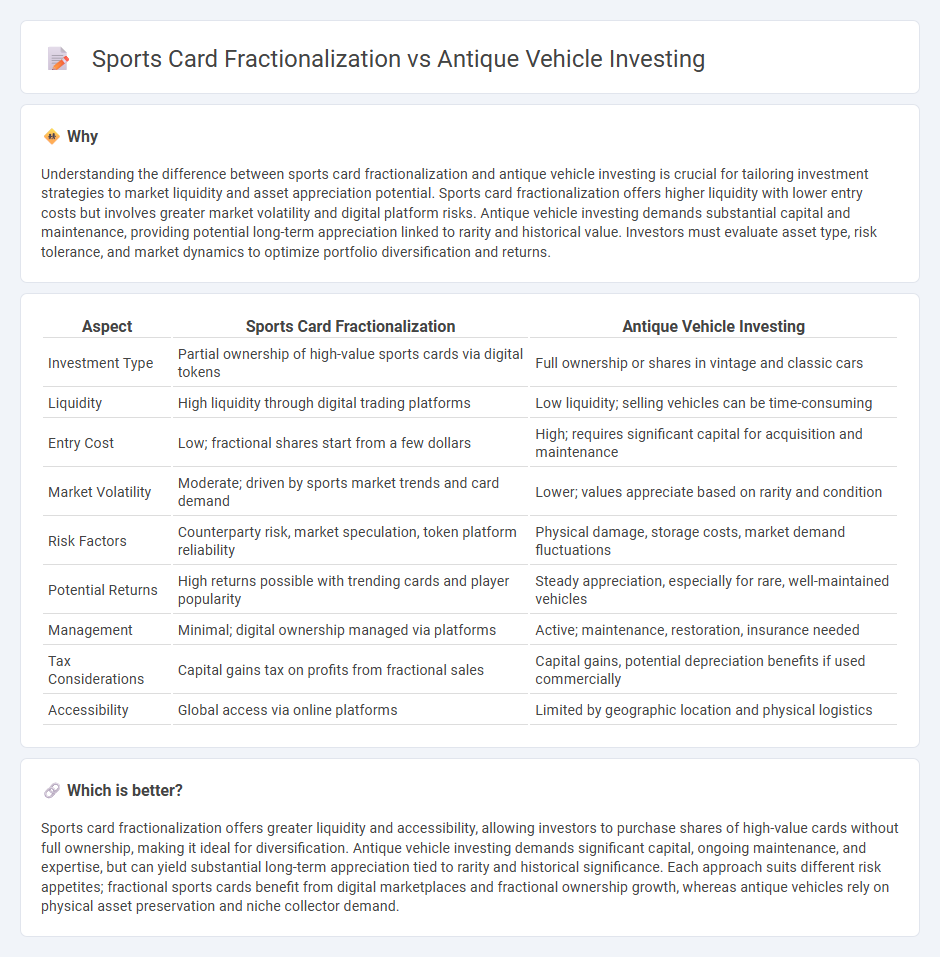

Understanding the difference between sports card fractionalization and antique vehicle investing is crucial for tailoring investment strategies to market liquidity and asset appreciation potential. Sports card fractionalization offers higher liquidity with lower entry costs but involves greater market volatility and digital platform risks. Antique vehicle investing demands substantial capital and maintenance, providing potential long-term appreciation linked to rarity and historical value. Investors must evaluate asset type, risk tolerance, and market dynamics to optimize portfolio diversification and returns.

Comparison Table

| Aspect | Sports Card Fractionalization | Antique Vehicle Investing |

|---|---|---|

| Investment Type | Partial ownership of high-value sports cards via digital tokens | Full ownership or shares in vintage and classic cars |

| Liquidity | High liquidity through digital trading platforms | Low liquidity; selling vehicles can be time-consuming |

| Entry Cost | Low; fractional shares start from a few dollars | High; requires significant capital for acquisition and maintenance |

| Market Volatility | Moderate; driven by sports market trends and card demand | Lower; values appreciate based on rarity and condition |

| Risk Factors | Counterparty risk, market speculation, token platform reliability | Physical damage, storage costs, market demand fluctuations |

| Potential Returns | High returns possible with trending cards and player popularity | Steady appreciation, especially for rare, well-maintained vehicles |

| Management | Minimal; digital ownership managed via platforms | Active; maintenance, restoration, insurance needed |

| Tax Considerations | Capital gains tax on profits from fractional sales | Capital gains, potential depreciation benefits if used commercially |

| Accessibility | Global access via online platforms | Limited by geographic location and physical logistics |

Which is better?

Sports card fractionalization offers greater liquidity and accessibility, allowing investors to purchase shares of high-value cards without full ownership, making it ideal for diversification. Antique vehicle investing demands significant capital, ongoing maintenance, and expertise, but can yield substantial long-term appreciation tied to rarity and historical significance. Each approach suits different risk appetites; fractional sports cards benefit from digital marketplaces and fractional ownership growth, whereas antique vehicles rely on physical asset preservation and niche collector demand.

Connection

Sports card fractionalization and antique vehicle investing both leverage asset tokenization to enable fractional ownership, increasing liquidity in traditionally illiquid markets. By dividing high-value collectibles into smaller shares, investors gain access to niche markets with reduced capital requirements while benefiting from asset appreciation. These modern investment strategies democratize access to rare assets, merging technology with passionate collector communities for diversified portfolio growth.

Key Terms

**Antique vehicle investing:**

Antique vehicle investing offers tangible asset appreciation with vintage cars often increasing in value due to rarity, historical significance, and condition, appealing to collectors and investors seeking unique portfolio diversification. Market demand is driven by classic car auctions, exclusive automotive events, and growing interest in preserving automotive heritage, providing long-term capital growth opportunities. Explore further to understand the nuances and maximize returns in antique vehicle investing.

Provenance

Antique vehicle investing emphasizes detailed provenance including original ownership, restoration history, and authentic documentation, which directly impacts market value and collector interest. Sports card fractionalization leverages provenance data through authenticated serial numbers and player significance to ensure transparent ownership and boost investment appeal. Explore the nuances of provenance in both markets to optimize your investment strategy.

Restoration quality

Restoration quality significantly impacts the value of antique vehicles, with meticulous attention to originality and materials driving higher investment returns. Sports card fractionalization, while centered on card grade and authenticity, does not involve physical restoration but emphasizes preservation and professional grading standards. Explore the nuances of restoration and preservation to optimize your investment approach in both markets.

Source and External Links

Are Classic Cars Good Investments? - Classic cars can appreciate in value and provide portfolio diversification as alternative investments, but they are illiquid, costly to maintain, and require expertise to invest profitably.

How to Invest in Classic Cars - Successful classic car investing involves thorough market research on rarity and condition, budgeting for maintenance, buying classic cars in the best condition possible, focusing on demand and rarity, and being patient for long-term gains.

Cars | Rally | Alternative Asset Investment - The global classic car market exceeded $30 billion in 2020 with some cars showing huge value appreciation, making classic cars a popular and relatively stable alternative investment.

dowidth.com

dowidth.com