Sports memorabilia investment offers unique opportunities to capitalize on the passion and nostalgia of collectors, often yielding high returns through auction sales and private transactions. Classic car investment provides tangible assets with historical value, appreciating steadily as rare models gain demand among enthusiasts and collectors. Explore the dynamics of these investment types to discover which aligns best with your portfolio goals.

Why it is important

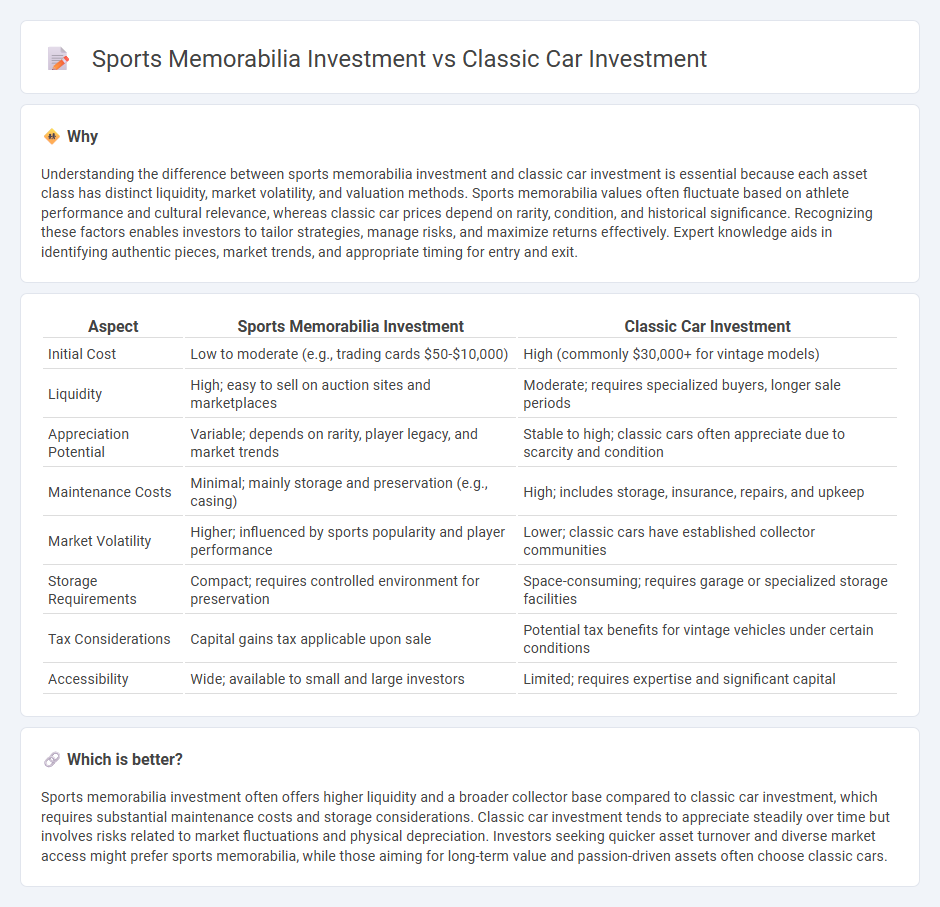

Understanding the difference between sports memorabilia investment and classic car investment is essential because each asset class has distinct liquidity, market volatility, and valuation methods. Sports memorabilia values often fluctuate based on athlete performance and cultural relevance, whereas classic car prices depend on rarity, condition, and historical significance. Recognizing these factors enables investors to tailor strategies, manage risks, and maximize returns effectively. Expert knowledge aids in identifying authentic pieces, market trends, and appropriate timing for entry and exit.

Comparison Table

| Aspect | Sports Memorabilia Investment | Classic Car Investment |

|---|---|---|

| Initial Cost | Low to moderate (e.g., trading cards $50-$10,000) | High (commonly $30,000+ for vintage models) |

| Liquidity | High; easy to sell on auction sites and marketplaces | Moderate; requires specialized buyers, longer sale periods |

| Appreciation Potential | Variable; depends on rarity, player legacy, and market trends | Stable to high; classic cars often appreciate due to scarcity and condition |

| Maintenance Costs | Minimal; mainly storage and preservation (e.g., casing) | High; includes storage, insurance, repairs, and upkeep |

| Market Volatility | Higher; influenced by sports popularity and player performance | Lower; classic cars have established collector communities |

| Storage Requirements | Compact; requires controlled environment for preservation | Space-consuming; requires garage or specialized storage facilities |

| Tax Considerations | Capital gains tax applicable upon sale | Potential tax benefits for vintage vehicles under certain conditions |

| Accessibility | Wide; available to small and large investors | Limited; requires expertise and significant capital |

Which is better?

Sports memorabilia investment often offers higher liquidity and a broader collector base compared to classic car investment, which requires substantial maintenance costs and storage considerations. Classic car investment tends to appreciate steadily over time but involves risks related to market fluctuations and physical depreciation. Investors seeking quicker asset turnover and diverse market access might prefer sports memorabilia, while those aiming for long-term value and passion-driven assets often choose classic cars.

Connection

Sports memorabilia investment and classic car investment both capitalize on the growing market for rare, tangible assets that appreciate due to scarcity, historical significance, and passionate collector communities. These investments share common drivers such as provenance verification, authenticity certification, and niche market demand, which enhance their long-term value potential. Enthusiasts in both sectors often leverage expert appraisals and auction platforms to maximize returns and ensure asset legitimacy.

Key Terms

**Classic car investment:**

Classic car investment offers a unique blend of historical value, rarity, and potential for considerable appreciation, with models like the 1960s Ferrari 250 GTO often commanding millions at auction. Unlike sports memorabilia, which relies heavily on athlete fame and item condition, classic cars provide tangible assets that can also be enjoyed through ownership and driving experience. Discover the critical factors and market trends that make classic cars a compelling investment choice.

Rarity

Classic cars offer rarity through limited production models, unique design features, and historical significance, often commanding high value among collectors. Sports memorabilia rarity is driven by items linked to iconic athletes or historic events, such as game-worn jerseys or signed equipment, which are highly sought after in niche markets. Explore the nuances of rarity in these investment types to identify which aligns best with your portfolio goals.

Provenance

Provenance plays a pivotal role in both classic car and sports memorabilia investments, significantly impacting authenticity and market value. Classic cars with documented ownership history by notable figures or participation in prestigious events tend to command higher prices, while sports memorabilia associated with key moments or athletes' authenticated signatures also drive strong investor interest. Explore how provenance can enhance your investment strategy in these niche markets.

Source and External Links

Cars | Rally | Alternative Asset Investment - The global classic car market was valued over $30 billion in 2020, showing strong appreciation exampled by a 1955 Porsche 356 Speedster that gained 568.5% in value over 19 years; classic cars are considered a stable, low-volatility alternative investment appealing for portfolio diversification.

Investing in Classic Cars - Nationwide - Classic cars, typically 15 to 25 years old with unique or limited production features, have gained 500% in value from 2004 to 2014, making them attractive investments even for those with moderate budgets, though success requires careful research and selecting cars with strong resale potential.

How to Invest in Classic Cars | Nasdaq - Investing in classic cars demands detailed market knowledge, considering rarity, condition, maintenance costs, and long-term trends; while potentially profitable, it also carries risks and requires a strategic, patient approach often benefitting from financial advisor guidance.

dowidth.com

dowidth.com