Fractional real estate allows investors to purchase a portion of a specific property, offering direct ownership and potential rental income, while Real Estate ETFs provide diversified exposure to a broad portfolio of real estate assets through traded securities. Each option presents different liquidity profiles, management responsibilities, and risk levels, influencing investment strategy and potential returns. Explore further to understand which real estate investment aligns best with your financial goals.

Why it is important

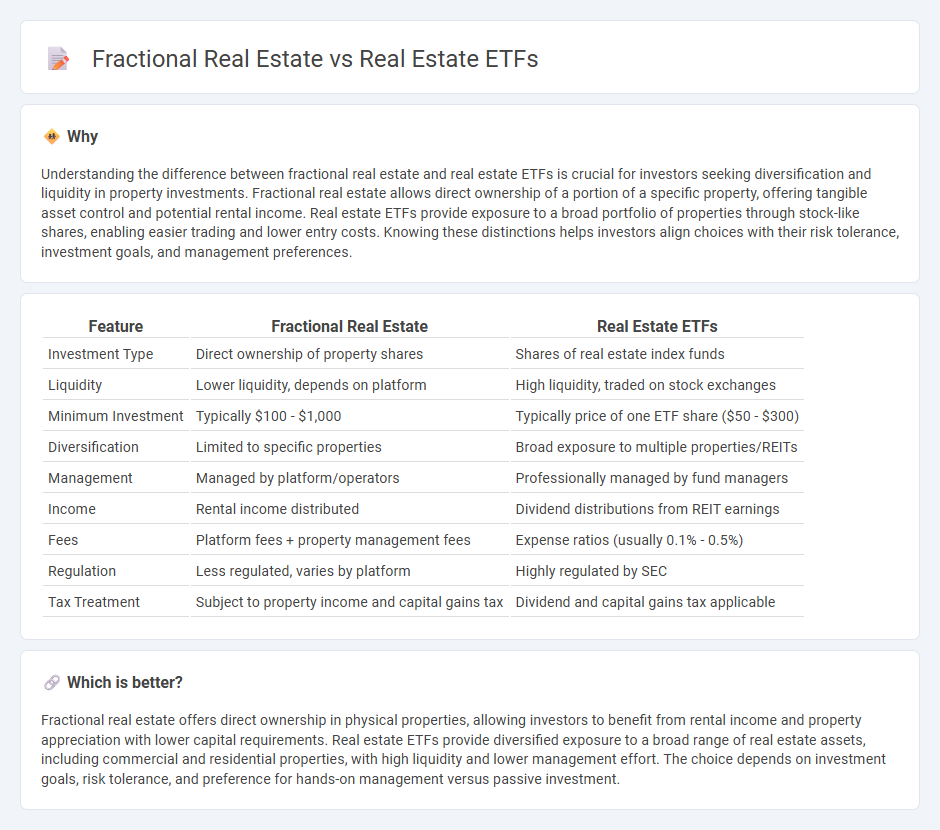

Understanding the difference between fractional real estate and real estate ETFs is crucial for investors seeking diversification and liquidity in property investments. Fractional real estate allows direct ownership of a portion of a specific property, offering tangible asset control and potential rental income. Real estate ETFs provide exposure to a broad portfolio of properties through stock-like shares, enabling easier trading and lower entry costs. Knowing these distinctions helps investors align choices with their risk tolerance, investment goals, and management preferences.

Comparison Table

| Feature | Fractional Real Estate | Real Estate ETFs |

|---|---|---|

| Investment Type | Direct ownership of property shares | Shares of real estate index funds |

| Liquidity | Lower liquidity, depends on platform | High liquidity, traded on stock exchanges |

| Minimum Investment | Typically $100 - $1,000 | Typically price of one ETF share ($50 - $300) |

| Diversification | Limited to specific properties | Broad exposure to multiple properties/REITs |

| Management | Managed by platform/operators | Professionally managed by fund managers |

| Income | Rental income distributed | Dividend distributions from REIT earnings |

| Fees | Platform fees + property management fees | Expense ratios (usually 0.1% - 0.5%) |

| Regulation | Less regulated, varies by platform | Highly regulated by SEC |

| Tax Treatment | Subject to property income and capital gains tax | Dividend and capital gains tax applicable |

Which is better?

Fractional real estate offers direct ownership in physical properties, allowing investors to benefit from rental income and property appreciation with lower capital requirements. Real estate ETFs provide diversified exposure to a broad range of real estate assets, including commercial and residential properties, with high liquidity and lower management effort. The choice depends on investment goals, risk tolerance, and preference for hands-on management versus passive investment.

Connection

Fractional real estate and real estate ETFs both enable investors to access the property market with lower capital by pooling resources to purchase shares in real estate assets. Fractional real estate offers direct partial ownership of specific properties, while real estate ETFs provide diversified exposure through traded shares of real estate investment trusts or companies. Both investment methods increase liquidity and allow portfolio diversification within the real estate sector, catering to smaller investors seeking flexible market entry.

Key Terms

Liquidity

Real estate ETFs offer high liquidity by allowing investors to buy and sell shares on stock exchanges with ease and minimal transaction costs. Fractional real estate investments provide access to property ownership but often involve longer holding periods and limited secondary market options, reducing immediate liquidity. Explore the nuances of liquidity in both investment types to optimize your real estate portfolio strategy.

Diversification

Real estate ETFs provide broad diversification across commercial and residential properties by pooling multiple real estate assets within a single fund, reducing exposure to individual property risks. Fractional real estate investments allow investors to buy specific shares of physical properties, offering targeted exposure but less diversification compared to ETFs. Discover how each option fits your investment strategy and risk tolerance.

Ownership structure

Real estate ETFs pool investor funds to purchase a diverse portfolio of properties managed by professionals, providing indirect ownership through shares. Fractional real estate allows investors to directly own a portion of a specific property, offering tangible asset control and potentially higher customization. Explore the nuances of ownership structure in real estate investments to find the right fit for your portfolio.

Source and External Links

5 Best-Performing Real Estate ETFs for July 2025 - NerdWallet - Real estate ETFs offer diversification, liquidity, passive income potential, and a hedge against inflation, with top performers including JRE (16.22% year-to-date) and SRVR (15.65%).

The Best REIT ETFs to Buy | Morningstar - The Vanguard Real Estate ETF is a leading REIT fund known for its diversification, low fees, and market-cap weighted portfolio mostly composed of equity REITs that provide exposure to US income-producing real estate.

Cohen & Steers Real Estate Active ETF - This actively managed ETF focuses on high total returns by accessing attractive valuations and growth catalysts across a broad universe of real estate securities with low correlations to traditional asset classes.

dowidth.com

dowidth.com