Secondaries in venture capital involve the buying and selling of existing equity stakes, providing liquidity to early investors without diluting ownership. Bridge financing offers temporary capital to startups, bridging gaps between funding rounds and supporting operational needs during growth phases. Explore how each strategy impacts portfolio management and startup valuation in venture ecosystems.

Why it is important

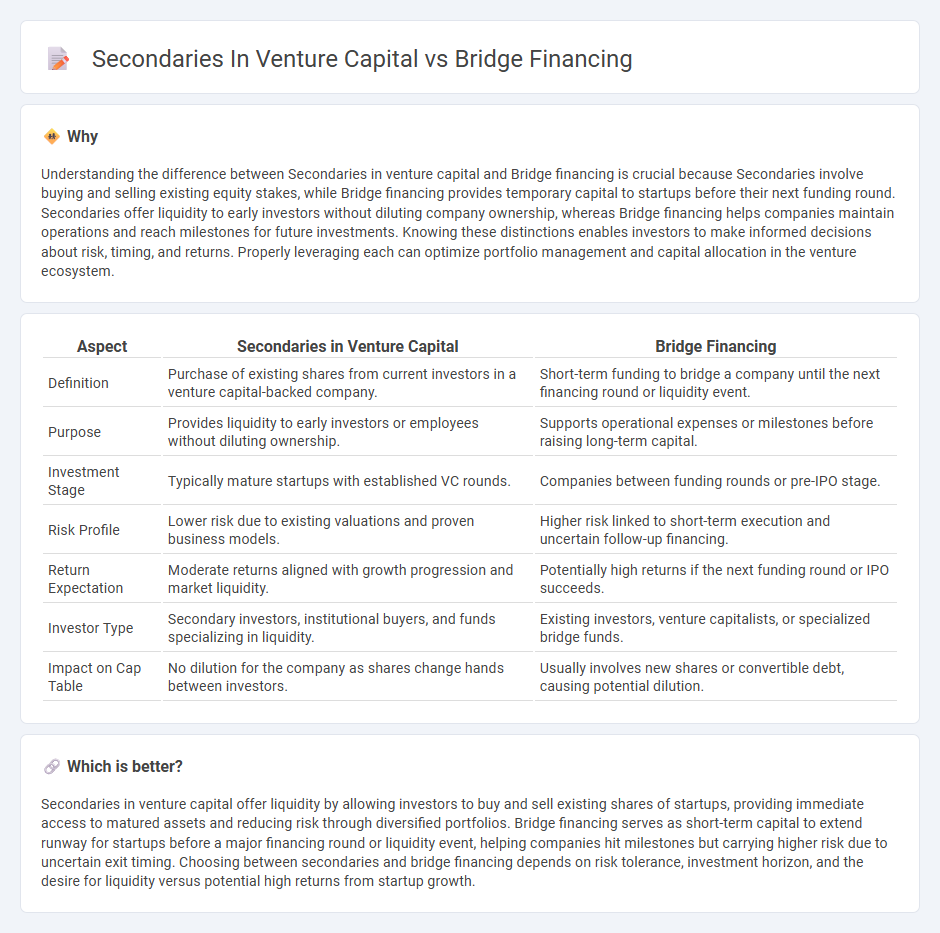

Understanding the difference between Secondaries in venture capital and Bridge financing is crucial because Secondaries involve buying and selling existing equity stakes, while Bridge financing provides temporary capital to startups before their next funding round. Secondaries offer liquidity to early investors without diluting company ownership, whereas Bridge financing helps companies maintain operations and reach milestones for future investments. Knowing these distinctions enables investors to make informed decisions about risk, timing, and returns. Properly leveraging each can optimize portfolio management and capital allocation in the venture ecosystem.

Comparison Table

| Aspect | Secondaries in Venture Capital | Bridge Financing |

|---|---|---|

| Definition | Purchase of existing shares from current investors in a venture capital-backed company. | Short-term funding to bridge a company until the next financing round or liquidity event. |

| Purpose | Provides liquidity to early investors or employees without diluting ownership. | Supports operational expenses or milestones before raising long-term capital. |

| Investment Stage | Typically mature startups with established VC rounds. | Companies between funding rounds or pre-IPO stage. |

| Risk Profile | Lower risk due to existing valuations and proven business models. | Higher risk linked to short-term execution and uncertain follow-up financing. |

| Return Expectation | Moderate returns aligned with growth progression and market liquidity. | Potentially high returns if the next funding round or IPO succeeds. |

| Investor Type | Secondary investors, institutional buyers, and funds specializing in liquidity. | Existing investors, venture capitalists, or specialized bridge funds. |

| Impact on Cap Table | No dilution for the company as shares change hands between investors. | Usually involves new shares or convertible debt, causing potential dilution. |

Which is better?

Secondaries in venture capital offer liquidity by allowing investors to buy and sell existing shares of startups, providing immediate access to matured assets and reducing risk through diversified portfolios. Bridge financing serves as short-term capital to extend runway for startups before a major financing round or liquidity event, helping companies hit milestones but carrying higher risk due to uncertain exit timing. Choosing between secondaries and bridge financing depends on risk tolerance, investment horizon, and the desire for liquidity versus potential high returns from startup growth.

Connection

Secondaries in venture capital involve the buying and selling of pre-existing investor stakes, providing liquidity options that can support bridge financing by enabling investors to access funds without waiting for company exits. Bridge financing acts as a short-term capital solution for startups or funds awaiting long-term financing rounds, often complementing secondary transactions by stabilizing cash flow during transition periods. This synergy enhances portfolio management flexibility and risk mitigation for both investors and entrepreneurs.

Key Terms

Liquidity

Bridge financing provides short-term liquidity to startups, enabling them to cover expenses until the next funding round, while secondaries offer investors a way to achieve liquidity by selling existing shares in venture capital funds or startups. Bridge loans typically have higher interest rates and are riskier due to their short duration, whereas secondary transactions depend on market demand and the valuation of shares. Explore the differences further to optimize liquidity strategies in venture capital investments.

Valuation

Bridge financing in venture capital typically involves short-term funding at a valuation close to the previous round, often with minimal changes to equity stakes, providing interim capital before a larger financing event. Secondaries focus on buying existing shares from current investors or employees, with valuations reflecting market demand and liquidity preferences rather than growth projections. Explore the differences in valuation strategies between bridge financing and secondaries to optimize investment decisions.

Exit strategy

Bridge financing provides startups with short-term capital to extend the runway before a significant exit event like an IPO or acquisition, aligning with the exit strategy by maintaining growth until liquidity is achievable. Secondaries in venture capital enable existing investors or employees to sell their shares to new investors before a formal exit, offering liquidity without waiting for the company's final exit event. Explore detailed comparisons and strategic implications of bridge financing and secondaries for optimizing venture capital exit outcomes.

Source and External Links

Bridge Financing - Definition, How it Works, Example - Bridge financing is a form of temporary financing designed to cover a company's short-term costs until long-term financing is secured, often involving expensive loans due to higher default risk and commonly used in initial public offerings.

Bridge loan - Wikipedia - A bridge loan is a short-term loan, usually lasting from 2 weeks to 3 years, used to provide interim financing until permanent financing is arranged, typically with higher interest rates and faster approval than conventional loans.

What Is A Bridge Loan And How Does It Work? - Bankrate - Bridge loans are short-term loans commonly used in real estate to cover the period between purchasing a new property and selling an existing one, usually involving interest-only payments and balloon payments within six to 12 months.

dowidth.com

dowidth.com