Fine art micro-shares offer investors the opportunity to own fractional interests in valuable artworks, enabling portfolio diversification with lower capital requirements, while private equity funds focus on pooled capital investments in private companies aiming for long-term growth and high returns. Both investment types provide alternative asset exposure but differ significantly in liquidity, risk profile, and market accessibility. Explore the unique benefits and considerations of fine art micro-shares versus private equity funds to make informed investment decisions.

Why it is important

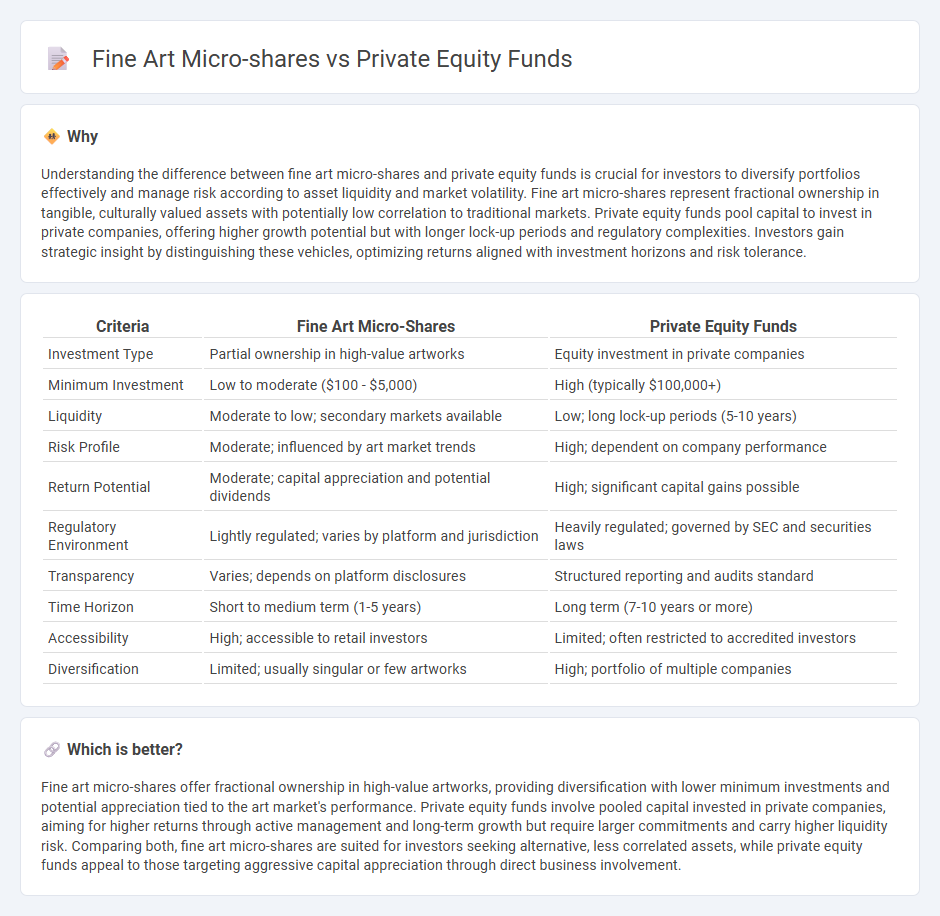

Understanding the difference between fine art micro-shares and private equity funds is crucial for investors to diversify portfolios effectively and manage risk according to asset liquidity and market volatility. Fine art micro-shares represent fractional ownership in tangible, culturally valued assets with potentially low correlation to traditional markets. Private equity funds pool capital to invest in private companies, offering higher growth potential but with longer lock-up periods and regulatory complexities. Investors gain strategic insight by distinguishing these vehicles, optimizing returns aligned with investment horizons and risk tolerance.

Comparison Table

| Criteria | Fine Art Micro-Shares | Private Equity Funds |

|---|---|---|

| Investment Type | Partial ownership in high-value artworks | Equity investment in private companies |

| Minimum Investment | Low to moderate ($100 - $5,000) | High (typically $100,000+) |

| Liquidity | Moderate to low; secondary markets available | Low; long lock-up periods (5-10 years) |

| Risk Profile | Moderate; influenced by art market trends | High; dependent on company performance |

| Return Potential | Moderate; capital appreciation and potential dividends | High; significant capital gains possible |

| Regulatory Environment | Lightly regulated; varies by platform and jurisdiction | Heavily regulated; governed by SEC and securities laws |

| Transparency | Varies; depends on platform disclosures | Structured reporting and audits standard |

| Time Horizon | Short to medium term (1-5 years) | Long term (7-10 years or more) |

| Accessibility | High; accessible to retail investors | Limited; often restricted to accredited investors |

| Diversification | Limited; usually singular or few artworks | High; portfolio of multiple companies |

Which is better?

Fine art micro-shares offer fractional ownership in high-value artworks, providing diversification with lower minimum investments and potential appreciation tied to the art market's performance. Private equity funds involve pooled capital invested in private companies, aiming for higher returns through active management and long-term growth but require larger commitments and carry higher liquidity risk. Comparing both, fine art micro-shares are suited for investors seeking alternative, less correlated assets, while private equity funds appeal to those targeting aggressive capital appreciation through direct business involvement.

Connection

Fine art micro-shares and private equity funds are connected through their shared approach of fractional ownership, allowing investors to diversify portfolios by acquiring partial stakes in valuable, traditionally illiquid assets. Private equity funds often leverage fine art micro-shares to tap into alternative investment opportunities with potential for high returns and portfolio hedging against market volatility. Both investment types rely on asset appreciation and market demand, bridging the gap between art markets and private equity capital flows.

Key Terms

Liquidity

Private equity funds typically have limited liquidity, with investment horizons spanning several years and redemption opportunities often restricted to specific windows. Fine art micro-shares offer greater liquidity by enabling fractional ownership and easier transferability on secondary markets, reducing capital lock-up periods. Explore these investment vehicles further to determine which liquidity profile aligns with your financial goals.

Valuation

Private equity funds are typically valued based on discounted cash flow analysis, comparable company multiples, and internal rate of return projections, reflecting their long-term investment horizon and operational involvement. Fine art micro-shares derive valuation from art market trends, provenance, artist reputation, and auction sale records, with fractions often trading on secondary markets influenced by collector demand and cultural value. Explore in-depth valuation methodologies and market dynamics between these unique asset classes to enhance your investment strategy.

Due diligence

Due diligence in private equity funds involves extensive financial analysis, legal review, and operational assessment to evaluate investment risks and potential returns. Fine art micro-shares require rigorous provenance verification, market valuation, and authenticity checks to mitigate risks associated with fraud and market volatility. Explore further to understand how due diligence strategies differ and impact investment outcomes in these asset classes.

Source and External Links

Private Equity Fund - Wikipedia - A private equity fund is a collective investment scheme used for making investments in various equity securities, managed by a private-equity firm.

Private Equity Funds - Corporate Finance Institute - Private equity funds are pools of capital invested in companies for high returns, typically with a fixed investment horizon.

Private Equity Funds | Investor.gov - A private equity fund is a pooled investment vehicle where the adviser manages money to invest in long-term opportunities in private assets.

dowidth.com

dowidth.com