Sports memorabilia investment offers unique value through rarity, historical significance, and passionate collector markets, often appreciating steadily over time. Watch investment capitalizes on craftsmanship, brand prestige, and limited editions, appealing to luxury and fashion enthusiasts with potential for high returns. Explore deeper insights to determine which investment aligns best with your financial goals.

Why it is important

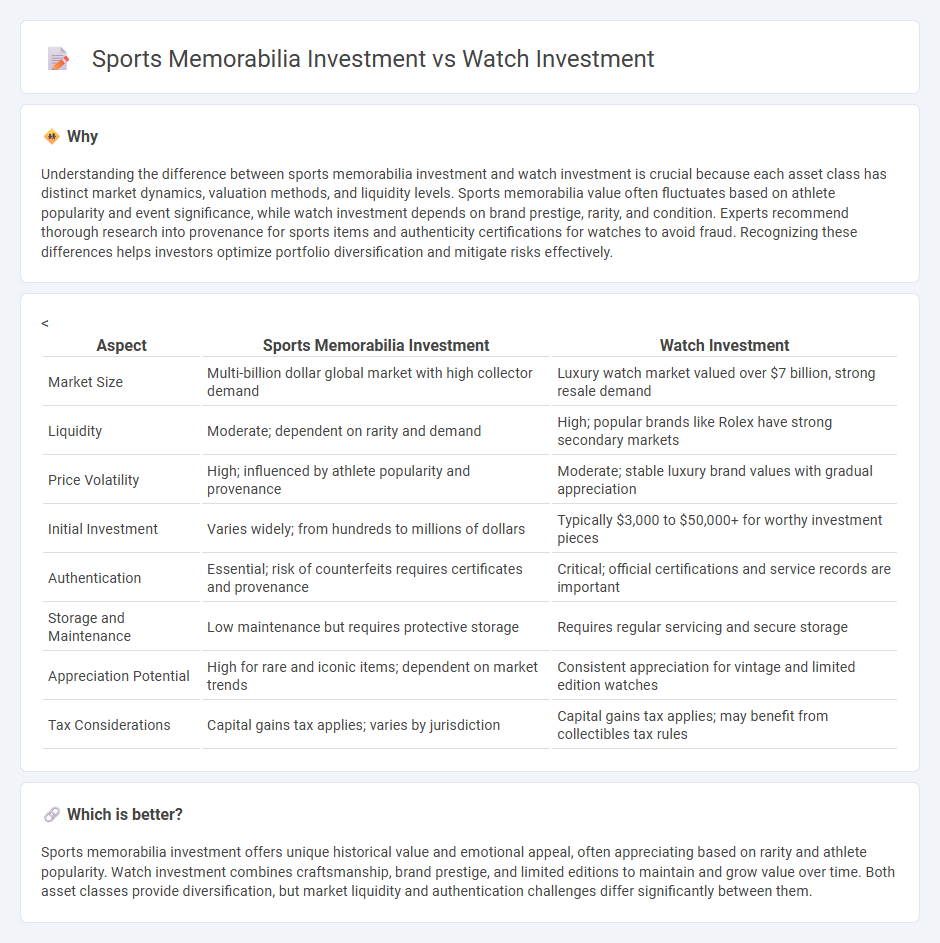

Understanding the difference between sports memorabilia investment and watch investment is crucial because each asset class has distinct market dynamics, valuation methods, and liquidity levels. Sports memorabilia value often fluctuates based on athlete popularity and event significance, while watch investment depends on brand prestige, rarity, and condition. Experts recommend thorough research into provenance for sports items and authenticity certifications for watches to avoid fraud. Recognizing these differences helps investors optimize portfolio diversification and mitigate risks effectively.

Comparison Table

| Aspect | Sports Memorabilia Investment | Watch Investment |

|---|---|---|

| Market Size | Multi-billion dollar global market with high collector demand | Luxury watch market valued over $7 billion, strong resale demand |

| Liquidity | Moderate; dependent on rarity and demand | High; popular brands like Rolex have strong secondary markets |

| Price Volatility | High; influenced by athlete popularity and provenance | Moderate; stable luxury brand values with gradual appreciation |

| Initial Investment | Varies widely; from hundreds to millions of dollars | Typically $3,000 to $50,000+ for worthy investment pieces |

| Authentication | Essential; risk of counterfeits requires certificates and provenance | Critical; official certifications and service records are important |

| Storage and Maintenance | Low maintenance but requires protective storage | Requires regular servicing and secure storage |

| Appreciation Potential | High for rare and iconic items; dependent on market trends | Consistent appreciation for vintage and limited edition watches |

| Tax Considerations | Capital gains tax applies; varies by jurisdiction | Capital gains tax applies; may benefit from collectibles tax rules |

Which is better?

Sports memorabilia investment offers unique historical value and emotional appeal, often appreciating based on rarity and athlete popularity. Watch investment combines craftsmanship, brand prestige, and limited editions to maintain and grow value over time. Both asset classes provide diversification, but market liquidity and authentication challenges differ significantly between them.

Connection

Sports memorabilia investment and watch investment both capitalize on the rarity and historical significance of tangible assets, appealing to collectors seeking long-term value appreciation. High-profile events, limited editions, and provenance play crucial roles in driving price surges within these markets. Investors often diversify portfolios by combining sports memorabilia and luxury watches to balance risk and enhance potential returns through asset uniqueness and cultural relevance.

Key Terms

Authenticity

Authenticity plays a crucial role in both watch investment and sports memorabilia investment, significantly impacting value and resale potential. High-quality certifications, provenance documentation, and expert appraisals are essential to verify originality and avoid counterfeits in both markets. Explore detailed guides on ensuring authenticity to maximize returns and safeguard your collectible investments.

Rarity

Watch investment thrives on rarity, especially with limited-edition models from brands like Rolex and Patek Philippe commanding premium prices due to their scarcity. Sports memorabilia investment focuses on unique items such as game-worn jerseys or signed balls tied to iconic athletes, making rarity a key driver of value. Discover how rarity impacts returns in both markets to enhance your investment strategy.

Market Liquidity

Watch investment offers higher market liquidity due to a robust global auction network and strong demand for luxury brands like Rolex and Patek Philippe. Sports memorabilia investment often faces lower liquidity, as sales depend heavily on niche collector interest and event-driven value spikes for items such as signed jerseys or rare trading cards. Explore deeper insights on market dynamics and liquidity strategies to optimize your investment portfolio.

Source and External Links

Are Watches a Good Investment? (Pros & Cons + An Alternative) - Watches generally make good long-term investments due to their portability, value appreciation over time, and relative stability during economic crises, but they lack liquidity and face risks from counterfeits.

Beginner's Guide - The Best Watches To Invest In - Global Boutique - Successful watch investment involves thorough research on luxury brands, models, and trusted resellers to identify collectible timepieces that could appreciate more than precious metals like gold or silver.

Invest in luxury watches - Investment watches offers tailored watch portfolios including brands like Rolex and Patek Philippe, with options for secure storage and flexible selling or holding strategies aligned to investor goals.

dowidth.com

dowidth.com