Royalty rights investing involves purchasing the rights to a percentage of revenue generated from a specific asset, offering steady income without ownership in the company. Equity investing means buying shares of a company, providing potential capital gains along with voting rights and dividends, but also exposure to market volatility. Explore the differences between these investment strategies to optimize your portfolio.

Why it is important

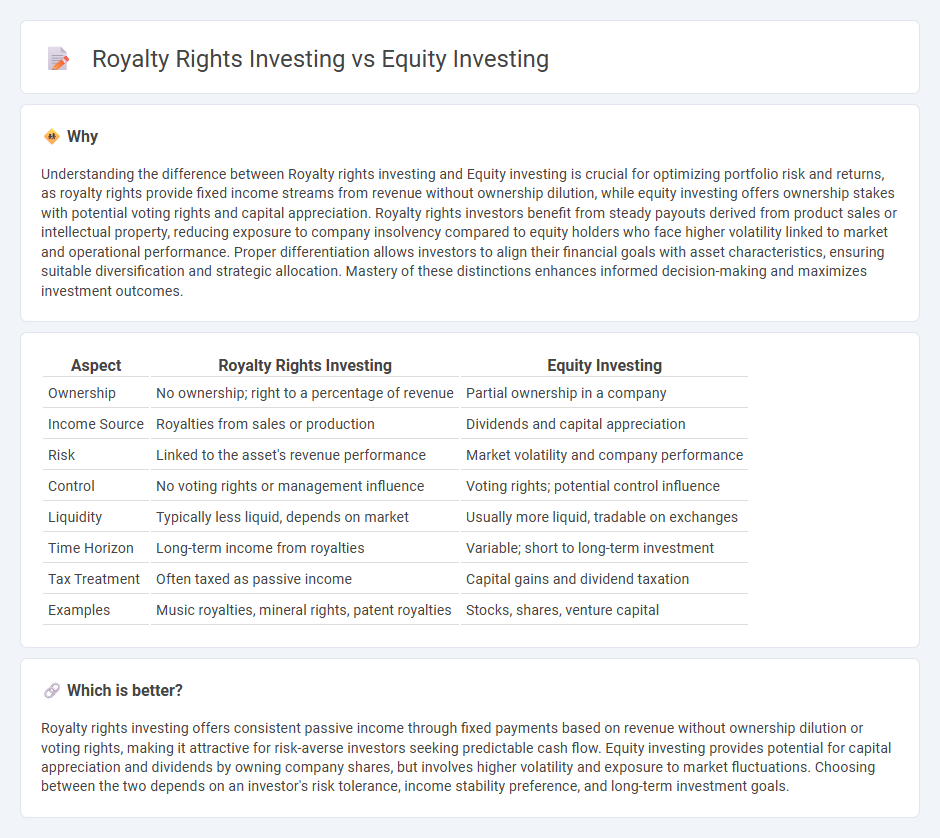

Understanding the difference between Royalty rights investing and Equity investing is crucial for optimizing portfolio risk and returns, as royalty rights provide fixed income streams from revenue without ownership dilution, while equity investing offers ownership stakes with potential voting rights and capital appreciation. Royalty rights investors benefit from steady payouts derived from product sales or intellectual property, reducing exposure to company insolvency compared to equity holders who face higher volatility linked to market and operational performance. Proper differentiation allows investors to align their financial goals with asset characteristics, ensuring suitable diversification and strategic allocation. Mastery of these distinctions enhances informed decision-making and maximizes investment outcomes.

Comparison Table

| Aspect | Royalty Rights Investing | Equity Investing |

|---|---|---|

| Ownership | No ownership; right to a percentage of revenue | Partial ownership in a company |

| Income Source | Royalties from sales or production | Dividends and capital appreciation |

| Risk | Linked to the asset's revenue performance | Market volatility and company performance |

| Control | No voting rights or management influence | Voting rights; potential control influence |

| Liquidity | Typically less liquid, depends on market | Usually more liquid, tradable on exchanges |

| Time Horizon | Long-term income from royalties | Variable; short to long-term investment |

| Tax Treatment | Often taxed as passive income | Capital gains and dividend taxation |

| Examples | Music royalties, mineral rights, patent royalties | Stocks, shares, venture capital |

Which is better?

Royalty rights investing offers consistent passive income through fixed payments based on revenue without ownership dilution or voting rights, making it attractive for risk-averse investors seeking predictable cash flow. Equity investing provides potential for capital appreciation and dividends by owning company shares, but involves higher volatility and exposure to market fluctuations. Choosing between the two depends on an investor's risk tolerance, income stability preference, and long-term investment goals.

Connection

Royalty rights investing and equity investing both offer avenues for investors to earn returns based on the performance of underlying assets, such as intellectual property or company shares. Royalty rights provide income linked to revenue generated by specific products or assets, while equity investing grants ownership stakes with potential dividends and capital appreciation. Both strategies allow diversification and can complement each other in a balanced investment portfolio focused on growth and income.

Key Terms

Ownership (Equity vs. Revenue Share)

Equity investing grants partial ownership in a company, providing investors with voting rights and potential capital appreciation, whereas royalty rights investing offers a revenue share without ownership or control, focusing solely on income from sales or usage. Investors in equity benefit from company growth and dividends, while royalty rights investors receive consistent cash flow tied to product or intellectual property performance. Explore further to understand the strategic benefits and risks of each investment type.

Capital Gains vs. Royalty Income

Equity investing generates capital gains through ownership stakes in companies, allowing investors to benefit from share price appreciation and dividends. Royalty rights investing provides consistent royalty income based on revenue streams from specific assets or intellectual property, offering predictable cash flow with less market volatility. Explore the differences in risk and return profiles to determine which investment strategy aligns with your financial goals.

Voting Rights vs. Contractual Rights

Equity investing grants shareholders voting rights, enabling influence over corporate decisions and board elections, while royalty rights investing provides contractual rights to a percentage of revenue without ownership or voting power. Voting rights in equity investments offer active participation in company governance, whereas royalty rights prioritize steady income streams based on contracts. Explore further to understand how each investment aligns with your financial goals and risk tolerance.

Source and External Links

Equity (finance) - Wikipedia - Equity investing means buying stocks in companies, either directly or through the secondary market, with the expectation of earning dividends or capital gains, and typically grants stockholders voting rights and a residual claim on company assets.

What Are Equities or Equity Investments? - SmartAsset - Equities represent ownership shares in companies, offering potential for high rewards, dividend income, portfolio diversification, and easy accessibility through various investment channels.

What are equity or stock funds? | Vanguard - Equity or stock funds, such as mutual funds and ETFs, pool investor money to buy a diversified portfolio of stocks, aiming for long-term growth but with higher volatility compared to bonds.

dowidth.com

dowidth.com