Royalty streams generate ongoing income from intellectual property rights, such as music, patents, or trademarks, providing passive revenue tied to asset usage. Rental income arises from leasing real estate or equipment, offering a consistent cash flow based on tenant payments. Explore the benefits and risks of each to optimize your investment portfolio.

Why it is important

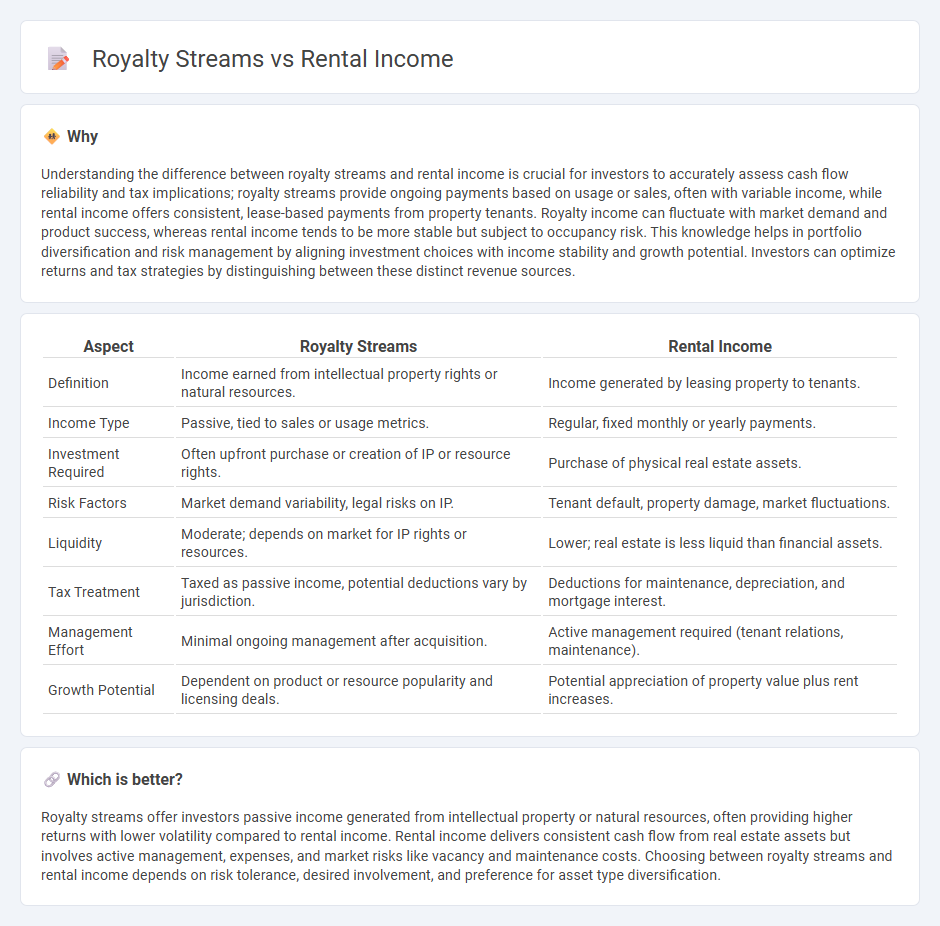

Understanding the difference between royalty streams and rental income is crucial for investors to accurately assess cash flow reliability and tax implications; royalty streams provide ongoing payments based on usage or sales, often with variable income, while rental income offers consistent, lease-based payments from property tenants. Royalty income can fluctuate with market demand and product success, whereas rental income tends to be more stable but subject to occupancy risk. This knowledge helps in portfolio diversification and risk management by aligning investment choices with income stability and growth potential. Investors can optimize returns and tax strategies by distinguishing between these distinct revenue sources.

Comparison Table

| Aspect | Royalty Streams | Rental Income |

|---|---|---|

| Definition | Income earned from intellectual property rights or natural resources. | Income generated by leasing property to tenants. |

| Income Type | Passive, tied to sales or usage metrics. | Regular, fixed monthly or yearly payments. |

| Investment Required | Often upfront purchase or creation of IP or resource rights. | Purchase of physical real estate assets. |

| Risk Factors | Market demand variability, legal risks on IP. | Tenant default, property damage, market fluctuations. |

| Liquidity | Moderate; depends on market for IP rights or resources. | Lower; real estate is less liquid than financial assets. |

| Tax Treatment | Taxed as passive income, potential deductions vary by jurisdiction. | Deductions for maintenance, depreciation, and mortgage interest. |

| Management Effort | Minimal ongoing management after acquisition. | Active management required (tenant relations, maintenance). |

| Growth Potential | Dependent on product or resource popularity and licensing deals. | Potential appreciation of property value plus rent increases. |

Which is better?

Royalty streams offer investors passive income generated from intellectual property or natural resources, often providing higher returns with lower volatility compared to rental income. Rental income delivers consistent cash flow from real estate assets but involves active management, expenses, and market risks like vacancy and maintenance costs. Choosing between royalty streams and rental income depends on risk tolerance, desired involvement, and preference for asset type diversification.

Connection

Royalty streams and rental income both generate passive cash flow by leveraging ownership rights over assets, typically intellectual property for royalties and real estate for rentals. Investors seeking diversification often include these income sources in their portfolios to balance risk and achieve steady returns. Structurally, both depend on contractual agreements that ensure recurring payments based on usage or occupancy.

Key Terms

Passive Income

Rental income generates steady passive cash flow by leasing real estate properties, often providing predictable monthly revenue with minimal active involvement. Royalty streams derive from intellectual property rights, such as patents, trademarks, or creative works, offering ongoing payments based on usage or sales without the need for property management. Explore detailed strategies and tax advantages of rental income and royalty streams to maximize your passive income portfolio.

Intellectual Property

Rental income from intellectual property involves licensing agreements where the owner grants usage rights for a fixed period in exchange for regular payments, generating predictable cash flow. Royalty streams are variable payments based on the commercial success or usage volume of the IP, often tied to sales, production units, or revenue percentages, aligning compensation with market performance. Explore the differences and benefits of these income models to optimize your IP monetization strategy.

Lease Agreement

Lease agreements establish clear terms for rental income, specifying payment schedules, amounts, and tenant obligations, ensuring predictable cash flow for property owners. Royalty streams, typically linked to intellectual property or mineral rights, generate income based on usage or sales volume rather than fixed periodic payments. Explore the critical distinctions between rental income and royalty streams to maximize financial benefits in lease agreements.

Source and External Links

Tips on rental real estate income, deductions and recordkeeping - Rental income includes all payments received for the use or occupation of property such as rent, advance rent, and any security deposit amounts kept if not returned to the tenant, and all rental income must be reported on your tax return, with associated expenses generally deductible.

What is rental income and how do I report it? - Rental income is taxable income received from renting out property, including rent payments, advance rents, payments for canceling leases, and tenant-paid expenses, and is typically reported using Schedule E on your tax return.

B3-3.1-08, Rental Income - Rental income used for qualifying purposes is calculated based on tax returns or lease agreements, with adjustments like adding back depreciation and averaging over the rental period, reflecting stable income likely to continue.

dowidth.com

dowidth.com