Sports memorabilia investment offers unique opportunities tied to athlete fame, event significance, and collectible rarity, often resulting in dynamic market demand and value appreciation. Rare book investment, by contrast, relies heavily on historical importance, edition scarcity, and condition, catering to collectors and institutions valuing literary heritage. Explore detailed comparisons of these asset classes to make informed investment decisions.

Why it is important

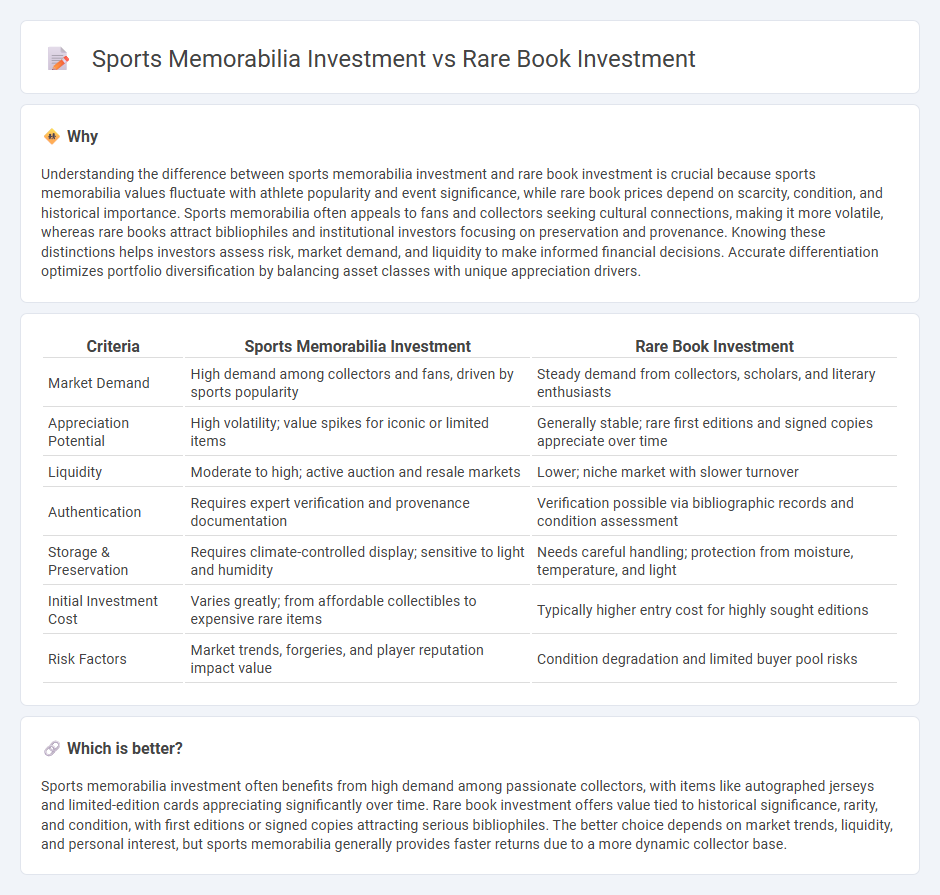

Understanding the difference between sports memorabilia investment and rare book investment is crucial because sports memorabilia values fluctuate with athlete popularity and event significance, while rare book prices depend on scarcity, condition, and historical importance. Sports memorabilia often appeals to fans and collectors seeking cultural connections, making it more volatile, whereas rare books attract bibliophiles and institutional investors focusing on preservation and provenance. Knowing these distinctions helps investors assess risk, market demand, and liquidity to make informed financial decisions. Accurate differentiation optimizes portfolio diversification by balancing asset classes with unique appreciation drivers.

Comparison Table

| Criteria | Sports Memorabilia Investment | Rare Book Investment |

|---|---|---|

| Market Demand | High demand among collectors and fans, driven by sports popularity | Steady demand from collectors, scholars, and literary enthusiasts |

| Appreciation Potential | High volatility; value spikes for iconic or limited items | Generally stable; rare first editions and signed copies appreciate over time |

| Liquidity | Moderate to high; active auction and resale markets | Lower; niche market with slower turnover |

| Authentication | Requires expert verification and provenance documentation | Verification possible via bibliographic records and condition assessment |

| Storage & Preservation | Requires climate-controlled display; sensitive to light and humidity | Needs careful handling; protection from moisture, temperature, and light |

| Initial Investment Cost | Varies greatly; from affordable collectibles to expensive rare items | Typically higher entry cost for highly sought editions |

| Risk Factors | Market trends, forgeries, and player reputation impact value | Condition degradation and limited buyer pool risks |

Which is better?

Sports memorabilia investment often benefits from high demand among passionate collectors, with items like autographed jerseys and limited-edition cards appreciating significantly over time. Rare book investment offers value tied to historical significance, rarity, and condition, with first editions or signed copies attracting serious bibliophiles. The better choice depends on market trends, liquidity, and personal interest, but sports memorabilia generally provides faster returns due to a more dynamic collector base.

Connection

Sports memorabilia investment and rare book investment share a common foundation in collectible asset appreciation driven by rarity, provenance, and cultural significance. Both markets rely heavily on authentication processes and expert valuation to establish trust and market value, attracting niche collectors and investors seeking tangible assets with historical and sentimental appeal. The liquidity of these investments often depends on specialized auction houses and dedicated platforms that connect buyers and sellers worldwide, reflecting the intersection of passion and financial strategy.

Key Terms

Rare book investment:

Rare book investment offers unique advantages such as historical value, rarity, and the potential for appreciation driven by cultural significance and market demand among collectors. Unlike sports memorabilia, rare books often carry intrinsic literary importance and can appreciate steadily due to limited editions and provenance. Explore how rare book investment can diversify your portfolio and provide a lasting connection to history.

Provenance

Provenance plays a critical role in determining the value of both rare books and sports memorabilia, as verified ownership history enhances authenticity and market appeal. Rare books with documented provenance often command higher prices due to their historical significance, while sports memorabilia linked to iconic athletes' achievements gain increased desirability among collectors. Explore detailed insights on how provenance impacts investment strategies in these collectible markets.

Edition

Investing in rare books often revolves around the edition's scarcity, with first editions and limited print runs commanding higher value due to their historical and collectible significance. Sports memorabilia investments focus on limited edition items such as signed jerseys, numbered trading cards, or exclusive event collectibles that highlight rarity and athlete legacy. Explore detailed comparisons to understand how edition scarcity influences value in both rare book and sports memorabilia markets.

Source and External Links

The Next Big Investment: Rare Books And Memorabilia With Autographs - Investing in signed first-edition books by promising authors can yield extremely high returns, with examples like a signed first edition of *The Catcher In The Rye* potentially worth hundreds of thousands of dollars if well-preserved.

Investing in rare books and manuscripts - The Beacon Newspaper - The rare books and manuscripts market is very active and can offer stable diversification from traditional volatile assets like stocks and cryptocurrencies.

How to invest in rare books | Square Mile - Investment in rare books includes buying first editions, modern editions with collectible appeal, and taking a chance on emerging authors who might become cult or Nobel Literature winners.

dowidth.com

dowidth.com