Collectible sneakers offer a tangible investment with potential high returns driven by rarity, brand collaborations, and cultural trends, contrasting with exchange-traded funds (ETFs) that provide diversified exposure to stocks, bonds, or commodities with lower volatility and liquidity. Sneakers require specialized market knowledge and can be illiquid and susceptible to market hype, whereas ETFs allow for passive investment strategies with standardized pricing and easier entry or exit. Explore how these distinct asset classes can fit into your overall investment strategy.

Why it is important

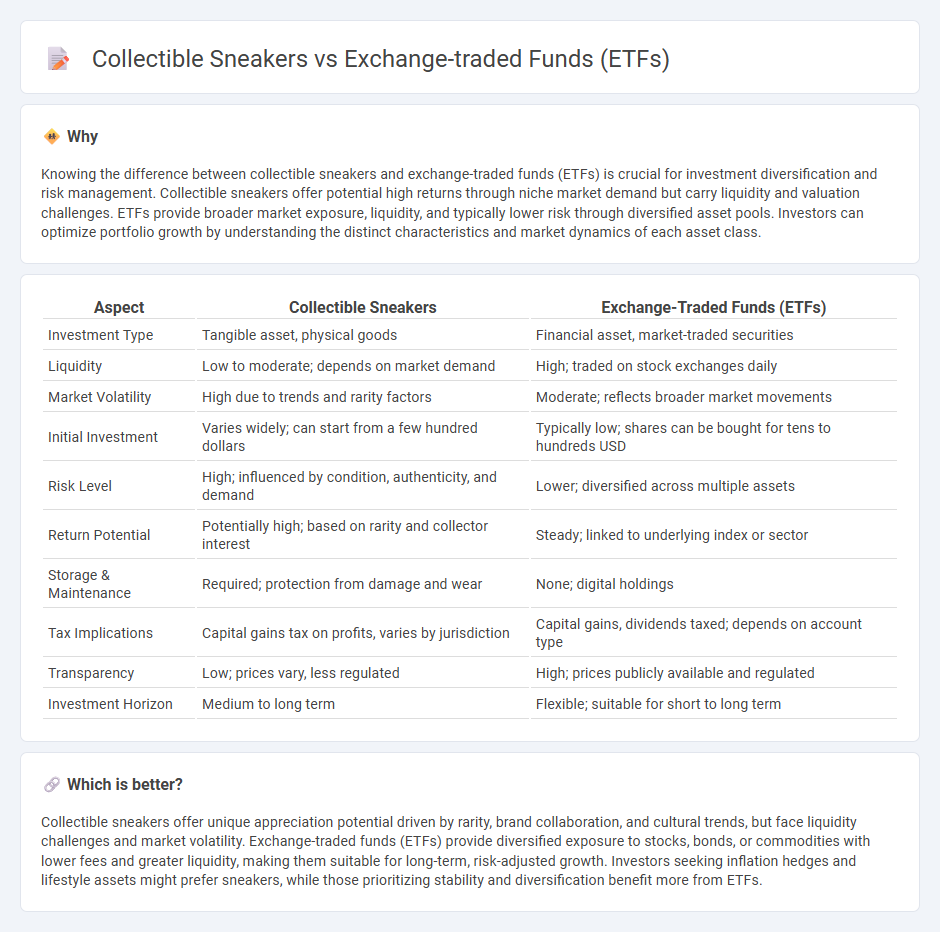

Knowing the difference between collectible sneakers and exchange-traded funds (ETFs) is crucial for investment diversification and risk management. Collectible sneakers offer potential high returns through niche market demand but carry liquidity and valuation challenges. ETFs provide broader market exposure, liquidity, and typically lower risk through diversified asset pools. Investors can optimize portfolio growth by understanding the distinct characteristics and market dynamics of each asset class.

Comparison Table

| Aspect | Collectible Sneakers | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Investment Type | Tangible asset, physical goods | Financial asset, market-traded securities |

| Liquidity | Low to moderate; depends on market demand | High; traded on stock exchanges daily |

| Market Volatility | High due to trends and rarity factors | Moderate; reflects broader market movements |

| Initial Investment | Varies widely; can start from a few hundred dollars | Typically low; shares can be bought for tens to hundreds USD |

| Risk Level | High; influenced by condition, authenticity, and demand | Lower; diversified across multiple assets |

| Return Potential | Potentially high; based on rarity and collector interest | Steady; linked to underlying index or sector |

| Storage & Maintenance | Required; protection from damage and wear | None; digital holdings |

| Tax Implications | Capital gains tax on profits, varies by jurisdiction | Capital gains, dividends taxed; depends on account type |

| Transparency | Low; prices vary, less regulated | High; prices publicly available and regulated |

| Investment Horizon | Medium to long term | Flexible; suitable for short to long term |

Which is better?

Collectible sneakers offer unique appreciation potential driven by rarity, brand collaboration, and cultural trends, but face liquidity challenges and market volatility. Exchange-traded funds (ETFs) provide diversified exposure to stocks, bonds, or commodities with lower fees and greater liquidity, making them suitable for long-term, risk-adjusted growth. Investors seeking inflation hedges and lifestyle assets might prefer sneakers, while those prioritizing stability and diversification benefit more from ETFs.

Connection

Collectible sneakers and Exchange-traded funds (ETFs) are connected through the concept of alternative investments, as both offer portfolio diversification beyond traditional stocks and bonds. The growing sneaker resale market mirrors trends in ETFs that focus on niche sectors, reflecting investors' interest in tangible assets with potential high returns. Data from market analysis shows the sneaker resale market valued over $6 billion, aligning with the increasing popularity of thematic and sector-specific ETFs in investment strategies.

Key Terms

Liquidity

Exchange-traded funds (ETFs) offer high liquidity through intraday trading on stock exchanges, allowing investors to buy or sell shares quickly and efficiently. Collectible sneakers, by contrast, have limited liquidity due to their dependence on niche marketplaces and the variable demand influenced by trends and rarity. Explore more about liquidity differences and investment strategies between ETFs and collectible sneakers for informed decision-making.

Diversification

Exchange-traded funds (ETFs) offer broad market diversification by pooling assets across various sectors, industries, and geographies, reducing individual investment risk. Collectible sneakers lack inherent diversification, as their value depends on trends, rarity, and brand hype, leading to higher volatility and concentration risk. Explore the advantages and challenges of ETFs and collectible sneakers to enhance your investment strategy and risk management.

Valuation

Exchange-traded funds (ETFs) offer valuation based on market liquidity and real-time pricing, providing transparency and ease of trading, while collectible sneakers' valuation depends heavily on rarity, brand collaborations, and market demand within niche communities. ETFs represent diversified asset baskets with predictable valuation models, contrasting the subjective and volatile pricing in sneaker markets influenced by trends and condition. Explore the nuances of these distinct investment vehicles to understand their valuation dynamics further.

Source and External Links

Exchange-Traded Fund (ETF) - Investor.gov - An ETF is an exchange-traded investment product that pools money from multiple investors and invests in various securities, offering benefits like flexibility and tax efficiency compared to mutual funds.

What is an ETF (Exchange-Traded Fund)? - Charles Schwab - ETFs combine the trading flexibility of stocks with the diversification benefits of mutual funds, allowing investors to access a wide range of asset classes at potentially lower costs.

Exchange-Traded Funds and Products | FINRA.org - ETFs are pooled investments traded on exchanges, offering diversification and trading flexibility by allowing investors to buy and sell shares throughout the day like stocks.

dowidth.com

dowidth.com