Whiskey cask investment offers an alternative asset class with potential for high returns driven by the aging process and increasing global demand for rare spirits. Stamp investment, meanwhile, provides value through historical rarity and collector interest, often benefiting from stable market performance. Explore the unique advantages and risks of each investment type to determine which aligns best with your portfolio goals.

Why it is important

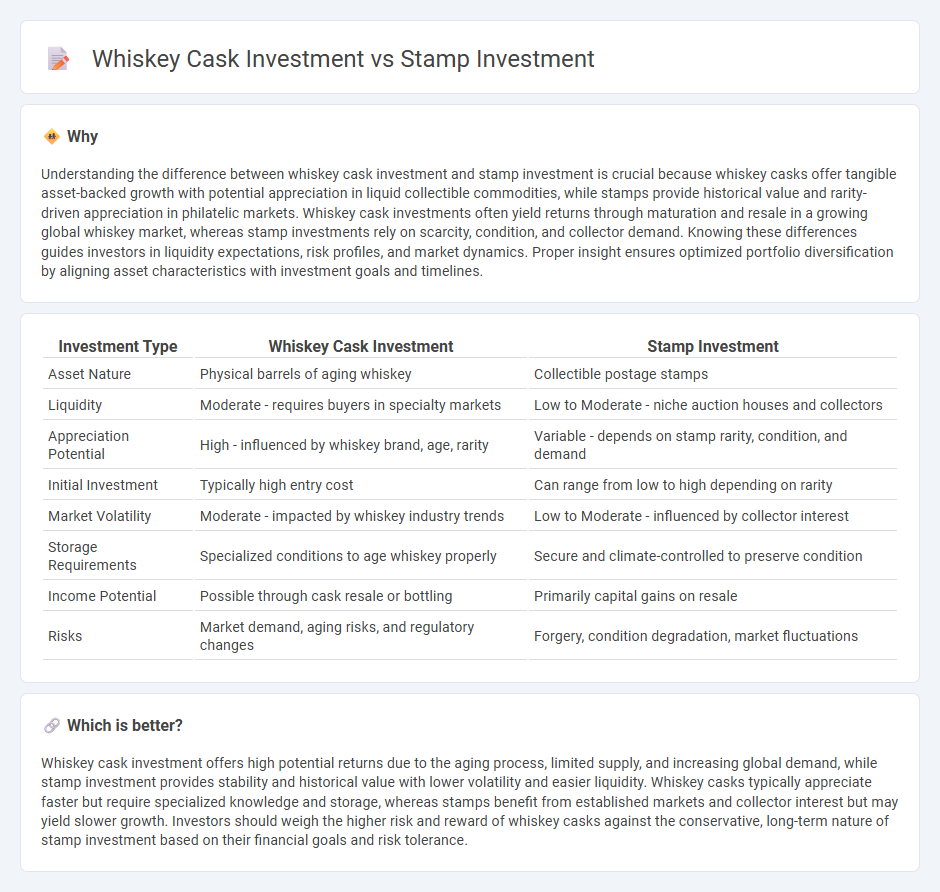

Understanding the difference between whiskey cask investment and stamp investment is crucial because whiskey casks offer tangible asset-backed growth with potential appreciation in liquid collectible commodities, while stamps provide historical value and rarity-driven appreciation in philatelic markets. Whiskey cask investments often yield returns through maturation and resale in a growing global whiskey market, whereas stamp investments rely on scarcity, condition, and collector demand. Knowing these differences guides investors in liquidity expectations, risk profiles, and market dynamics. Proper insight ensures optimized portfolio diversification by aligning asset characteristics with investment goals and timelines.

Comparison Table

| Investment Type | Whiskey Cask Investment | Stamp Investment |

|---|---|---|

| Asset Nature | Physical barrels of aging whiskey | Collectible postage stamps |

| Liquidity | Moderate - requires buyers in specialty markets | Low to Moderate - niche auction houses and collectors |

| Appreciation Potential | High - influenced by whiskey brand, age, rarity | Variable - depends on stamp rarity, condition, and demand |

| Initial Investment | Typically high entry cost | Can range from low to high depending on rarity |

| Market Volatility | Moderate - impacted by whiskey industry trends | Low to Moderate - influenced by collector interest |

| Storage Requirements | Specialized conditions to age whiskey properly | Secure and climate-controlled to preserve condition |

| Income Potential | Possible through cask resale or bottling | Primarily capital gains on resale |

| Risks | Market demand, aging risks, and regulatory changes | Forgery, condition degradation, market fluctuations |

Which is better?

Whiskey cask investment offers high potential returns due to the aging process, limited supply, and increasing global demand, while stamp investment provides stability and historical value with lower volatility and easier liquidity. Whiskey casks typically appreciate faster but require specialized knowledge and storage, whereas stamps benefit from established markets and collector interest but may yield slower growth. Investors should weigh the higher risk and reward of whiskey casks against the conservative, long-term nature of stamp investment based on their financial goals and risk tolerance.

Connection

Whiskey cask investment and stamp investment both represent alternative asset classes that offer portfolio diversification beyond traditional stocks and bonds. Both assets derive value from rarity, historical significance, and limited availability, making them attractive to collectors and investors seeking tangible investments. Market trends highlight growing demand in luxury and collectible markets, with whiskey casks appreciating due to aging potential and stamps gaining value through scarcity and provenance.

Key Terms

Provenance

Provenance plays a crucial role in both stamp and whiskey cask investments, as it verifies authenticity and historical value, thereby enhancing market worth. Stamps benefit from detailed postal histories and expert certifications, while whiskey casks rely on distillery records and aging processes documented through trusted sources. Explore in-depth insights to understand how provenance impacts investment potential in these unique asset classes.

Liquidity

Stamp investment offers moderate liquidity through established auction houses and online marketplaces, enabling quicker sales for rare and collectible stamps. Whiskey cask investment generally involves lower liquidity due to the niche market and longer maturation periods before the cask's value appreciates. Explore the advantages and challenges of liquidity in both stamp and whiskey cask investments to make an informed decision.

Authentication

Stamp investment relies heavily on expert authentication to verify rarity, condition, and provenance, ensuring genuine collectibles that maintain or increase value over time. Whiskey cask investment demands thorough validation of cask origin, distillery, age, and storage conditions to authenticate quality and legitimate market value. Discover the critical authentication processes that differentiate these two unique investment types.

Source and External Links

Philatelic Investment - Investing in collectible postage stamps for profit involves understanding the advantages and challenges of this unique investment class.

Investing in Stamps - This guide provides insights into investing in stamps as a diversification strategy, highlighting historical significance and cultural connection.

Can Postage Stamp Collecting Be a Good Investment? - This article explores the potential of stamp collecting as an investment, emphasizing the importance of research and risk management.

dowidth.com

dowidth.com