Farmland funds offer investors exposure to agricultural land, providing tangible assets with potential for steady income through crop production and land appreciation. Cryptocurrency funds focus on digital assets, presenting higher volatility but significant growth opportunities through blockchain technology. Explore the unique benefits and risks of each to determine the best fit for your investment strategy.

Why it is important

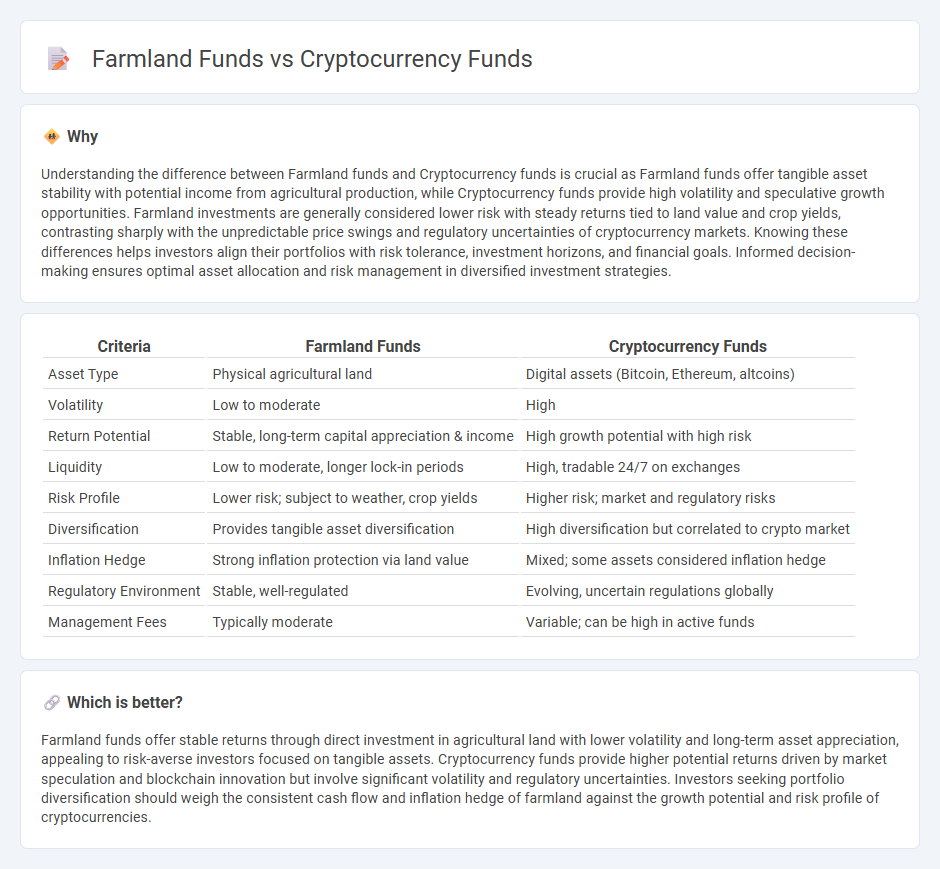

Understanding the difference between Farmland funds and Cryptocurrency funds is crucial as Farmland funds offer tangible asset stability with potential income from agricultural production, while Cryptocurrency funds provide high volatility and speculative growth opportunities. Farmland investments are generally considered lower risk with steady returns tied to land value and crop yields, contrasting sharply with the unpredictable price swings and regulatory uncertainties of cryptocurrency markets. Knowing these differences helps investors align their portfolios with risk tolerance, investment horizons, and financial goals. Informed decision-making ensures optimal asset allocation and risk management in diversified investment strategies.

Comparison Table

| Criteria | Farmland Funds | Cryptocurrency Funds |

|---|---|---|

| Asset Type | Physical agricultural land | Digital assets (Bitcoin, Ethereum, altcoins) |

| Volatility | Low to moderate | High |

| Return Potential | Stable, long-term capital appreciation & income | High growth potential with high risk |

| Liquidity | Low to moderate, longer lock-in periods | High, tradable 24/7 on exchanges |

| Risk Profile | Lower risk; subject to weather, crop yields | Higher risk; market and regulatory risks |

| Diversification | Provides tangible asset diversification | High diversification but correlated to crypto market |

| Inflation Hedge | Strong inflation protection via land value | Mixed; some assets considered inflation hedge |

| Regulatory Environment | Stable, well-regulated | Evolving, uncertain regulations globally |

| Management Fees | Typically moderate | Variable; can be high in active funds |

Which is better?

Farmland funds offer stable returns through direct investment in agricultural land with lower volatility and long-term asset appreciation, appealing to risk-averse investors focused on tangible assets. Cryptocurrency funds provide higher potential returns driven by market speculation and blockchain innovation but involve significant volatility and regulatory uncertainties. Investors seeking portfolio diversification should weigh the consistent cash flow and inflation hedge of farmland against the growth potential and risk profile of cryptocurrencies.

Connection

Farmland funds and cryptocurrency funds are connected through their shared appeal as alternative investment vehicles offering portfolio diversification beyond traditional assets like stocks and bonds. Both types of funds attract investors seeking hedges against inflation, with farmland providing tangible assets linked to food production and cryptocurrency offering exposure to decentralized digital currencies and blockchain technology. The increasing integration of blockchain in agriculture supply chains further bridges these sectors by enhancing transparency and traceability, thus creating synergies between farmland investments and crypto assets.

Key Terms

Volatility

Cryptocurrency funds exhibit extreme volatility with price swings often exceeding 10% daily, driven by market speculation and regulatory news, while farmland funds offer stability through steady land value appreciation and consistent agricultural yields. Farmland investments typically have low correlation with traditional markets, providing a hedge against economic downturns; cryptocurrency funds, however, are subject to rapid value fluctuations influenced by market sentiment and technological advancements. Explore the comparative risk profiles and potential returns of these distinct asset classes to optimize your investment strategy.

Liquidity

Cryptocurrency funds offer high liquidity due to 24/7 trading on multiple global exchanges, enabling rapid asset conversion and portfolio adjustments. Farmland funds typically have low liquidity since real estate transactions require extensive due diligence, legal processes, and longer holding periods. Explore detailed comparisons to understand how liquidity impacts investment strategies in these asset classes.

Tangible Assets

Cryptocurrency funds offer exposure to digital assets, characterized by high volatility and speculative potential, while farmland funds invest in tangible, income-generating agricultural land with stable long-term value. Tangible assets in farmland funds provide diversification and inflation protection, contrasting the intangible nature and regulatory uncertainties of cryptocurrencies. Explore the comparative benefits and risks of these asset classes to make an informed investment decision.

Source and External Links

Fidelity Crypto Funds - Fidelity offers spot bitcoin and ether exchange-traded products (ETPs) that allow investors to gain exposure to cryptocurrency prices directly in brokerage, trust, and IRA accounts, without holding the assets themselves.

ProFunds Crypto-Linked Mutual Funds - ProFunds provides a suite of mutual funds (BTCFX, ETHFX, BITIX) that track bitcoin, ether, and inverse bitcoin performance through futures contracts, offering crypto exposure without the need for a digital wallet or direct crypto ownership.

Cryptocurrency ETFs - Investors can access a diverse range of cryptocurrency ETFs, including options like the Invesco Galaxy Bitcoin ETF (BTCO) and Franklin Bitcoin ETF (EZBC), which track bitcoin and provide liquidity and ease of trading on traditional exchanges.

dowidth.com

dowidth.com