Fine art micro-shares allow investors to purchase fractional ownership in high-value artworks, providing access to the art market with lower capital requirements and potential for appreciation based on the artist's reputation and market trends. Angel investing platforms enable individuals to fund early-stage startups, offering equity stakes that can yield significant returns if the company succeeds, though with higher risk and longer investment horizons. Explore further to understand which investment strategy aligns best with your financial goals and risk tolerance.

Why it is important

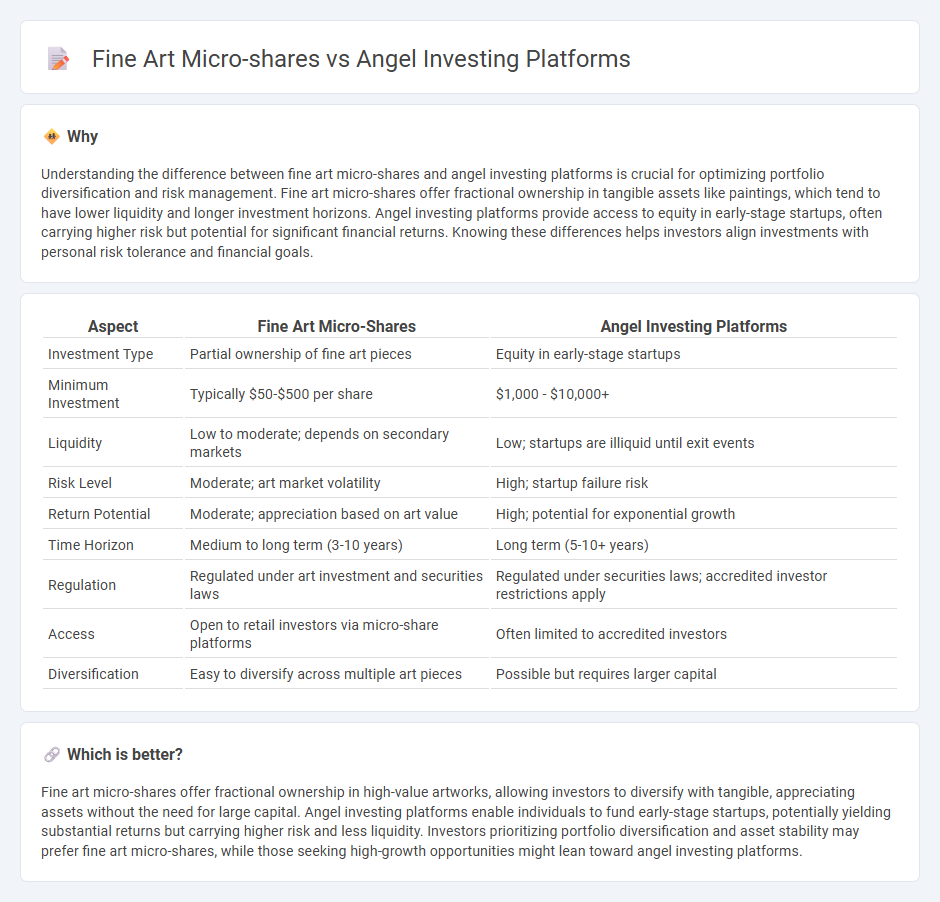

Understanding the difference between fine art micro-shares and angel investing platforms is crucial for optimizing portfolio diversification and risk management. Fine art micro-shares offer fractional ownership in tangible assets like paintings, which tend to have lower liquidity and longer investment horizons. Angel investing platforms provide access to equity in early-stage startups, often carrying higher risk but potential for significant financial returns. Knowing these differences helps investors align investments with personal risk tolerance and financial goals.

Comparison Table

| Aspect | Fine Art Micro-Shares | Angel Investing Platforms |

|---|---|---|

| Investment Type | Partial ownership of fine art pieces | Equity in early-stage startups |

| Minimum Investment | Typically $50-$500 per share | $1,000 - $10,000+ |

| Liquidity | Low to moderate; depends on secondary markets | Low; startups are illiquid until exit events |

| Risk Level | Moderate; art market volatility | High; startup failure risk |

| Return Potential | Moderate; appreciation based on art value | High; potential for exponential growth |

| Time Horizon | Medium to long term (3-10 years) | Long term (5-10+ years) |

| Regulation | Regulated under art investment and securities laws | Regulated under securities laws; accredited investor restrictions apply |

| Access | Open to retail investors via micro-share platforms | Often limited to accredited investors |

| Diversification | Easy to diversify across multiple art pieces | Possible but requires larger capital |

Which is better?

Fine art micro-shares offer fractional ownership in high-value artworks, allowing investors to diversify with tangible, appreciating assets without the need for large capital. Angel investing platforms enable individuals to fund early-stage startups, potentially yielding substantial returns but carrying higher risk and less liquidity. Investors prioritizing portfolio diversification and asset stability may prefer fine art micro-shares, while those seeking high-growth opportunities might lean toward angel investing platforms.

Connection

Fine art micro-shares and angel investing platforms both democratize access to high-value investment opportunities by allowing fractional ownership, which lowers entry barriers for smaller investors. These platforms leverage technology to create liquidity and transparency in traditionally illiquid markets, enabling diversified portfolios that include art and early-stage startups. By integrating blockchain or secure digital ledgers, they ensure provenance and streamline transactions, enhancing investor confidence and market efficiency.

Key Terms

Equity ownership

Angel investing platforms offer equity ownership in startups, allowing investors to hold shares that can appreciate significantly as the company grows. Fine art micro-shares provide fractional ownership in valuable artworks, granting investors indirect equity-like interests tied to the art's market value and potential resale profits. Explore how these investment models compare in terms of equity stakes and financial returns to make informed decisions.

Due diligence

Angel investing platforms require rigorous due diligence, including evaluating startup business models, market potential, financial health, and founder backgrounds to mitigate high investment risks. Fine art micro-shares demand due diligence centered on provenance verification, artwork authenticity, market demand, and liquidity prospects within the art investment market. Explore detailed comparisons of due diligence processes in these alternative investment types to make informed decisions.

Liquidity

Angel investing platforms typically offer limited liquidity due to long investment horizons and the time required for startups to exit through acquisition or IPO. Fine art micro-shares provide higher liquidity by enabling fractional ownership and allowing investors to trade shares on secondary markets with greater frequency. Explore the nuances of liquidity differences between these investment models to make informed financial decisions.

Source and External Links

Best Angel Investing Platforms: Find Your Perfect Match - Top angel investing platforms include AngelList, SeedInvest, Crowdcube, StartEngine, Gust, OurCrowd, and Republic, offering various benefits like low minimum investments, rigorous vetting, and international options for investors and startups alike.

15 best angel investing platforms [2025 update] - Leading platforms to find angel investors are AngelList, WeFunder, Republic, and StartEngine, noted for their extensive investor databases, regulatory compliance, and support for startups at different funding stages.

12 Best Angel Investor Websites for Startups in 2025 | TRUiC - AngelList, Gust, and Angel Investment Network stand out as top websites where startups can connect with and secure funding from angel investors with helpful tools like CRM, legal resources, and community support.

dowidth.com

dowidth.com