Music royalties platforms provide investors with steady, passive income by allowing them to purchase shares in artists' future earnings, benefiting from the consistent revenue generated by streaming and licensing. Peer-to-peer lending connects borrowers directly with lenders through online platforms, offering higher returns than traditional savings accounts while carrying varying credit risk. Discover more about how these innovative investment options can diversify your portfolio.

Why it is important

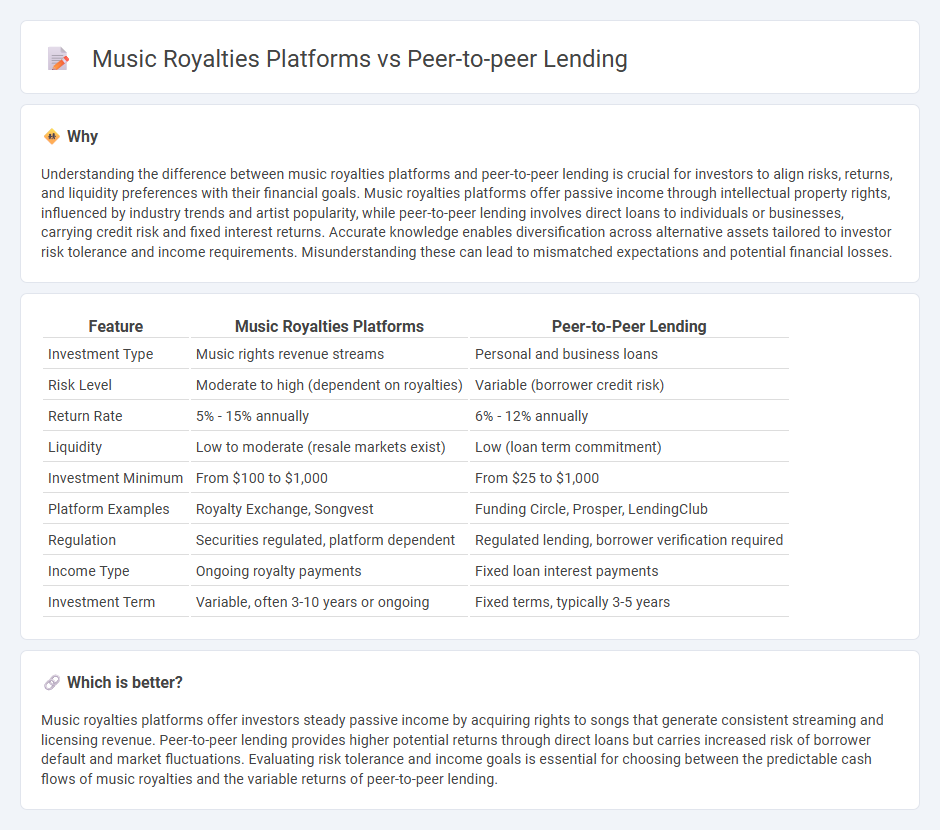

Understanding the difference between music royalties platforms and peer-to-peer lending is crucial for investors to align risks, returns, and liquidity preferences with their financial goals. Music royalties platforms offer passive income through intellectual property rights, influenced by industry trends and artist popularity, while peer-to-peer lending involves direct loans to individuals or businesses, carrying credit risk and fixed interest returns. Accurate knowledge enables diversification across alternative assets tailored to investor risk tolerance and income requirements. Misunderstanding these can lead to mismatched expectations and potential financial losses.

Comparison Table

| Feature | Music Royalties Platforms | Peer-to-Peer Lending |

|---|---|---|

| Investment Type | Music rights revenue streams | Personal and business loans |

| Risk Level | Moderate to high (dependent on royalties) | Variable (borrower credit risk) |

| Return Rate | 5% - 15% annually | 6% - 12% annually |

| Liquidity | Low to moderate (resale markets exist) | Low (loan term commitment) |

| Investment Minimum | From $100 to $1,000 | From $25 to $1,000 |

| Platform Examples | Royalty Exchange, Songvest | Funding Circle, Prosper, LendingClub |

| Regulation | Securities regulated, platform dependent | Regulated lending, borrower verification required |

| Income Type | Ongoing royalty payments | Fixed loan interest payments |

| Investment Term | Variable, often 3-10 years or ongoing | Fixed terms, typically 3-5 years |

Which is better?

Music royalties platforms offer investors steady passive income by acquiring rights to songs that generate consistent streaming and licensing revenue. Peer-to-peer lending provides higher potential returns through direct loans but carries increased risk of borrower default and market fluctuations. Evaluating risk tolerance and income goals is essential for choosing between the predictable cash flows of music royalties and the variable returns of peer-to-peer lending.

Connection

Music royalties platforms and peer-to-peer lending intersect through innovative investment models that enable fractional ownership of royalty streams, offering investors direct income from music assets. Peer-to-peer lending frameworks facilitate funding for artists or rights holders by connecting them with investors seeking alternative revenue sources, enhancing liquidity in the music industry. This synergy creates diversified portfolios combining steady royalty cash flows with peer-to-peer debt returns, optimizing risk-adjusted investment strategies.

Key Terms

Interest Rate

Peer-to-peer lending platforms typically offer interest rates ranging from 5% to 12%, directly influenced by borrower creditworthiness and market demand, providing predictable income streams. Music royalties platforms, on the other hand, generate returns based on royalty payouts which can vary widely but average around 10% to 15% annually, influenced by song popularity and licensing agreements. Discover more about how interest rates impact your investment choices between peer-to-peer lending and music royalties platforms.

Default Risk

Peer-to-peer lending platforms face higher default risk due to unsecured loans, with default rates averaging 5-10% depending on borrower profiles and economic conditions. Music royalties platforms offer lower default risk as they provide investors with rights to future income streams backed by proven royalty payments and artist contracts. Explore the dynamics of default risk in these alternative investments to make informed choices.

Copyright Ownership

Peer-to-peer lending platforms facilitate direct loans between individuals, while music royalties platforms enable investors to acquire partial ownership of music copyrights. Copyright ownership on music royalties platforms grants investors ongoing income streams from licensed music usage, unlike the fixed returns typical in peer-to-peer lending. Discover how control over intellectual property differentiates these investment models and impacts potential earnings.

Source and External Links

Peer-to-peer lending - Wikipedia - Peer-to-peer lending (P2P) is an online practice that matches lenders directly with borrowers without traditional financial intermediaries, often facilitated by P2P platforms that handle credit checks, payments, and loan servicing.

Peer to peer lending: what you need to know - MoneyHelper - P2P lending connects individual or business borrowers with lenders through online marketplaces, offering higher interest returns than traditional savings but with much higher risk, so checking FCA regulation is important.

PEER-TO-PEER LENDING - NASAA - Peer-to-peer lending involves unsecured loans typically between $1,000 and $25,000 funded by other individuals via internet marketplaces, providing access to loans difficult to obtain from traditional banks especially in cautious economic conditions.

dowidth.com

dowidth.com