Regenerative agriculture investing focuses on restoring soil health, enhancing biodiversity, and sequestering carbon through sustainable farming practices, offering long-term ecological and financial benefits. Renewable energy investing targets the development of solar, wind, and hydroelectric power projects to reduce carbon emissions and meet growing global energy demands. Explore the key differences and potential returns of these impact-driven investment opportunities.

Why it is important

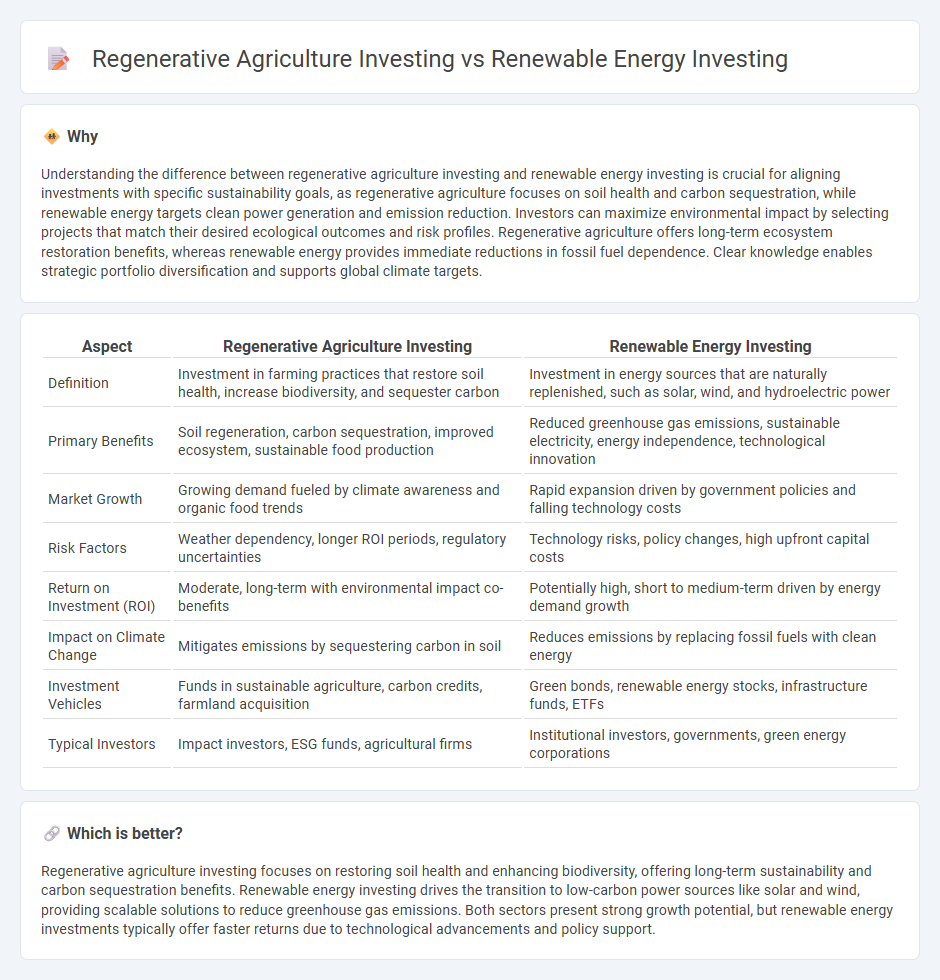

Understanding the difference between regenerative agriculture investing and renewable energy investing is crucial for aligning investments with specific sustainability goals, as regenerative agriculture focuses on soil health and carbon sequestration, while renewable energy targets clean power generation and emission reduction. Investors can maximize environmental impact by selecting projects that match their desired ecological outcomes and risk profiles. Regenerative agriculture offers long-term ecosystem restoration benefits, whereas renewable energy provides immediate reductions in fossil fuel dependence. Clear knowledge enables strategic portfolio diversification and supports global climate targets.

Comparison Table

| Aspect | Regenerative Agriculture Investing | Renewable Energy Investing |

|---|---|---|

| Definition | Investment in farming practices that restore soil health, increase biodiversity, and sequester carbon | Investment in energy sources that are naturally replenished, such as solar, wind, and hydroelectric power |

| Primary Benefits | Soil regeneration, carbon sequestration, improved ecosystem, sustainable food production | Reduced greenhouse gas emissions, sustainable electricity, energy independence, technological innovation |

| Market Growth | Growing demand fueled by climate awareness and organic food trends | Rapid expansion driven by government policies and falling technology costs |

| Risk Factors | Weather dependency, longer ROI periods, regulatory uncertainties | Technology risks, policy changes, high upfront capital costs |

| Return on Investment (ROI) | Moderate, long-term with environmental impact co-benefits | Potentially high, short to medium-term driven by energy demand growth |

| Impact on Climate Change | Mitigates emissions by sequestering carbon in soil | Reduces emissions by replacing fossil fuels with clean energy |

| Investment Vehicles | Funds in sustainable agriculture, carbon credits, farmland acquisition | Green bonds, renewable energy stocks, infrastructure funds, ETFs |

| Typical Investors | Impact investors, ESG funds, agricultural firms | Institutional investors, governments, green energy corporations |

Which is better?

Regenerative agriculture investing focuses on restoring soil health and enhancing biodiversity, offering long-term sustainability and carbon sequestration benefits. Renewable energy investing drives the transition to low-carbon power sources like solar and wind, providing scalable solutions to reduce greenhouse gas emissions. Both sectors present strong growth potential, but renewable energy investments typically offer faster returns due to technological advancements and policy support.

Connection

Regenerative agriculture investing enhances soil health and carbon sequestration, aligning closely with renewable energy investing's goal of reducing greenhouse gas emissions through cleaner energy sources like solar and wind. Both investment sectors contribute to sustainable environmental impact by promoting carbon neutrality and resilience against climate change. These complementary approaches attract investors seeking integrated solutions for long-term ecological and financial returns.

Key Terms

Renewable energy investing: Clean Energy Credits, Power Purchase Agreements, Grid Integration

Renewable energy investing centers on Clean Energy Credits (CECs), Power Purchase Agreements (PPAs), and advanced Grid Integration technologies that optimize energy distribution and storage. CECs incentivize the production of green energy, while PPAs offer long-term contracts that stabilize revenue streams for renewable projects. Explore how these mechanisms drive sustainable investment growth and transform energy markets.

Regenerative agriculture investing: Soil Carbon Sequestration, Holistic Grazing, Perennial Crops

Regenerative agriculture investing centers on practices like soil carbon sequestration, holistic grazing, and perennial crops that enhance ecosystem health while capturing atmospheric carbon, offering long-term environmental and financial benefits. This approach improves soil fertility and biodiversity, reduces greenhouse gas emissions, and supports sustainable food systems compared to traditional farming. Explore how investing in regenerative agriculture drives climate resilience and profitable innovation in agri-tech and sustainable land management.

**Renewable Energy Investing:**

Renewable energy investing targets sustainable power sources such as solar, wind, and hydropower, driving the global shift toward carbon-neutral economies and reducing greenhouse gas emissions. Key entities include companies like NextEra Energy and Vestas, with growing investment vehicles such as green bonds and renewable energy ETFs delivering both environmental impact and financial returns. Explore more about the financial benefits and environmental impact of renewable energy investing to understand its role in a sustainable future.

Source and External Links

Renewable Energy Opportunities For Investors | Russell Investments - Institutional investors can efficiently allocate capital to renewable energy assets through private infrastructure funds, with nearly 70 renewable energy funds currently tracked, reflecting growing opportunities in climate-focused investing.

Investing in Renewable Energy - GreenPortfolio - Renewable energy investments have historically outperformed fossil fuels in returns and exhibited less volatility, making them attractive for portfolios seeking both financial gain and environmental benefits.

Renewable energy investing | Robeco USA - Investment in renewable energy is possible by purchasing equities or bonds in utility companies or component manufacturers, focusing on sources such as solar, wind, hydro, biomass, and geothermal power, with emerging interest in tidal power and green hydrogen.

dowidth.com

dowidth.com