Music royalties platforms offer investors a unique opportunity to earn passive income by purchasing rights to songs, benefiting from consistent streaming and licensing revenues. Stock trading apps provide access to a diverse range of equities, allowing users to capitalize on market fluctuations and company growth potential. Explore the advantages and risks of both investment avenues to determine which aligns best with your financial goals.

Why it is important

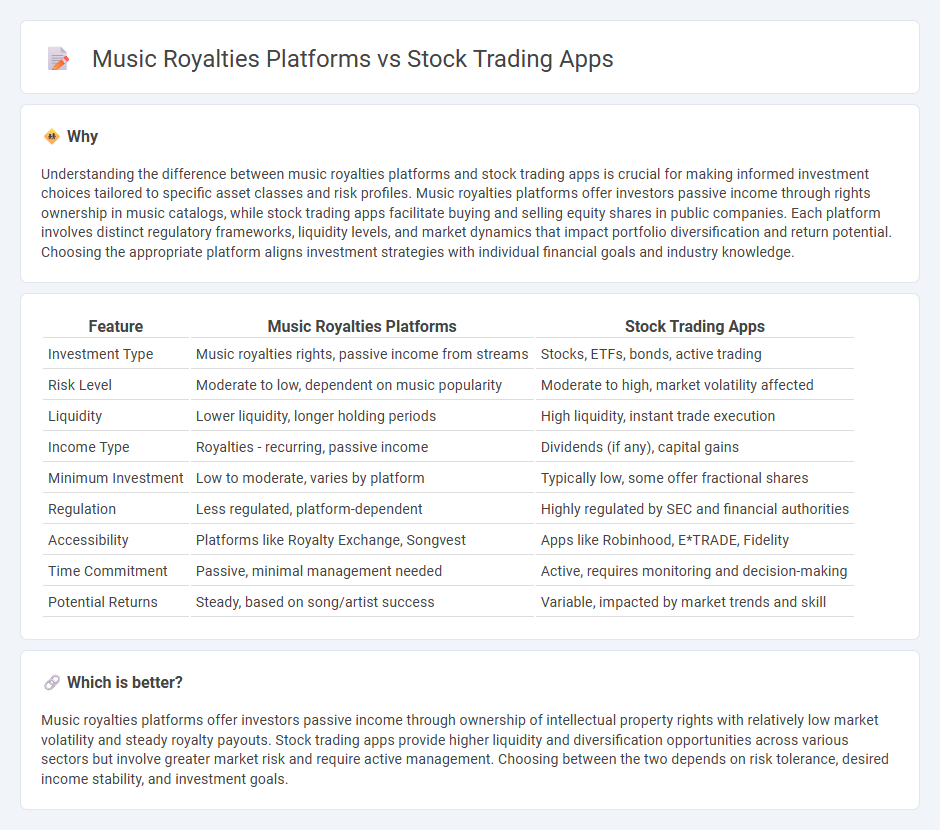

Understanding the difference between music royalties platforms and stock trading apps is crucial for making informed investment choices tailored to specific asset classes and risk profiles. Music royalties platforms offer investors passive income through rights ownership in music catalogs, while stock trading apps facilitate buying and selling equity shares in public companies. Each platform involves distinct regulatory frameworks, liquidity levels, and market dynamics that impact portfolio diversification and return potential. Choosing the appropriate platform aligns investment strategies with individual financial goals and industry knowledge.

Comparison Table

| Feature | Music Royalties Platforms | Stock Trading Apps |

|---|---|---|

| Investment Type | Music royalties rights, passive income from streams | Stocks, ETFs, bonds, active trading |

| Risk Level | Moderate to low, dependent on music popularity | Moderate to high, market volatility affected |

| Liquidity | Lower liquidity, longer holding periods | High liquidity, instant trade execution |

| Income Type | Royalties - recurring, passive income | Dividends (if any), capital gains |

| Minimum Investment | Low to moderate, varies by platform | Typically low, some offer fractional shares |

| Regulation | Less regulated, platform-dependent | Highly regulated by SEC and financial authorities |

| Accessibility | Platforms like Royalty Exchange, Songvest | Apps like Robinhood, E*TRADE, Fidelity |

| Time Commitment | Passive, minimal management needed | Active, requires monitoring and decision-making |

| Potential Returns | Steady, based on song/artist success | Variable, impacted by market trends and skill |

Which is better?

Music royalties platforms offer investors passive income through ownership of intellectual property rights with relatively low market volatility and steady royalty payouts. Stock trading apps provide higher liquidity and diversification opportunities across various sectors but involve greater market risk and require active management. Choosing between the two depends on risk tolerance, desired income stability, and investment goals.

Connection

Music royalties platforms and stock trading apps are connected through the concept of investment diversification and asset management, allowing investors to allocate capital into alternative income streams like music royalties alongside traditional stocks. Both platforms use digital technology to facilitate fractional ownership and real-time trading, enhancing liquidity and accessibility for individual investors. This convergence enables portfolio expansion with non-correlated assets, optimizing risk-adjusted returns and financial growth strategies.

Key Terms

**Stock trading apps:**

Stock trading apps offer real-time market data, advanced charting tools, and commission-free trading, making them accessible for both novice and experienced investors. These platforms integrate AI-driven insights and customizable alerts to optimize portfolio management and enhance investment decision-making. Discover how stock trading apps can transform your financial strategy by exploring the latest features and user benefits.

Brokerage

Stock trading apps facilitate real-time equity transactions, leveraging brokerage firms' extended networks for optimal trade execution and commission structures. Music royalties platforms act as intermediaries, managing the distribution of earnings generated from licensing and streaming, akin to brokerage services in financial markets but tailored to intellectual property rights. Explore detailed comparisons to understand how brokerage roles uniquely adapt across these dynamic industries.

Portfolio

Stock trading apps provide real-time access to diversified financial assets, enabling users to build and manage portfolios with stocks, ETFs, and derivatives. Music royalties platforms offer portfolio diversification by allowing investors to acquire rights to various music catalogs, generating passive income linked to song performance. Explore how these portfolio options can align with your investment goals and risk tolerance.

Source and External Links

Best Stock Trading Apps | 2025 Investing Guide - Webull is highlighted as a top app for commission-free options trading and advanced tools, suitable for intermediate and experienced investors, with features like paper trading, technical indicators, and a strong mobile experience.

19 Best Apps for Investing - App Store - This compilation from Apple lists popular stock trading apps including Robinhood, Webull, E*TRADE, Fidelity, Acorns, and more, catering to various investor needs from beginners to seasoned traders.

Robinhood: Trading & Investing - Apps on Google Play - Robinhood offers commission-free trading on stocks, ETFs, options, and crypto, with advanced tools, no minimum investment, and features like instant deposits and 24/7 live support, making it a popular choice for casual and active traders alike.

dowidth.com

dowidth.com