Psychedelic stocks, driven by innovation in mental health treatments and expanding legalization, offer high growth potential but come with significant volatility and regulatory risks. Consumer goods stocks provide stable returns through consistent demand and established market presence, appealing to risk-averse investors seeking steady income. Explore how these contrasting investment opportunities align with your portfolio strategy to optimize growth and risk management.

Why it is important

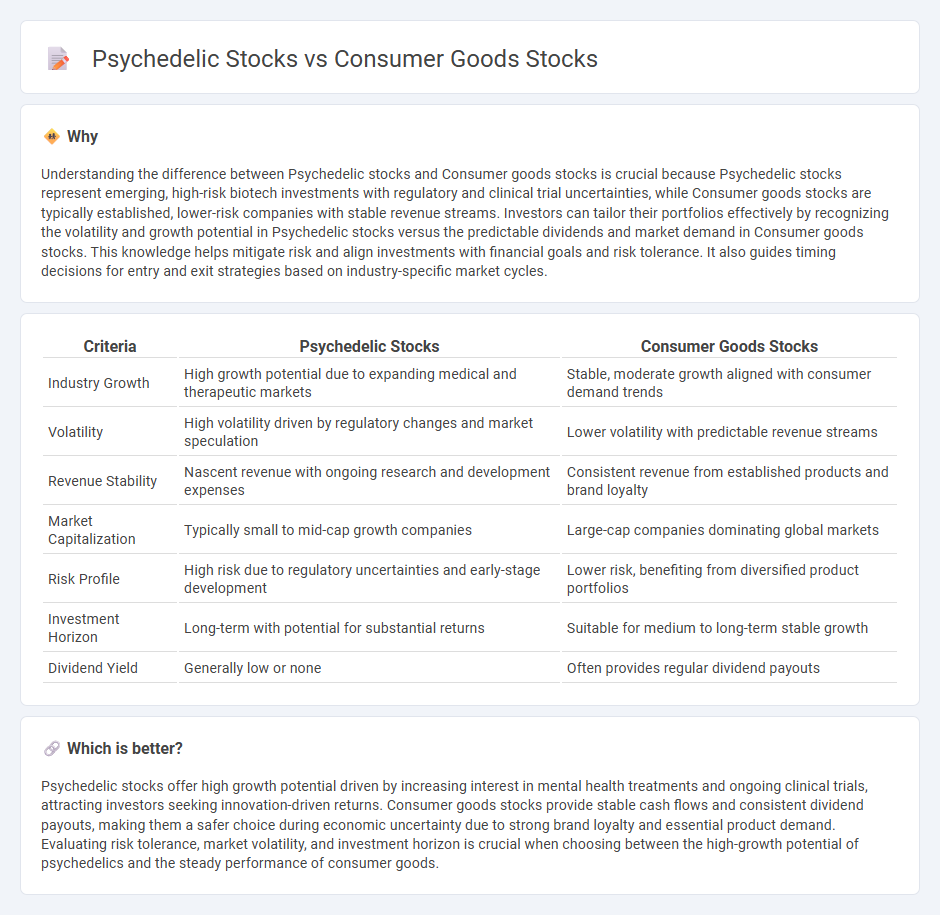

Understanding the difference between Psychedelic stocks and Consumer goods stocks is crucial because Psychedelic stocks represent emerging, high-risk biotech investments with regulatory and clinical trial uncertainties, while Consumer goods stocks are typically established, lower-risk companies with stable revenue streams. Investors can tailor their portfolios effectively by recognizing the volatility and growth potential in Psychedelic stocks versus the predictable dividends and market demand in Consumer goods stocks. This knowledge helps mitigate risk and align investments with financial goals and risk tolerance. It also guides timing decisions for entry and exit strategies based on industry-specific market cycles.

Comparison Table

| Criteria | Psychedelic Stocks | Consumer Goods Stocks |

|---|---|---|

| Industry Growth | High growth potential due to expanding medical and therapeutic markets | Stable, moderate growth aligned with consumer demand trends |

| Volatility | High volatility driven by regulatory changes and market speculation | Lower volatility with predictable revenue streams |

| Revenue Stability | Nascent revenue with ongoing research and development expenses | Consistent revenue from established products and brand loyalty |

| Market Capitalization | Typically small to mid-cap growth companies | Large-cap companies dominating global markets |

| Risk Profile | High risk due to regulatory uncertainties and early-stage development | Lower risk, benefiting from diversified product portfolios |

| Investment Horizon | Long-term with potential for substantial returns | Suitable for medium to long-term stable growth |

| Dividend Yield | Generally low or none | Often provides regular dividend payouts |

Which is better?

Psychedelic stocks offer high growth potential driven by increasing interest in mental health treatments and ongoing clinical trials, attracting investors seeking innovation-driven returns. Consumer goods stocks provide stable cash flows and consistent dividend payouts, making them a safer choice during economic uncertainty due to strong brand loyalty and essential product demand. Evaluating risk tolerance, market volatility, and investment horizon is crucial when choosing between the high-growth potential of psychedelics and the steady performance of consumer goods.

Connection

Psychedelic stocks and consumer goods stocks are connected through emerging market trends driven by changing consumer preferences towards wellness and mental health products. Companies in the psychedelic industry often focus on therapeutic applications that overlap with consumer health and lifestyle sectors, influencing investment strategies across both markets. This interconnectedness highlights the growing investor interest in innovative health solutions within consumer-driven markets.

Key Terms

Market Demand

Consumer goods stocks benefit from consistent market demand driven by everyday necessities, ensuring steady revenue streams and lower volatility. Psychedelic stocks, though emerging, show increasing market demand fueled by growing research, potential therapeutic applications, and evolving regulatory landscapes. Explore further insights on the shifting dynamics between these two sectors' market demand.

Regulatory Environment

Consumer goods stocks benefit from a well-established regulatory framework with predictable compliance standards across major markets, ensuring steady operational stability and investor confidence. Psychedelic stocks face an evolving regulatory environment marked by ongoing clinical trials, shifting government policies, and varied legalization timelines, which introduce higher risk but potential for significant growth. Explore further to understand how regulatory trends impact investment opportunities in these dynamic sectors.

Growth Potential

Consumer goods stocks provide steady revenue streams with consistent demand, often characterized by lower volatility and reliable dividends, making them attractive for conservative investors. Psychedelic stocks, driven by groundbreaking research and expanding legalization, exhibit high growth potential but come with increased risk due to regulatory uncertainties and market speculation. Explore the evolving landscape of these sectors to understand their distinct growth opportunities and investment dynamics.

Source and External Links

Top 7 Consumer Staples Stocks: July 2025 - Philip Morris International, Walmart, and Kellanova lead the list of top-performing consumer staples stocks over the past year, with PM showing an 81.04% return, WMT at 51.34%, and K at 37.68%.

The Best Consumer Defensive Stocks to Buy - Morningstar highlights Campbell's, Kraft Heinz, Lamb Weston Holdings, Clorox, Boston Beer, Brown-Forman, and Constellation Brands as leading consumer defensive stocks, noting Clorox's wide economic moat and current undervaluation.

A List of Stocks in the Consumer Staples Sector - The consumer staples sector includes 247 stocks--such as Walmart, Costco, Procter & Gamble, and Coca-Cola--with a combined market cap of $4.3 trillion and an average dividend yield of 1.68%.

dowidth.com

dowidth.com