Royalty stream investing involves providing capital to companies in exchange for a percentage of future revenues, offering steady income without ownership dilution. Angel investing entails direct equity investment in startups, typically yielding high returns alongside significant risk due to early-stage business uncertainty. Explore the key differences and benefits of these investment strategies to make informed financial decisions.

Why it is important

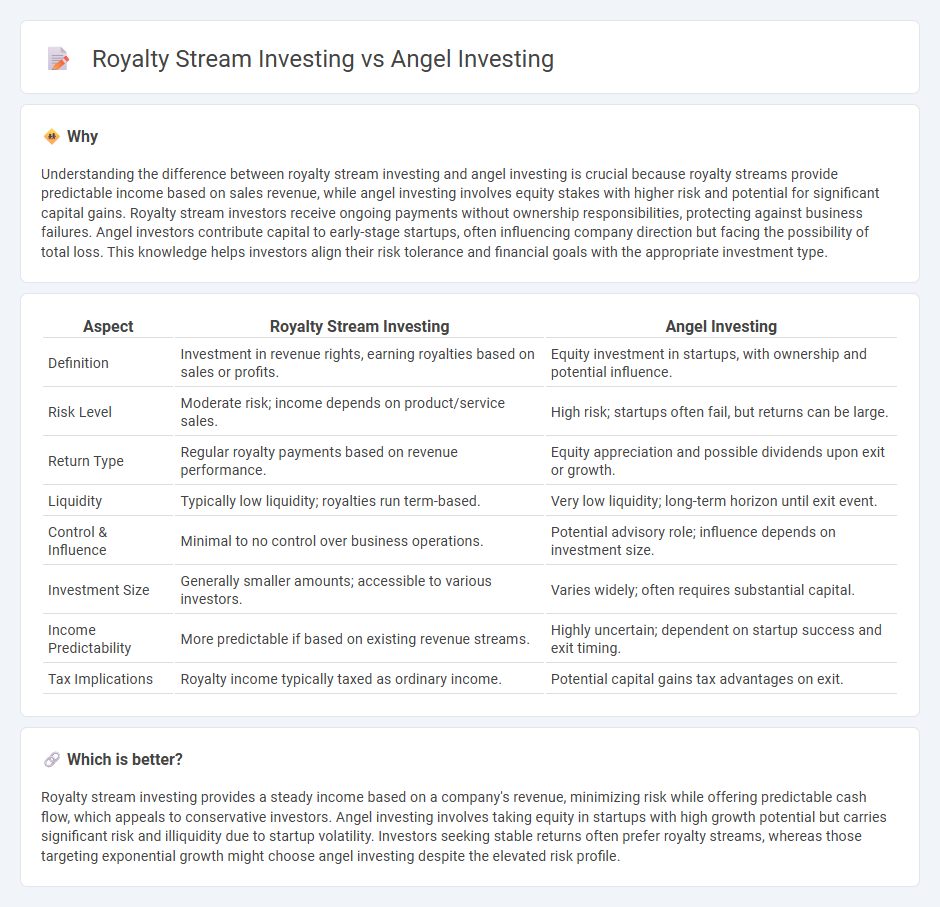

Understanding the difference between royalty stream investing and angel investing is crucial because royalty streams provide predictable income based on sales revenue, while angel investing involves equity stakes with higher risk and potential for significant capital gains. Royalty stream investors receive ongoing payments without ownership responsibilities, protecting against business failures. Angel investors contribute capital to early-stage startups, often influencing company direction but facing the possibility of total loss. This knowledge helps investors align their risk tolerance and financial goals with the appropriate investment type.

Comparison Table

| Aspect | Royalty Stream Investing | Angel Investing |

|---|---|---|

| Definition | Investment in revenue rights, earning royalties based on sales or profits. | Equity investment in startups, with ownership and potential influence. |

| Risk Level | Moderate risk; income depends on product/service sales. | High risk; startups often fail, but returns can be large. |

| Return Type | Regular royalty payments based on revenue performance. | Equity appreciation and possible dividends upon exit or growth. |

| Liquidity | Typically low liquidity; royalties run term-based. | Very low liquidity; long-term horizon until exit event. |

| Control & Influence | Minimal to no control over business operations. | Potential advisory role; influence depends on investment size. |

| Investment Size | Generally smaller amounts; accessible to various investors. | Varies widely; often requires substantial capital. |

| Income Predictability | More predictable if based on existing revenue streams. | Highly uncertain; dependent on startup success and exit timing. |

| Tax Implications | Royalty income typically taxed as ordinary income. | Potential capital gains tax advantages on exit. |

Which is better?

Royalty stream investing provides a steady income based on a company's revenue, minimizing risk while offering predictable cash flow, which appeals to conservative investors. Angel investing involves taking equity in startups with high growth potential but carries significant risk and illiquidity due to startup volatility. Investors seeking stable returns often prefer royalty streams, whereas those targeting exponential growth might choose angel investing despite the elevated risk profile.

Connection

Royalty stream investing and angel investing both provide capital to early-stage companies but differ in structure; royalty streams offer investors a percentage of revenue without equity dilution, while angel investing grants equity ownership in exchange for funding. Both methods support startups' growth by supplying essential funding before traditional venture capital rounds. These investment types appeal to investors seeking exposure to high-growth potential with varying risk and return profiles.

Key Terms

Equity ownership (Angel Investing)

Angel investing provides equity ownership in startups, granting investors partial control and potential appreciation as the company grows. Unlike royalty stream investing, which offers fixed returns based on revenue without ownership, angel investors share in the company's long-term success and risks. Explore the advantages of equity ownership in angel investing to enhance your investment portfolio.

Royalties (Royalty Stream Investing)

Royalty stream investing provides a predictable income by purchasing a percentage of revenue generated from intellectual property or natural resources, unlike angel investing which involves equity stakes in startups. This method mitigates risk through steady cash flow derived from proven assets, offering diversified exposure without equity dilution. Explore how royalty stream investing can enhance your portfolio stability and generate passive income.

Exit strategy

Angel investing typically involves acquiring equity in startups with the expectation of a high-return exit through acquisition or IPO, often requiring 5-10 years to realize significant gains. Royalty stream investing provides ongoing income based on revenue share without equity ownership, allowing investors to receive returns as long as the underlying business or product generates revenue, thus offering continuous cash flow rather than a one-time exit event. Explore how these exit strategies align with your investment goals for more informed decision-making.

Source and External Links

Understanding angel financing and investing - Angel investors are individuals who provide capital to startups in exchange for equity or convertible debt, generally stepping in after initial funding from founders and their close networks, and they also often mentor founders to help navigate early business challenges.

Demystifying Angel Investing - Angel investing offers potential for high returns and tax advantages while enabling investors to support startups and contribute to regional economic growth, with access to resources and networks provided by organizations like the Angel Capital Association.

Angel Investors - Angel investors are wealthy individuals who invest their own funds in startups for equity, often providing smaller amounts of patient capital and mentorship, with expectations of eventual profit via public offering or acquisition.

dowidth.com

dowidth.com