Sneaker flipping involves buying limited-edition sneakers at retail prices and reselling them at a premium, leveraging trends and brand hype to generate quick profits. Classic car investing requires purchasing vintage automobiles with historical value, anticipating appreciation based on rarity, condition, and market demand over time. Explore the advantages and risks of each investment strategy to determine which suits your financial goals.

Why it is important

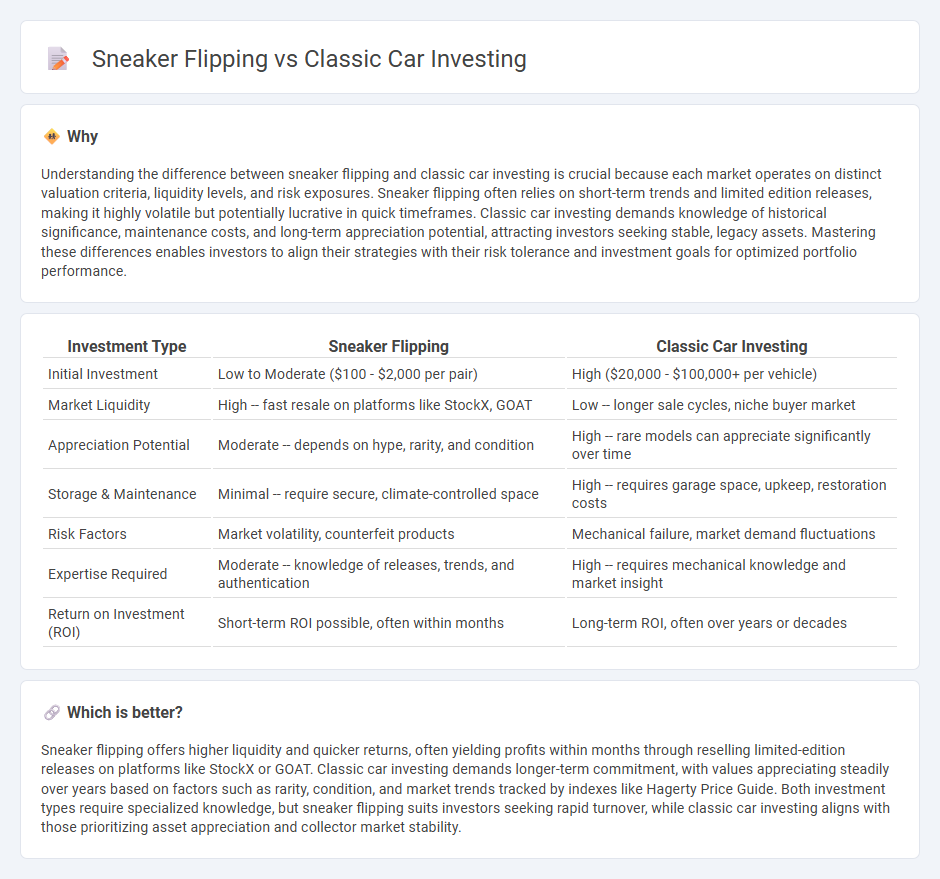

Understanding the difference between sneaker flipping and classic car investing is crucial because each market operates on distinct valuation criteria, liquidity levels, and risk exposures. Sneaker flipping often relies on short-term trends and limited edition releases, making it highly volatile but potentially lucrative in quick timeframes. Classic car investing demands knowledge of historical significance, maintenance costs, and long-term appreciation potential, attracting investors seeking stable, legacy assets. Mastering these differences enables investors to align their strategies with their risk tolerance and investment goals for optimized portfolio performance.

Comparison Table

| Investment Type | Sneaker Flipping | Classic Car Investing |

|---|---|---|

| Initial Investment | Low to Moderate ($100 - $2,000 per pair) | High ($20,000 - $100,000+ per vehicle) |

| Market Liquidity | High -- fast resale on platforms like StockX, GOAT | Low -- longer sale cycles, niche buyer market |

| Appreciation Potential | Moderate -- depends on hype, rarity, and condition | High -- rare models can appreciate significantly over time |

| Storage & Maintenance | Minimal -- require secure, climate-controlled space | High -- requires garage space, upkeep, restoration costs |

| Risk Factors | Market volatility, counterfeit products | Mechanical failure, market demand fluctuations |

| Expertise Required | Moderate -- knowledge of releases, trends, and authentication | High -- requires mechanical knowledge and market insight |

| Return on Investment (ROI) | Short-term ROI possible, often within months | Long-term ROI, often over years or decades |

Which is better?

Sneaker flipping offers higher liquidity and quicker returns, often yielding profits within months through reselling limited-edition releases on platforms like StockX or GOAT. Classic car investing demands longer-term commitment, with values appreciating steadily over years based on factors such as rarity, condition, and market trends tracked by indexes like Hagerty Price Guide. Both investment types require specialized knowledge, but sneaker flipping suits investors seeking rapid turnover, while classic car investing aligns with those prioritizing asset appreciation and collector market stability.

Connection

Investment in sneaker flipping and classic cars both capitalize on scarcity and cultural trends, driving asset value appreciation over time. Collectors and investors leverage limited editions, brand collaborations, and historical significance to maximize returns in these niche markets. Market demand for authenticity, condition, and provenance are critical factors influencing price dynamics in sneaker and classic car investments.

Key Terms

Classic car investing: Appreciation, Provenance, Restoration

Classic car investing offers significant appreciation potential as rare models and those with historical provenance often increase in value over time, driven by collector demand and market trends. The provenance of a vehicle--its documented history, previous ownership, and authenticity--plays a crucial role in determining its market value, while meticulous restoration preserves originality and enhances appeal. Explore deeper insights into classic car investment strategies and market dynamics to maximize returns.

Sneaker flipping: Hype, Limited edition, Resale value

Sneaker flipping capitalizes on hype-driven releases and limited edition drops, creating high demand and scarcity that drive resale value significantly above retail prices. Collectors and enthusiasts fuel market dynamics where rare collaborations and exclusive designs can appreciate rapidly, often yielding substantial profits in a short timeframe. Explore how the sneaker resale market works and discover strategies to maximize your returns.

**Classic Car Investing:**

Classic car investing offers significant appreciation potential as rare models from brands like Ferrari, Porsche, and Jaguar have historically delivered high returns, sometimes outperforming traditional assets. Factors such as provenance, originality, and market trends heavily influence valuation, making expert knowledge essential for maximizing profit. Discover detailed strategies and market insights to enhance your classic car investment portfolio.

Source and External Links

How to Invest in Classic Cars - SmartAsset - Classic car investing requires thorough research, a focus on rarity and condition, and patience for long-term gains, while accounting for ongoing costs like maintenance and storage.

Are Classic Cars Good Investments? Weighing the Pros and Cons - Classic cars can offer portfolio diversification and high return potential, but they are illiquid, lack market transparency, and come with significant expenses and risks, making them suitable mainly for knowledgeable investors.

Investing in Classic Cars - Nationwide - While classic cars have shown major appreciation in value historically, success depends on careful selection, budgeting, and understanding resale potential, with profits possible but not guaranteed.

dowidth.com

dowidth.com