Tangible asset tokenization transforms physical assets such as real estate or precious metals into digital tokens on a blockchain, offering enhanced liquidity and fractional ownership. Exchange-traded funds (ETFs) are investment funds traded on stock exchanges, providing diversified exposure to various asset classes without direct ownership of the underlying assets. Explore the advantages and risks of each investment method to optimize your portfolio strategy.

Why it is important

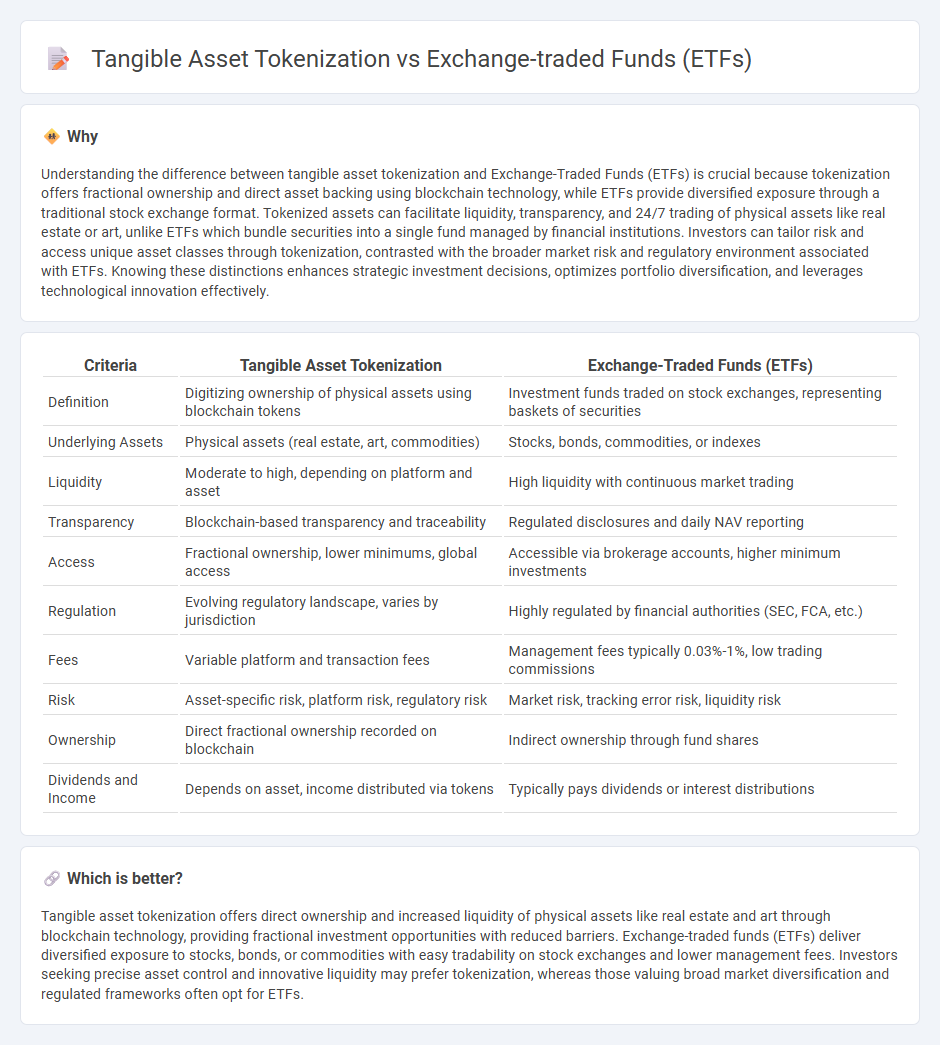

Understanding the difference between tangible asset tokenization and Exchange-Traded Funds (ETFs) is crucial because tokenization offers fractional ownership and direct asset backing using blockchain technology, while ETFs provide diversified exposure through a traditional stock exchange format. Tokenized assets can facilitate liquidity, transparency, and 24/7 trading of physical assets like real estate or art, unlike ETFs which bundle securities into a single fund managed by financial institutions. Investors can tailor risk and access unique asset classes through tokenization, contrasted with the broader market risk and regulatory environment associated with ETFs. Knowing these distinctions enhances strategic investment decisions, optimizes portfolio diversification, and leverages technological innovation effectively.

Comparison Table

| Criteria | Tangible Asset Tokenization | Exchange-Traded Funds (ETFs) |

|---|---|---|

| Definition | Digitizing ownership of physical assets using blockchain tokens | Investment funds traded on stock exchanges, representing baskets of securities |

| Underlying Assets | Physical assets (real estate, art, commodities) | Stocks, bonds, commodities, or indexes |

| Liquidity | Moderate to high, depending on platform and asset | High liquidity with continuous market trading |

| Transparency | Blockchain-based transparency and traceability | Regulated disclosures and daily NAV reporting |

| Access | Fractional ownership, lower minimums, global access | Accessible via brokerage accounts, higher minimum investments |

| Regulation | Evolving regulatory landscape, varies by jurisdiction | Highly regulated by financial authorities (SEC, FCA, etc.) |

| Fees | Variable platform and transaction fees | Management fees typically 0.03%-1%, low trading commissions |

| Risk | Asset-specific risk, platform risk, regulatory risk | Market risk, tracking error risk, liquidity risk |

| Ownership | Direct fractional ownership recorded on blockchain | Indirect ownership through fund shares |

| Dividends and Income | Depends on asset, income distributed via tokens | Typically pays dividends or interest distributions |

Which is better?

Tangible asset tokenization offers direct ownership and increased liquidity of physical assets like real estate and art through blockchain technology, providing fractional investment opportunities with reduced barriers. Exchange-traded funds (ETFs) deliver diversified exposure to stocks, bonds, or commodities with easy tradability on stock exchanges and lower management fees. Investors seeking precise asset control and innovative liquidity may prefer tokenization, whereas those valuing broad market diversification and regulated frameworks often opt for ETFs.

Connection

Tangible asset tokenization transforms physical assets such as real estate or commodities into digital tokens, enabling fractional ownership and increased liquidity. Exchange-traded funds (ETFs) often incorporate these tokenized assets, providing investors easier access to diversified portfolios of traditionally illiquid tangible assets. This integration enhances market efficiency by combining blockchain transparency with the regulated trading environment of ETFs.

Key Terms

Liquidity

Exchange-traded funds (ETFs) offer high liquidity by enabling investors to trade shares on stock exchanges throughout the trading day, benefiting from established markets and price transparency. In contrast, tangible asset tokenization provides liquidity through blockchain-based fractional ownership, allowing 24/7 trading and direct peer-to-peer transactions, though liquidity varies based on platform adoption and asset type. Explore the advantages and limitations of these liquidity mechanisms to understand which investment aligns with your financial goals.

Ownership

Exchange-traded funds (ETFs) offer investors fractional ownership in a diversified portfolio of assets, regulated and traded on public exchanges, ensuring liquidity and transparency. Tangible asset tokenization digitizes ownership rights of physical assets like real estate or art using blockchain technology, providing direct, immutable proof of ownership with potential for global accessibility. Explore how these ownership models transform investment strategies and asset management.

Transparency

Exchange-traded funds (ETFs) provide high transparency through regular disclosure of holdings, market pricing, and regulatory oversight, enabling investors to gauge fund composition and performance easily. Tangible asset tokenization offers transparency by using blockchain technology to provide immutable, real-time ownership records and transactional data, reducing intermediaries and enhancing trust. Explore how these transparency features impact investment decisions in evolving financial markets.

Source and External Links

Exchange-Traded Fund (ETF) - ETFs are investment products traded on stock exchanges that pool investor money to hold portfolios of stocks, bonds, or other assets, providing share ownership that can be bought or sold during market hours, often with greater tax efficiency than mutual funds.

What is an ETF (Exchange-Traded Fund)? - ETFs combine the flexibility of stocks with the diversification of mutual funds, trading throughout the day on exchanges, and offering lower costs, trading versatility, and exposure across a wide range of asset classes.

Exchange-Traded Funds and Products - ETFs allow investors to buy shares of pooled assets that track indexes or are actively managed, traded on exchanges via authorized participants, and typically provide periodic dividends or interest with transparent holdings.

dowidth.com

dowidth.com