Virtual land real estate offers investors a digital asset with high growth potential in emerging metaverse platforms, providing unique opportunities for creative development and community engagement. Bonds represent traditional fixed-income securities, delivering predictable returns and lower risk through government or corporate debt investments. Explore the differences between these asset classes to determine the best fit for your investment portfolio.

Why it is important

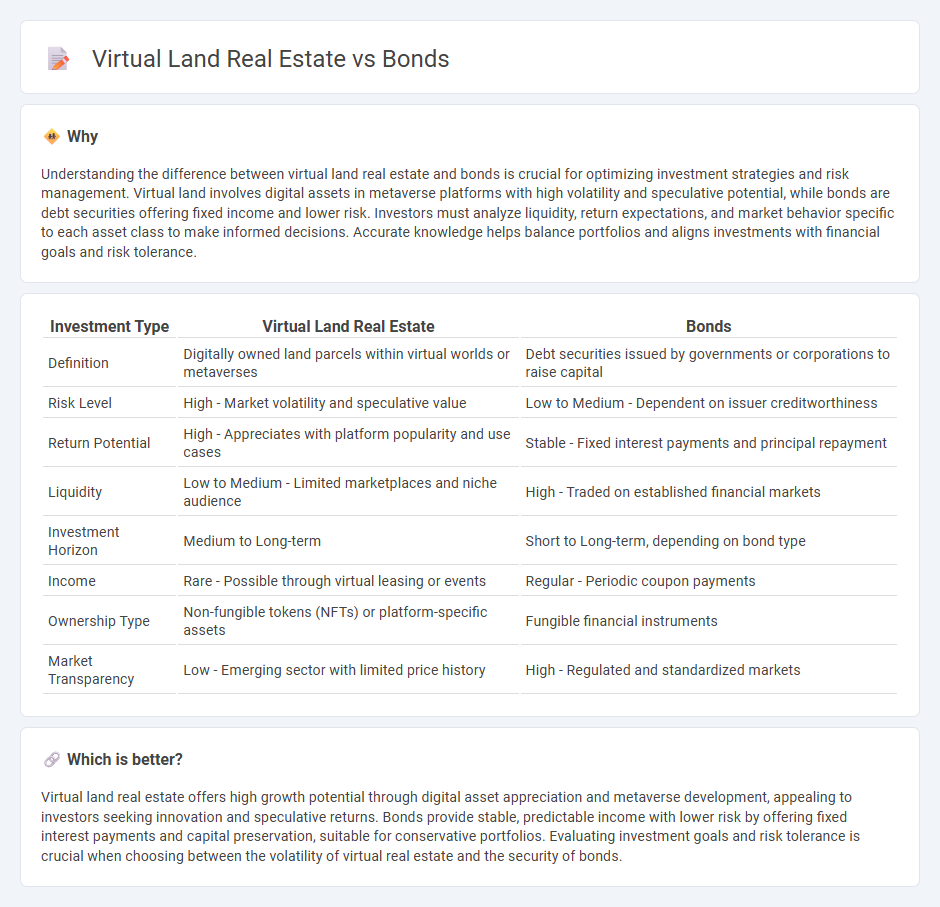

Understanding the difference between virtual land real estate and bonds is crucial for optimizing investment strategies and risk management. Virtual land involves digital assets in metaverse platforms with high volatility and speculative potential, while bonds are debt securities offering fixed income and lower risk. Investors must analyze liquidity, return expectations, and market behavior specific to each asset class to make informed decisions. Accurate knowledge helps balance portfolios and aligns investments with financial goals and risk tolerance.

Comparison Table

| Investment Type | Virtual Land Real Estate | Bonds |

|---|---|---|

| Definition | Digitally owned land parcels within virtual worlds or metaverses | Debt securities issued by governments or corporations to raise capital |

| Risk Level | High - Market volatility and speculative value | Low to Medium - Dependent on issuer creditworthiness |

| Return Potential | High - Appreciates with platform popularity and use cases | Stable - Fixed interest payments and principal repayment |

| Liquidity | Low to Medium - Limited marketplaces and niche audience | High - Traded on established financial markets |

| Investment Horizon | Medium to Long-term | Short to Long-term, depending on bond type |

| Income | Rare - Possible through virtual leasing or events | Regular - Periodic coupon payments |

| Ownership Type | Non-fungible tokens (NFTs) or platform-specific assets | Fungible financial instruments |

| Market Transparency | Low - Emerging sector with limited price history | High - Regulated and standardized markets |

Which is better?

Virtual land real estate offers high growth potential through digital asset appreciation and metaverse development, appealing to investors seeking innovation and speculative returns. Bonds provide stable, predictable income with lower risk by offering fixed interest payments and capital preservation, suitable for conservative portfolios. Evaluating investment goals and risk tolerance is crucial when choosing between the volatility of virtual real estate and the security of bonds.

Connection

Virtual land real estate offers a digital asset class that investors can diversify into alongside traditional bonds, balancing high-growth potential with stable income streams. Bonds provide predictable returns and lower risk, complementing the speculative nature and price volatility often seen in virtual land markets. Integrating virtual land investments with bond portfolios can enhance overall risk management and yield optimization in modern investment strategies.

Key Terms

Yield

Bonds typically offer predictable, fixed yields derived from interest payments over a set period, providing stability and low risk for investors. Virtual land real estate, traded on digital platforms like Decentraland and The Sandbox, can yield variable and potentially higher returns through land appreciation, leasing, or development opportunities, but carries greater market volatility. Explore detailed comparisons to understand how yield dynamics differ between traditional bonds and virtual land investments.

Liquidity

Bonds offer high liquidity due to their established secondary markets and predictable interest payments, making them easily tradable assets. Virtual land real estate, while gaining popularity, typically experiences lower liquidity because of a smaller market and buyer base, coupled with the volatility of the metaverse environment. Explore the nuances of liquidity between these asset classes to make informed investment decisions.

Volatility

Bonds offer lower volatility with relatively stable returns due to fixed interest payments, making them a reliable investment during market fluctuations. In contrast, virtual land real estate experiences high volatility driven by speculative demand, market trends in the metaverse, and evolving digital platform regulations. Explore the dynamics of volatility in these asset classes to make informed investment decisions.

Source and External Links

Bonds | Investor.gov - Bonds are debt securities issued by governments, municipalities, or corporations to raise money, where investors lend money and receive regular interest payments plus repayment of principal at maturity.

Bond (finance) - Wikipedia - Bonds provide borrowers with external funds for long-term investments, are mostly traded by institutions, are generally less volatile than stocks, and bondholders have legal protection in bankruptcy cases.

What is a Bond and How do they Work? - Vanguard - Bonds are loans issued by governments or companies that pay periodic interest and return principal at a set date, offering income and lower volatility compared to stocks but no ownership rights.

dowidth.com

dowidth.com