Carbon credit trading involves buying and selling permits that allow a company to emit a certain amount of carbon dioxide, creating a market-driven approach to reducing greenhouse gas emissions. Renewable energy funds focus on investing directly in projects like solar, wind, and hydro power, fostering the growth of clean energy infrastructure and sustainable returns. Explore the benefits and risks of each investment strategy to make informed financial decisions in the green economy.

Why it is important

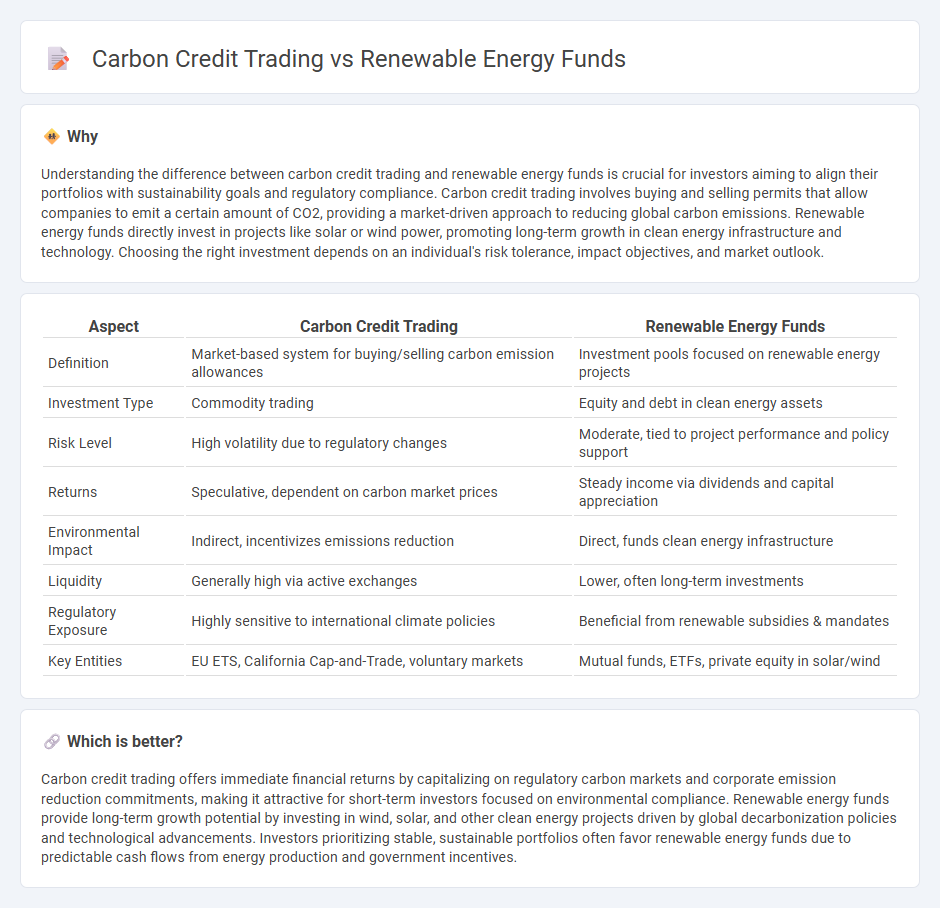

Understanding the difference between carbon credit trading and renewable energy funds is crucial for investors aiming to align their portfolios with sustainability goals and regulatory compliance. Carbon credit trading involves buying and selling permits that allow companies to emit a certain amount of CO2, providing a market-driven approach to reducing global carbon emissions. Renewable energy funds directly invest in projects like solar or wind power, promoting long-term growth in clean energy infrastructure and technology. Choosing the right investment depends on an individual's risk tolerance, impact objectives, and market outlook.

Comparison Table

| Aspect | Carbon Credit Trading | Renewable Energy Funds |

|---|---|---|

| Definition | Market-based system for buying/selling carbon emission allowances | Investment pools focused on renewable energy projects |

| Investment Type | Commodity trading | Equity and debt in clean energy assets |

| Risk Level | High volatility due to regulatory changes | Moderate, tied to project performance and policy support |

| Returns | Speculative, dependent on carbon market prices | Steady income via dividends and capital appreciation |

| Environmental Impact | Indirect, incentivizes emissions reduction | Direct, funds clean energy infrastructure |

| Liquidity | Generally high via active exchanges | Lower, often long-term investments |

| Regulatory Exposure | Highly sensitive to international climate policies | Beneficial from renewable subsidies & mandates |

| Key Entities | EU ETS, California Cap-and-Trade, voluntary markets | Mutual funds, ETFs, private equity in solar/wind |

Which is better?

Carbon credit trading offers immediate financial returns by capitalizing on regulatory carbon markets and corporate emission reduction commitments, making it attractive for short-term investors focused on environmental compliance. Renewable energy funds provide long-term growth potential by investing in wind, solar, and other clean energy projects driven by global decarbonization policies and technological advancements. Investors prioritizing stable, sustainable portfolios often favor renewable energy funds due to predictable cash flows from energy production and government incentives.

Connection

Carbon credit trading incentivizes reductions in greenhouse gas emissions by assigning monetary value to carbon savings, which directly supports investments in renewable energy projects. Renewable energy funds channel capital into solar, wind, and other clean technologies, generating carbon credits that can be traded for profit or compliance purposes. This symbiotic relationship accelerates the transition to low-carbon economies while offering financial returns aligned with sustainability goals.

Key Terms

Green Bonds

Green bonds have emerged as a compelling investment vehicle within renewable energy funds, channeling capital directly into sustainable infrastructure projects that reduce carbon footprints. Unlike carbon credit trading, which operates on a market-based mechanism for offsetting emissions, green bonds provide fixed-income opportunities with environmentally impactful outcomes. Explore how green bonds can diversify your portfolio while supporting the global transition to a low-carbon economy.

Emissions Allowances

Renewable energy funds invest directly in clean energy projects such as solar, wind, and hydro, promoting sustainable power generation and reducing greenhouse gas emissions. Carbon credit trading, particularly emissions allowances under cap-and-trade systems, enables companies to buy and sell permits that cap their total emissions, incentivizing pollutant reduction through market mechanisms. Explore the differences between these financial tools and their impacts on climate strategy to better understand sustainable investment opportunities.

ESG (Environmental, Social, and Governance)

Renewable energy funds channel capital into sustainable projects such as solar, wind, and hydroelectric power, advancing ESG goals by reducing carbon footprints and promoting social responsibility. Carbon credit trading incentivizes companies to lower greenhouse gas emissions through market-based mechanisms, aligning economic activities with environmental targets and governance standards. Explore how combining these strategies can optimize ESG investments and drive impactful climate action.

Source and External Links

Renewable Energy Fund | REF Grants, Programs & Materials - The Rhode Island Commerce Renewable Energy Fund (REF) offers grants to support renewable energy projects aimed at producing cleaner electricity and stimulating job growth, focusing on solar and other green technologies in Rhode Island, with specific programs like the Renewable Energy Growth Program (REG) and REF as financial incentives.

Alternative Energy Equities ETFs - Alternative energy ETFs invest in companies within the renewable energy sector, especially solar energy, offering diversified investment options like the Fidelity Clean Energy ETF (FRNW) and others that track renewable energy producers and technology firms.

6 Best-Performing Clean Energy ETFs for July 2025 - NerdWallet - Clean energy ETFs provide exposure to stocks in alternative energy sectors such as solar, wind, hydro, and geothermal, enabling diversified investment with some of the top performers delivering over 20% returns in the past year.

dowidth.com

dowidth.com