Music royalties generate steady, long-term passive income by earning shares from song performances and licensing rights. Venture capital, on the other hand, provides high-risk, high-reward funding to startups with potential for exponential growth but uncertain returns. Explore the key differences and benefits of investing in music royalties versus venture capital to make informed financial decisions.

Why it is important

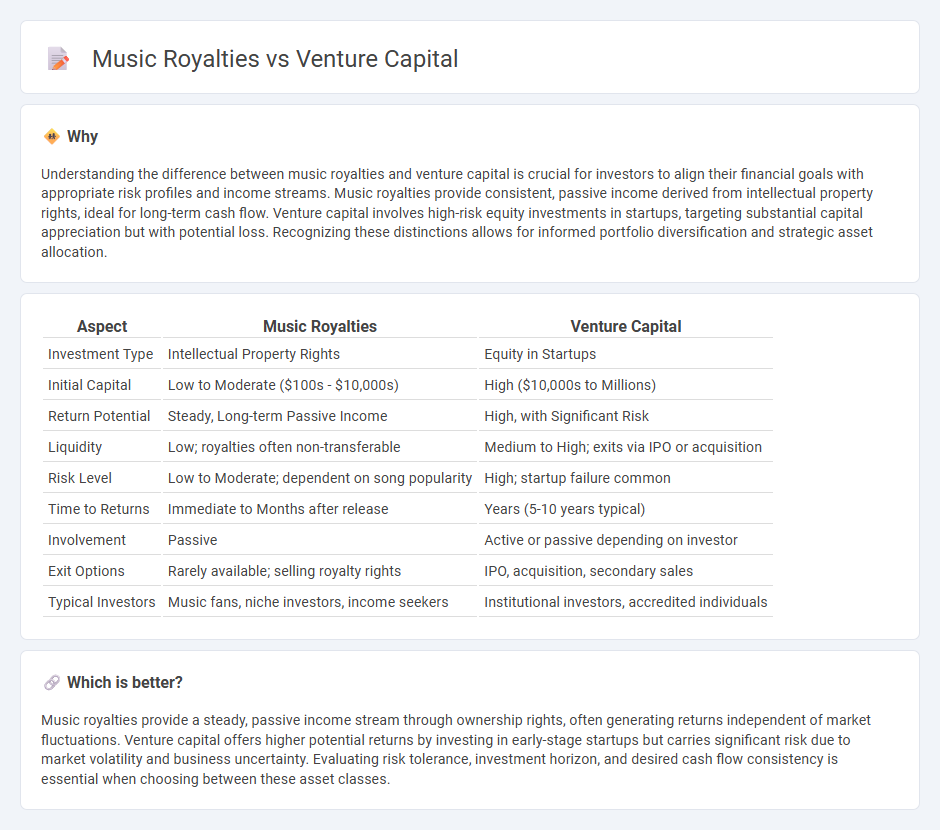

Understanding the difference between music royalties and venture capital is crucial for investors to align their financial goals with appropriate risk profiles and income streams. Music royalties provide consistent, passive income derived from intellectual property rights, ideal for long-term cash flow. Venture capital involves high-risk equity investments in startups, targeting substantial capital appreciation but with potential loss. Recognizing these distinctions allows for informed portfolio diversification and strategic asset allocation.

Comparison Table

| Aspect | Music Royalties | Venture Capital |

|---|---|---|

| Investment Type | Intellectual Property Rights | Equity in Startups |

| Initial Capital | Low to Moderate ($100s - $10,000s) | High ($10,000s to Millions) |

| Return Potential | Steady, Long-term Passive Income | High, with Significant Risk |

| Liquidity | Low; royalties often non-transferable | Medium to High; exits via IPO or acquisition |

| Risk Level | Low to Moderate; dependent on song popularity | High; startup failure common |

| Time to Returns | Immediate to Months after release | Years (5-10 years typical) |

| Involvement | Passive | Active or passive depending on investor |

| Exit Options | Rarely available; selling royalty rights | IPO, acquisition, secondary sales |

| Typical Investors | Music fans, niche investors, income seekers | Institutional investors, accredited individuals |

Which is better?

Music royalties provide a steady, passive income stream through ownership rights, often generating returns independent of market fluctuations. Venture capital offers higher potential returns by investing in early-stage startups but carries significant risk due to market volatility and business uncertainty. Evaluating risk tolerance, investment horizon, and desired cash flow consistency is essential when choosing between these asset classes.

Connection

Music royalties provide a steady income stream that attracts venture capital firms seeking diversified, low-risk investments with long-term returns. Venture capitalists increasingly fund technology startups that digitize royalty collection and distribution, enhancing transparency and efficiency in the music industry. This intersection between music royalties and venture capital fuels innovation, driving growth in both creative assets and financial markets.

Key Terms

Equity

Venture capital investments offer equity stakes in startups, providing potential high returns through ownership and company growth. Music royalties represent a share of income generated from copyrighted works, offering steady cash flow without equity participation. Explore deeper insights into how equity-based ventures compare to royalty income opportunities.

Recoupment

Venture capital investments focus on equity stakes aiming for high returns, while music royalties provide recurring income streams subject to contract terms and royalty rates, with recoupment clauses determining how initial advances are recovered before payouts. Recoupment in music royalties ensures that initial costs are recouped by record labels or publishers before artists receive further earnings, contrasting with venture capital where capital recovery is tied to exit events rather than ongoing cash flow. Explore the detailed dynamics of recoupment factors in both venture capital and music royalties for deeper financial insights.

Intellectual Property (IP)

Venture capital investments often target innovative startups with scalable business models and strong intellectual property portfolios that can drive significant market value. Music royalties represent a form of IP revenue stream generated from copyrights on compositions and sound recordings, offering steady cash flow based on usage and licensing agreements. Explore the nuances of IP valuation in venture capital and music royalties to optimize your investment strategy.

Source and External Links

What is Venture Capital? - Venture capital funds high-growth companies by turning innovative ideas into products, offering strategic support, and providing long-term, high-risk equity investments that fuel job creation and economic growth.

Fund your business | U.S. Small Business Administration - Venture capital provides funding to high-growth startups in exchange for equity and board involvement, involving a detailed process of finding investors, sharing business plans, due diligence, and negotiating terms.

What is Venture Capital? | J.P. Morgan - Venture capital finances innovative startups with high growth potential and risk, takes equity stakes, uses a long-term investment horizon, and succeeds by portfolios achieving major liquidity events like IPOs or acquisitions.

dowidth.com

dowidth.com