Whale watching shares offer exposure to niche maritime tourism markets with potential for high growth and volatility compared to broad index funds, which provide diversified investments across multiple sectors reducing risk. Index funds typically track major benchmarks such as the S&P 500, delivering steady returns aligned with overall market performance. Explore the distinct benefits and risks of whale watching shares versus index funds to make informed investment decisions.

Why it is important

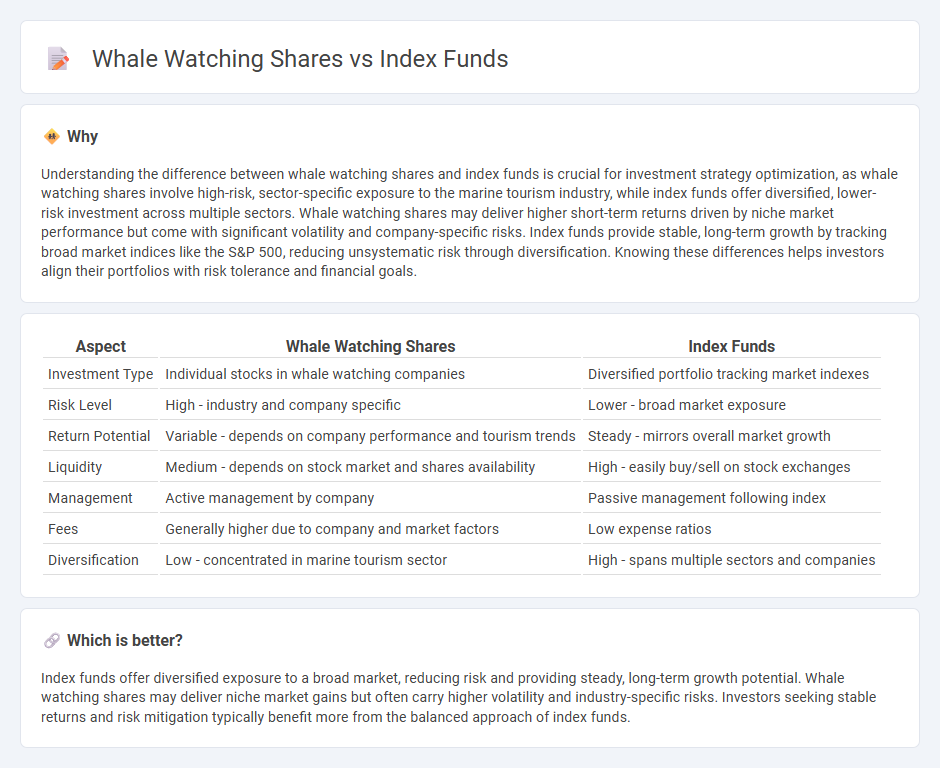

Understanding the difference between whale watching shares and index funds is crucial for investment strategy optimization, as whale watching shares involve high-risk, sector-specific exposure to the marine tourism industry, while index funds offer diversified, lower-risk investment across multiple sectors. Whale watching shares may deliver higher short-term returns driven by niche market performance but come with significant volatility and company-specific risks. Index funds provide stable, long-term growth by tracking broad market indices like the S&P 500, reducing unsystematic risk through diversification. Knowing these differences helps investors align their portfolios with risk tolerance and financial goals.

Comparison Table

| Aspect | Whale Watching Shares | Index Funds |

|---|---|---|

| Investment Type | Individual stocks in whale watching companies | Diversified portfolio tracking market indexes |

| Risk Level | High - industry and company specific | Lower - broad market exposure |

| Return Potential | Variable - depends on company performance and tourism trends | Steady - mirrors overall market growth |

| Liquidity | Medium - depends on stock market and shares availability | High - easily buy/sell on stock exchanges |

| Management | Active management by company | Passive management following index |

| Fees | Generally higher due to company and market factors | Low expense ratios |

| Diversification | Low - concentrated in marine tourism sector | High - spans multiple sectors and companies |

Which is better?

Index funds offer diversified exposure to a broad market, reducing risk and providing steady, long-term growth potential. Whale watching shares may deliver niche market gains but often carry higher volatility and industry-specific risks. Investors seeking stable returns and risk mitigation typically benefit more from the balanced approach of index funds.

Connection

Whale watching shares are niche investments influenced by tourism trends, while index funds aggregate diverse assets, including travel and leisure sectors, providing broader market exposure. Investing in whale watching companies through index funds allows for risk diversification and capitalizes on the sustainable tourism industry's growth. This connection highlights how specialized shares contribute to composite investment vehicles, balancing sector-specific dynamics with overall portfolio stability.

Key Terms

Diversification

Index funds offer broad market diversification by pooling investments across numerous companies, reducing individual stock risk and providing steady growth potentials. Whale watching shares, while niche, allow investors to tap into the sustainable tourism sector with a more focused but potentially volatile exposure. Explore more about balancing diversification strategies between broad index funds and specialized shares.

Market Influence

Index funds aggregate diverse assets, providing stable returns and broad market exposure that dilutes the effect of individual stock volatility. Whale watching shares, often tied to niche tourism sectors, can exhibit heightened sensitivity to environmental factors and consumer trends, influencing market performance unpredictably. Explore deeper insights into how these investment vehicles shape market dynamics and impact portfolio strategies.

Source and External Links

Index Funds | Investor.gov - An index fund is a mutual fund or ETF that seeks to replicate the returns of a market index by investing in all or a sample of its underlying securities, often weighted by market capitalization.

What is an index fund? - Vanguard - An index fund tracks a specific benchmark like the S&P 500 by holding all or a representative sample of the index's stocks, providing diversified risk and long-term growth potential without active stock selection.

The Best Index Funds | Morningstar - Index funds are passive investments designed to closely follow market indexes with low costs, and research shows they often outperform actively managed funds over time.

dowidth.com

dowidth.com