Song catalog purchases offer investors unique royalty income streams and potential for long-term appreciation tied to music rights, often requiring lower upfront capital compared to real estate investments. Real estate provides tangible assets with potential for rental income, property value growth, and tax advantages through depreciation, but typically demands higher initial investment and ongoing management. Explore the distinct benefits and risks of these asset classes to optimize your investment strategy.

Why it is important

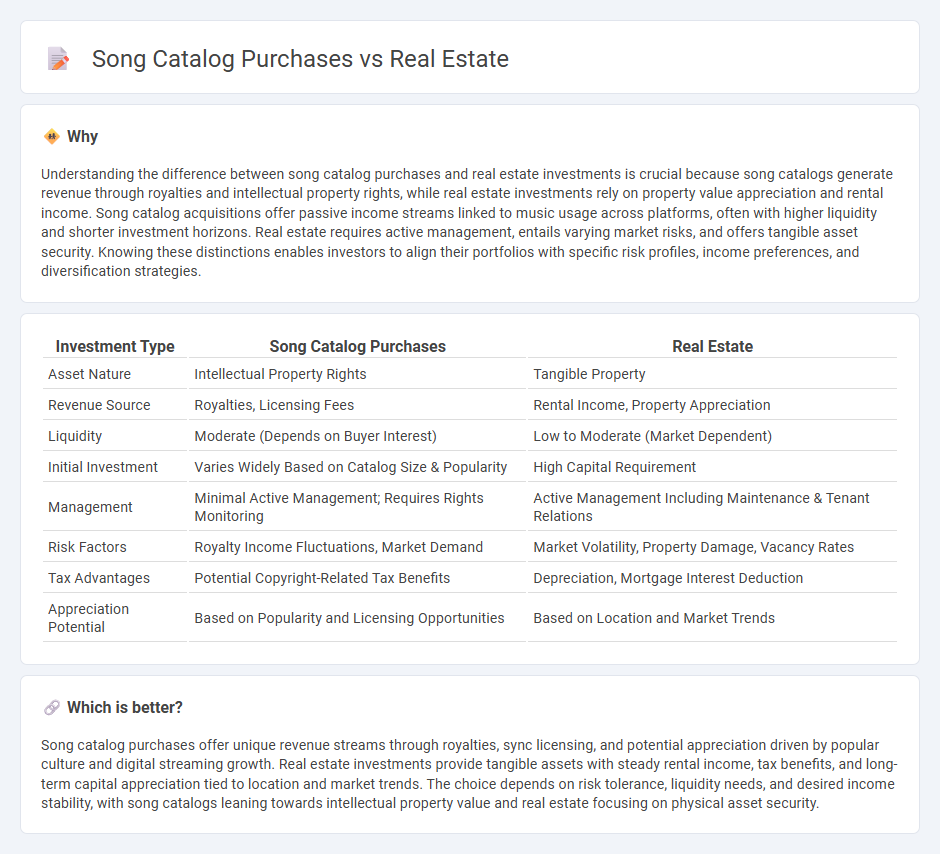

Understanding the difference between song catalog purchases and real estate investments is crucial because song catalogs generate revenue through royalties and intellectual property rights, while real estate investments rely on property value appreciation and rental income. Song catalog acquisitions offer passive income streams linked to music usage across platforms, often with higher liquidity and shorter investment horizons. Real estate requires active management, entails varying market risks, and offers tangible asset security. Knowing these distinctions enables investors to align their portfolios with specific risk profiles, income preferences, and diversification strategies.

Comparison Table

| Investment Type | Song Catalog Purchases | Real Estate |

|---|---|---|

| Asset Nature | Intellectual Property Rights | Tangible Property |

| Revenue Source | Royalties, Licensing Fees | Rental Income, Property Appreciation |

| Liquidity | Moderate (Depends on Buyer Interest) | Low to Moderate (Market Dependent) |

| Initial Investment | Varies Widely Based on Catalog Size & Popularity | High Capital Requirement |

| Management | Minimal Active Management; Requires Rights Monitoring | Active Management Including Maintenance & Tenant Relations |

| Risk Factors | Royalty Income Fluctuations, Market Demand | Market Volatility, Property Damage, Vacancy Rates |

| Tax Advantages | Potential Copyright-Related Tax Benefits | Depreciation, Mortgage Interest Deduction |

| Appreciation Potential | Based on Popularity and Licensing Opportunities | Based on Location and Market Trends |

Which is better?

Song catalog purchases offer unique revenue streams through royalties, sync licensing, and potential appreciation driven by popular culture and digital streaming growth. Real estate investments provide tangible assets with steady rental income, tax benefits, and long-term capital appreciation tied to location and market trends. The choice depends on risk tolerance, liquidity needs, and desired income stability, with song catalogs leaning towards intellectual property value and real estate focusing on physical asset security.

Connection

Song catalog purchases and real estate investments share common characteristics as alternative assets offering diversification and passive income streams. Both asset classes provide potential for long-term cash flow through royalties and rental income respectively, while benefiting from asset appreciation over time. Investors leverage the stability and inflation-hedging properties of music rights and property holdings to enhance portfolio resilience.

Key Terms

Asset Valuation

Asset valuation in real estate hinges on property location, market trends, and physical asset conditions, often evaluated through comparable sales and income potential. Song catalog purchases depend on royalty streams, licensing agreements, and the longevity of intellectual property, with valuation emphasizing historical revenue and future earning forecasts. Explore deeper insights into asset valuation techniques across these distinct investment categories.

Cash Flow

Real estate investments generate consistent cash flow through rental income, often providing steady monthly returns and potential tax advantages. Song catalog purchases yield royalties from music streaming, licensing, and synchronization, offering variable cash flow influenced by song popularity and market trends. Explore detailed comparisons to optimize your cash flow strategy in these asset classes.

Liquidity

Real estate investments typically offer lower liquidity due to longer transaction processes and higher entry costs, making quick sales challenging compared to song catalog purchases. Song catalogs provide higher liquidity as music rights can be transferred relatively quickly through digital platforms and have smaller financial barriers. Explore the distinct liquidity profiles and benefits of real estate and song catalog investments to make informed financial decisions.

Source and External Links

Real Estate Explained: Definition And Types - Bankrate - Real estate refers to land plus any property or resources on it, used for residential, commercial, or industrial purposes, and is a major personal asset and economic indicator.

Real estate - Wikipedia - Real estate consists of land and buildings along with natural resources, and includes residential, commercial, and environmental aspects such as green development and impacts on emissions.

Redfin | Real Estate & Homes for Sale, Rentals, Mortgages & Agents - Redfin offers nationwide real estate listings including homes for sale and rentals, with tools to browse and purchase properties across various US cities.

dowidth.com

dowidth.com