Music royalties platforms offer investors access to consistent cash flow through streaming revenues and licensing fees, leveraging the growing digital music market and increasing consumption worldwide. In contrast, classic car investment platforms focus on tangible assets with potential for appreciation based on rarity, condition, and market trends within the collector car industry. Explore detailed comparisons to understand which investment aligns best with your financial goals.

Why it is important

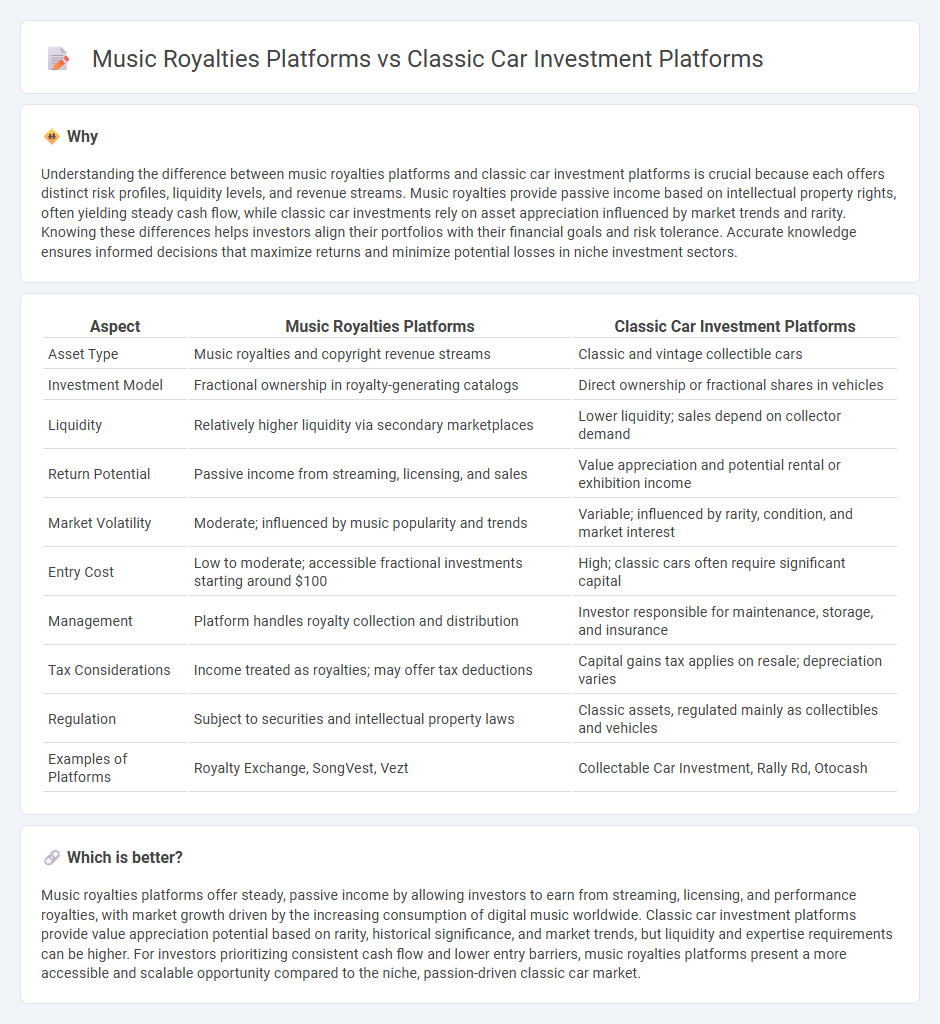

Understanding the difference between music royalties platforms and classic car investment platforms is crucial because each offers distinct risk profiles, liquidity levels, and revenue streams. Music royalties provide passive income based on intellectual property rights, often yielding steady cash flow, while classic car investments rely on asset appreciation influenced by market trends and rarity. Knowing these differences helps investors align their portfolios with their financial goals and risk tolerance. Accurate knowledge ensures informed decisions that maximize returns and minimize potential losses in niche investment sectors.

Comparison Table

| Aspect | Music Royalties Platforms | Classic Car Investment Platforms |

|---|---|---|

| Asset Type | Music royalties and copyright revenue streams | Classic and vintage collectible cars |

| Investment Model | Fractional ownership in royalty-generating catalogs | Direct ownership or fractional shares in vehicles |

| Liquidity | Relatively higher liquidity via secondary marketplaces | Lower liquidity; sales depend on collector demand |

| Return Potential | Passive income from streaming, licensing, and sales | Value appreciation and potential rental or exhibition income |

| Market Volatility | Moderate; influenced by music popularity and trends | Variable; influenced by rarity, condition, and market interest |

| Entry Cost | Low to moderate; accessible fractional investments starting around $100 | High; classic cars often require significant capital |

| Management | Platform handles royalty collection and distribution | Investor responsible for maintenance, storage, and insurance |

| Tax Considerations | Income treated as royalties; may offer tax deductions | Capital gains tax applies on resale; depreciation varies |

| Regulation | Subject to securities and intellectual property laws | Classic assets, regulated mainly as collectibles and vehicles |

| Examples of Platforms | Royalty Exchange, SongVest, Vezt | Collectable Car Investment, Rally Rd, Otocash |

Which is better?

Music royalties platforms offer steady, passive income by allowing investors to earn from streaming, licensing, and performance royalties, with market growth driven by the increasing consumption of digital music worldwide. Classic car investment platforms provide value appreciation potential based on rarity, historical significance, and market trends, but liquidity and expertise requirements can be higher. For investors prioritizing consistent cash flow and lower entry barriers, music royalties platforms present a more accessible and scalable opportunity compared to the niche, passion-driven classic car market.

Connection

Music royalties platforms and classic car investment platforms both operate within the alternative investment landscape, providing investors with unique asset classes that generate passive income and offer portfolio diversification. These platforms leverage digital technology to fractionalize ownership, making assets like music royalties and vintage vehicles accessible to a broader range of investors. By tapping into niche markets with historically resilient value, both types of platforms attract investors seeking non-traditional investment opportunities beyond stocks and bonds.

Key Terms

Asset Valuation

Classic car investment platforms typically rely on historical sales data, rarity, provenance, and market trends to determine asset valuation, emphasizing physical condition and collectible status. Music royalties platforms assess asset value based on streaming metrics, copyright ownership, and projected future income from royalties, focusing on income-generating potential. Explore detailed comparisons to understand which asset class aligns better with your investment strategy.

Liquidity

Classic car investment platforms offer lower liquidity due to the physical asset's nature, requiring time-consuming processes for valuation, maintenance, and resale. Music royalties platforms provide higher liquidity with digital rights trading on secondary markets, allowing investors to buy or sell shares more swiftly. Explore how liquidity differences impact your investment strategy and portfolio fluidity.

Ownership Structure

Classic car investment platforms typically offer fractional ownership through Special Purpose Vehicles (SPVs), where investors hold shares in a legal entity owning the vehicle, ensuring clear asset management and limited liability. Music royalties platforms allow investors to purchase royalty rights or shares of income streams directly from artists or rights holders, providing ongoing revenue tied to music performance and sales. Explore the nuances of ownership structures in these investment options to make informed decisions tailored to your portfolio.

Source and External Links

How To Invest in Collectible and Vintage Cars - TheCarCrowd (UK) offers fractional ownership of classic cars via limited companies with up to 1,000 shares per car, while the Inspira Classic Car Fund provides digital investment products and complementary lifestyle benefits.

Crowdfunding for Cars: Revving Up Car Investments - LenderKit - TheCarCrowd enables UK and international sophisticated investors to buy shares in classic cars held by LLCs, including maintenance, storage, and insurance, with voting rights on asset disposition and profits shared upon sales.

Classic Automobiles - aShareX - aShareX facilitates secure classic car investments through online and live auctions, offering fractional bidding to allow investors to own shares of rare cars without full ownership responsibilities, including storage and maintenance handled by the platform.

dowidth.com

dowidth.com