Litigation finance involves funding legal cases in exchange for a portion of the settlement or judgment, offering investors a unique asset class with relatively low correlation to traditional markets. Cryptocurrency investment, characterized by digital assets like Bitcoin and Ethereum, presents high volatility and potential for significant returns driven by decentralized blockchain technology. Explore more insights to understand the risks and benefits of these emerging investment opportunities.

Why it is important

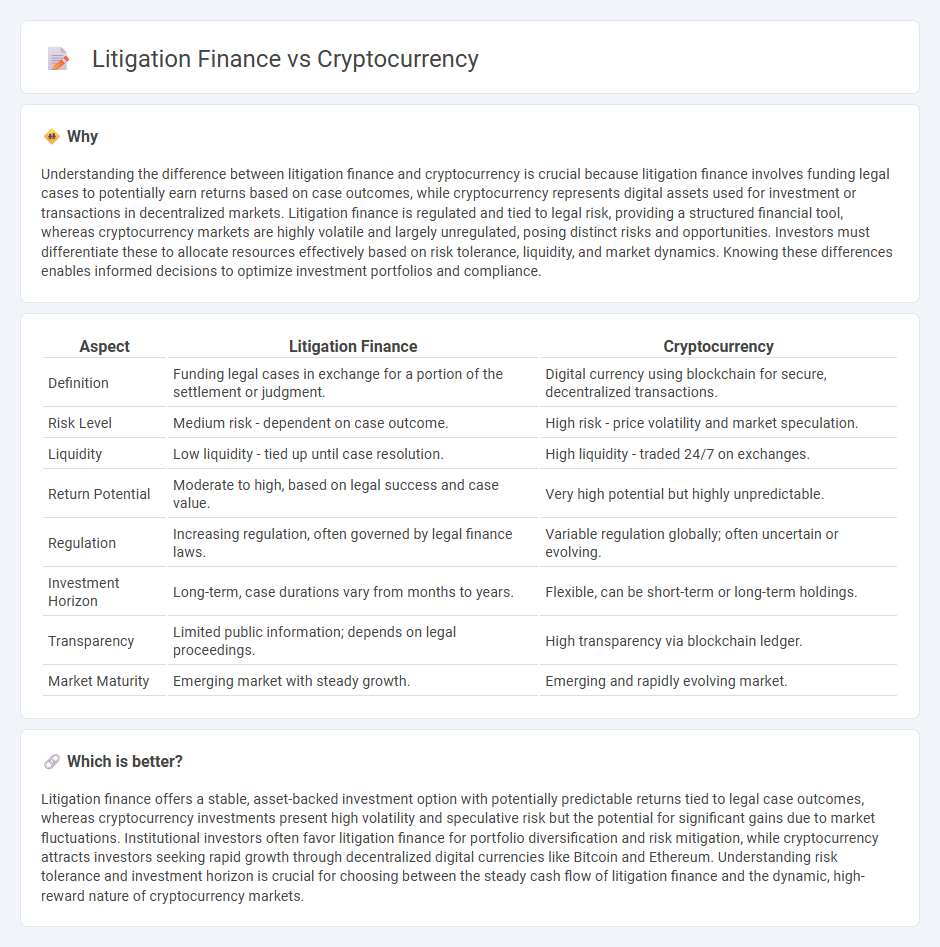

Understanding the difference between litigation finance and cryptocurrency is crucial because litigation finance involves funding legal cases to potentially earn returns based on case outcomes, while cryptocurrency represents digital assets used for investment or transactions in decentralized markets. Litigation finance is regulated and tied to legal risk, providing a structured financial tool, whereas cryptocurrency markets are highly volatile and largely unregulated, posing distinct risks and opportunities. Investors must differentiate these to allocate resources effectively based on risk tolerance, liquidity, and market dynamics. Knowing these differences enables informed decisions to optimize investment portfolios and compliance.

Comparison Table

| Aspect | Litigation Finance | Cryptocurrency |

|---|---|---|

| Definition | Funding legal cases in exchange for a portion of the settlement or judgment. | Digital currency using blockchain for secure, decentralized transactions. |

| Risk Level | Medium risk - dependent on case outcome. | High risk - price volatility and market speculation. |

| Liquidity | Low liquidity - tied up until case resolution. | High liquidity - traded 24/7 on exchanges. |

| Return Potential | Moderate to high, based on legal success and case value. | Very high potential but highly unpredictable. |

| Regulation | Increasing regulation, often governed by legal finance laws. | Variable regulation globally; often uncertain or evolving. |

| Investment Horizon | Long-term, case durations vary from months to years. | Flexible, can be short-term or long-term holdings. |

| Transparency | Limited public information; depends on legal proceedings. | High transparency via blockchain ledger. |

| Market Maturity | Emerging market with steady growth. | Emerging and rapidly evolving market. |

Which is better?

Litigation finance offers a stable, asset-backed investment option with potentially predictable returns tied to legal case outcomes, whereas cryptocurrency investments present high volatility and speculative risk but the potential for significant gains due to market fluctuations. Institutional investors often favor litigation finance for portfolio diversification and risk mitigation, while cryptocurrency attracts investors seeking rapid growth through decentralized digital currencies like Bitcoin and Ethereum. Understanding risk tolerance and investment horizon is crucial for choosing between the steady cash flow of litigation finance and the dynamic, high-reward nature of cryptocurrency markets.

Connection

Litigation finance leverages cryptocurrency by enabling investors to fund legal cases using digital assets, providing liquidity and expanding funding sources beyond traditional capital. Cryptocurrency offers transparency and security through blockchain technology, enhancing the tracking and management of litigation finance transactions. This integration facilitates faster settlements and broadens access to justice by democratizing investment opportunities in legal disputes.

Key Terms

Cryptocurrency:

Cryptocurrency leverages blockchain technology to offer decentralized, transparent, and secure transactions, enabling rapid global payments and reducing reliance on traditional banking systems. This digital asset class provides investors with liquidity, portability, and the potential for high returns, but carries volatility and regulatory risks. Explore the evolving landscape of cryptocurrency to understand its impact on finance and investment opportunities.

Blockchain

Blockchain technology underpins both cryptocurrency and litigation finance by ensuring secure, transparent, and immutable transaction records. In litigation finance, blockchain enhances traceability and trust, enabling investors to fund cases with reduced risk while maintaining accountability. Explore how blockchain innovations are transforming the future of digital assets and legal funding.

Tokenization

Tokenization in cryptocurrency transforms traditional assets into digital tokens on blockchain, enhancing liquidity and accessibility. Litigation finance employs tokenization to fractionalize legal claims, enabling investors to participate while diversifying risk. Explore how tokenization integrates innovation between these two dynamic financial sectors.

Source and External Links

What is Cryptocurrency and How Does it Work? - Kaspersky - Cryptocurrency is a digital payment system using cryptography and blockchain technology to enable peer-to-peer transactions without a central authority, first introduced by Bitcoin in 2009.

Cryptocurrency - Wikipedia - Cryptocurrencies are digital currencies secured by blockchain technology, decentralized and not reliant on any central authority, with Bitcoin as the first and most notable example.

Digital Currencies | Explainer | Education - Reserve Bank of Australia - Cryptocurrencies are digital tokens enabling direct peer-to-peer payments, characterized by high price volatility and significant speculative interest rather than mainstream payment use.

dowidth.com

dowidth.com