Patent monetization involves leveraging intellectual property rights to generate revenue through licensing or sale, while angel investing focuses on providing early-stage capital to startups in exchange for equity. Both strategies offer distinct risk profiles and potential returns, with patent monetization relying on the enforceability and uniqueness of innovations, and angel investing hinging on the growth prospects of emerging businesses. Explore the advantages and challenges of each approach to determine the best fit for your investment portfolio.

Why it is important

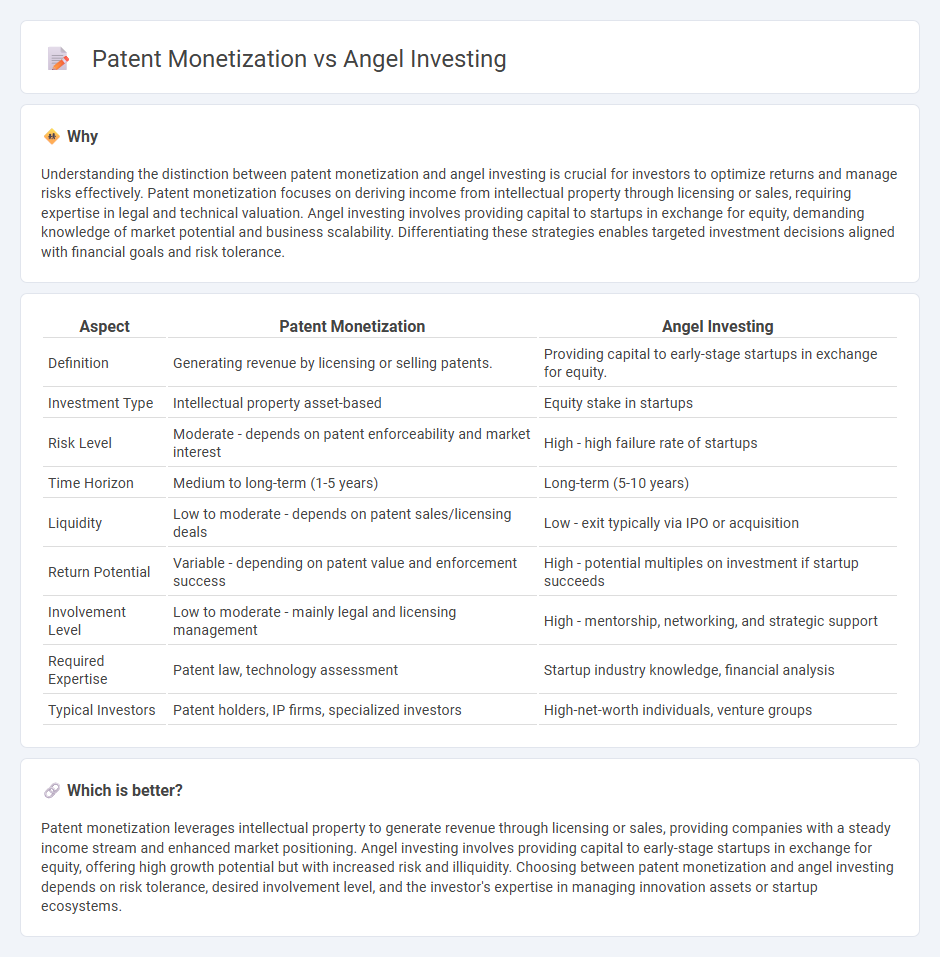

Understanding the distinction between patent monetization and angel investing is crucial for investors to optimize returns and manage risks effectively. Patent monetization focuses on deriving income from intellectual property through licensing or sales, requiring expertise in legal and technical valuation. Angel investing involves providing capital to startups in exchange for equity, demanding knowledge of market potential and business scalability. Differentiating these strategies enables targeted investment decisions aligned with financial goals and risk tolerance.

Comparison Table

| Aspect | Patent Monetization | Angel Investing |

|---|---|---|

| Definition | Generating revenue by licensing or selling patents. | Providing capital to early-stage startups in exchange for equity. |

| Investment Type | Intellectual property asset-based | Equity stake in startups |

| Risk Level | Moderate - depends on patent enforceability and market interest | High - high failure rate of startups |

| Time Horizon | Medium to long-term (1-5 years) | Long-term (5-10 years) |

| Liquidity | Low to moderate - depends on patent sales/licensing deals | Low - exit typically via IPO or acquisition |

| Return Potential | Variable - depending on patent value and enforcement success | High - potential multiples on investment if startup succeeds |

| Involvement Level | Low to moderate - mainly legal and licensing management | High - mentorship, networking, and strategic support |

| Required Expertise | Patent law, technology assessment | Startup industry knowledge, financial analysis |

| Typical Investors | Patent holders, IP firms, specialized investors | High-net-worth individuals, venture groups |

Which is better?

Patent monetization leverages intellectual property to generate revenue through licensing or sales, providing companies with a steady income stream and enhanced market positioning. Angel investing involves providing capital to early-stage startups in exchange for equity, offering high growth potential but with increased risk and illiquidity. Choosing between patent monetization and angel investing depends on risk tolerance, desired involvement level, and the investor's expertise in managing innovation assets or startup ecosystems.

Connection

Patent monetization and angel investing are connected through their shared focus on capitalizing innovation and early-stage technology. Angel investors often provide crucial funding to startups holding valuable patents, enabling these companies to develop patented technologies into market-ready products. This synergy accelerates commercialization, enhances the patent's valuation, and maximizes returns on intellectual property investments.

Key Terms

Angel investing:

Angel investing involves providing early-stage capital to startups in exchange for equity, often supporting innovative technology and high-growth potential ventures. This form of investment carries higher risks compared to traditional funding but offers substantial returns if the company succeeds. Discover how angel investing can accelerate your entrepreneurial journey and diversify your portfolio.

Equity stake

Angel investing involves providing capital to startups in exchange for equity, granting investors ownership and potential returns through company growth. Patent monetization focuses on generating revenue from intellectual property by licensing or selling patents without necessarily acquiring equity in the business. Explore the benefits and risks of each approach to determine the best strategy for your investment goals.

Seed funding

Seed funding through angel investing provides early-stage startups with crucial capital along with mentorship and industry connections, accelerating business growth and innovation. Patent monetization involves leveraging intellectual property assets to generate revenue or attract investment, offering a strategic financial resource for startups with unique technologies. Explore how combining these approaches can optimize your seed funding strategy and drive startup success.

Source and External Links

Understanding angel financing and investing - Angel investors provide early-stage capital to startups in exchange for equity or convertible debt, often mentoring founders and helping them reach key milestones before institutional investment rounds.

Angel Investors - Wealthy individuals invest their own money in small businesses for equity, offering both funding and strategic advice, typically seeking an eventual exit through acquisition or IPO.

Angel investor - Angel investors are private individuals who provide capital to startups, often taking an average equity stake and expecting above-average returns, with their market showing consistent growth and increasing interest in impact investments.

dowidth.com

dowidth.com