Fractional farmland ownership allows investors to buy a share of agricultural land, benefiting from crop yields and land appreciation without full ownership responsibilities. Farm bonds provide a fixed-income investment tied to agricultural projects, offering steady returns backed by farming operations. Explore the differences between these investment options to determine the best fit for your portfolio goals.

Why it is important

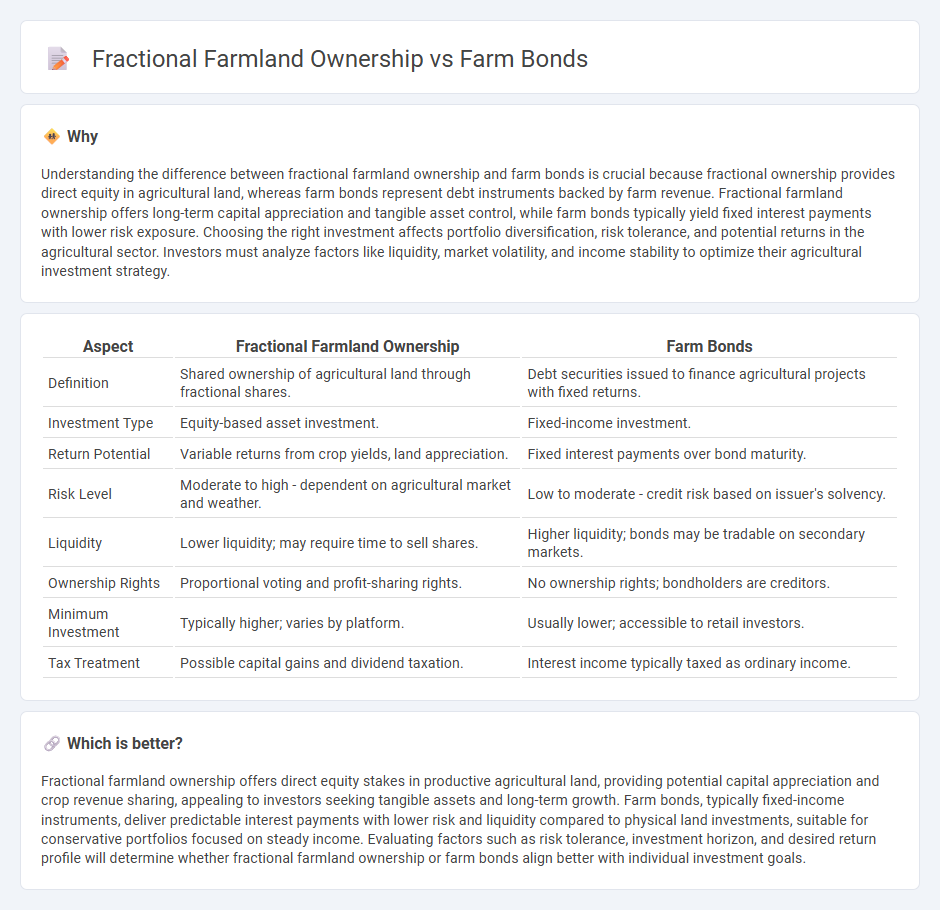

Understanding the difference between fractional farmland ownership and farm bonds is crucial because fractional ownership provides direct equity in agricultural land, whereas farm bonds represent debt instruments backed by farm revenue. Fractional farmland ownership offers long-term capital appreciation and tangible asset control, while farm bonds typically yield fixed interest payments with lower risk exposure. Choosing the right investment affects portfolio diversification, risk tolerance, and potential returns in the agricultural sector. Investors must analyze factors like liquidity, market volatility, and income stability to optimize their agricultural investment strategy.

Comparison Table

| Aspect | Fractional Farmland Ownership | Farm Bonds |

|---|---|---|

| Definition | Shared ownership of agricultural land through fractional shares. | Debt securities issued to finance agricultural projects with fixed returns. |

| Investment Type | Equity-based asset investment. | Fixed-income investment. |

| Return Potential | Variable returns from crop yields, land appreciation. | Fixed interest payments over bond maturity. |

| Risk Level | Moderate to high - dependent on agricultural market and weather. | Low to moderate - credit risk based on issuer's solvency. |

| Liquidity | Lower liquidity; may require time to sell shares. | Higher liquidity; bonds may be tradable on secondary markets. |

| Ownership Rights | Proportional voting and profit-sharing rights. | No ownership rights; bondholders are creditors. |

| Minimum Investment | Typically higher; varies by platform. | Usually lower; accessible to retail investors. |

| Tax Treatment | Possible capital gains and dividend taxation. | Interest income typically taxed as ordinary income. |

Which is better?

Fractional farmland ownership offers direct equity stakes in productive agricultural land, providing potential capital appreciation and crop revenue sharing, appealing to investors seeking tangible assets and long-term growth. Farm bonds, typically fixed-income instruments, deliver predictable interest payments with lower risk and liquidity compared to physical land investments, suitable for conservative portfolios focused on steady income. Evaluating factors such as risk tolerance, investment horizon, and desired return profile will determine whether fractional farmland ownership or farm bonds align better with individual investment goals.

Connection

Fractional farmland ownership allows individual investors to buy shares of agricultural land, providing access to farmland investment with lower capital requirements. Farm bonds offer debt financing to farmers, enabling them to raise capital for operations or expansion while providing investors with fixed-income opportunities linked to agricultural projects. Both mechanisms connect through their role in democratizing access to agricultural investments and supporting farm financing by distributing risk among multiple investors.

Key Terms

Liquidity

Farm bonds offer higher liquidity compared to fractional farmland ownership by allowing investors to buy and sell bonds on secondary markets with relative ease. Fractional farmland ownership often involves lengthy sale processes and limited market options, resulting in lower liquidity for investors. Explore more about the liquidity differences and investment potentials between farm bonds and fractional farmland ownership.

Ownership structure

Farm bonds represent debt instruments issued by agricultural enterprises, providing investors fixed income without equity participation, thus retaining full ownership within the issuing entity. Fractional farmland ownership involves dividing land equity among multiple investors, granting proportional ownership rights and potential profit-sharing based on land appreciation and crop yields. Explore detailed comparisons to understand which ownership structure aligns best with your investment goals.

Yield

Farm bonds offer fixed returns backed by agricultural projects, providing predictable income with lower risk exposure. Fractional farmland ownership allows investors to share direct yields from crop production, benefiting from potentially higher profits linked to market fluctuations and land appreciation. Explore detailed comparisons to understand which option maximizes your agricultural investment yield.

Source and External Links

Agricultural Bonds | NFP - Farm products broker bonds (agricultural bonds) ensure compliance with the Packers and Stockyards Act, protecting fair trade practices for agricultural packers, market agencies, and dealers by guaranteeing legal and ethical conduct in transactions.

Agricultural Surety Bonds: The Ultimate Guide - Agricultural surety bonds act as financial guarantees that protect buyers and regulatory agencies by ensuring agricultural principals meet their obligations, fostering trust across the agricultural marketplace.

Fixed Rate Bonds - Farm Credit Fixed Rate Bonds are high-credit quality debt instruments issued by the Farm Credit System, providing flexible financing options for agricultural lending, structured with various maturities and call features.

dowidth.com

dowidth.com