Private credit funds focus on providing direct loans to middle-market companies, often offering higher yields and tailored financing solutions compared to traditional bank loans. Leveraged loan funds invest primarily in syndicated loans extended to companies with significant debt levels, aiming for capital appreciation along with income generation. Explore the differences in risk profiles and return potentials between these two investment strategies to make informed portfolio decisions.

Why it is important

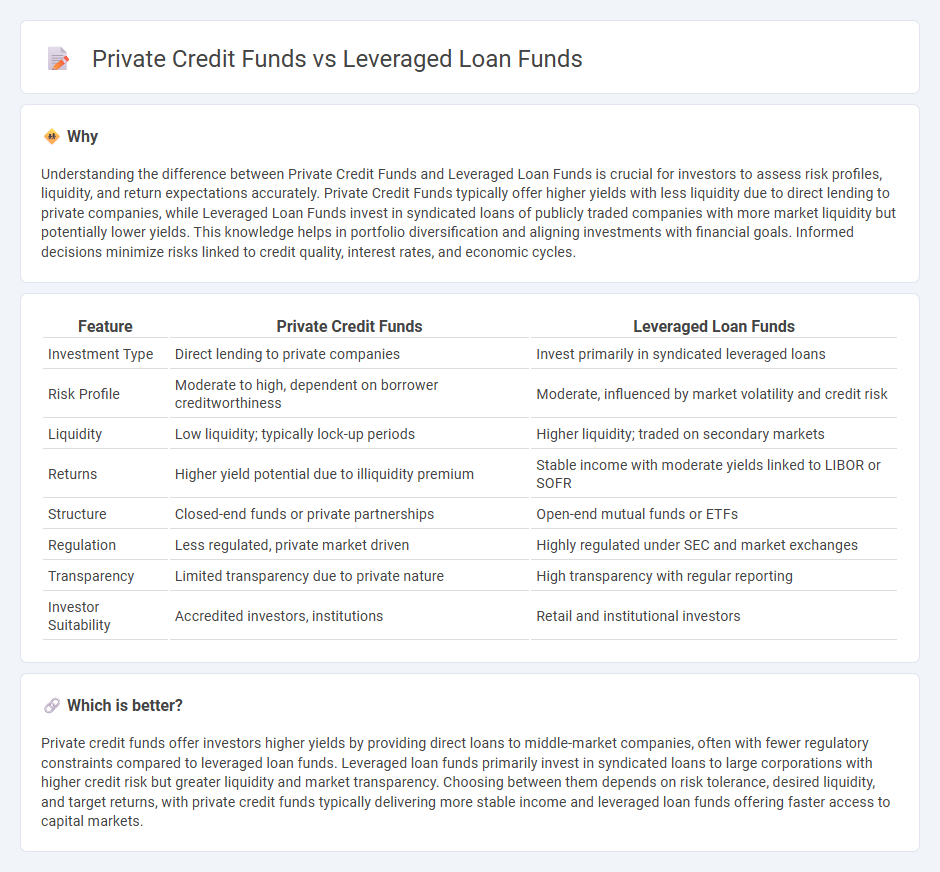

Understanding the difference between Private Credit Funds and Leveraged Loan Funds is crucial for investors to assess risk profiles, liquidity, and return expectations accurately. Private Credit Funds typically offer higher yields with less liquidity due to direct lending to private companies, while Leveraged Loan Funds invest in syndicated loans of publicly traded companies with more market liquidity but potentially lower yields. This knowledge helps in portfolio diversification and aligning investments with financial goals. Informed decisions minimize risks linked to credit quality, interest rates, and economic cycles.

Comparison Table

| Feature | Private Credit Funds | Leveraged Loan Funds |

|---|---|---|

| Investment Type | Direct lending to private companies | Invest primarily in syndicated leveraged loans |

| Risk Profile | Moderate to high, dependent on borrower creditworthiness | Moderate, influenced by market volatility and credit risk |

| Liquidity | Low liquidity; typically lock-up periods | Higher liquidity; traded on secondary markets |

| Returns | Higher yield potential due to illiquidity premium | Stable income with moderate yields linked to LIBOR or SOFR |

| Structure | Closed-end funds or private partnerships | Open-end mutual funds or ETFs |

| Regulation | Less regulated, private market driven | Highly regulated under SEC and market exchanges |

| Transparency | Limited transparency due to private nature | High transparency with regular reporting |

| Investor Suitability | Accredited investors, institutions | Retail and institutional investors |

Which is better?

Private credit funds offer investors higher yields by providing direct loans to middle-market companies, often with fewer regulatory constraints compared to leveraged loan funds. Leveraged loan funds primarily invest in syndicated loans to large corporations with higher credit risk but greater liquidity and market transparency. Choosing between them depends on risk tolerance, desired liquidity, and target returns, with private credit funds typically delivering more stable income and leveraged loan funds offering faster access to capital markets.

Connection

Private credit funds and leveraged loan funds are interconnected through their focus on providing debt financing to middle-market companies that may not have access to traditional bank lending. Leveraged loan funds invest primarily in senior secured loans with higher yields, targeting companies with significant leverage, while private credit funds often encompass a broader range of direct lending strategies, including mezzanine debt and unitranche loans. Both fund types play a critical role in alternative credit markets by offering flexible capital solutions that support corporate growth and refinancing activities in a low-interest-rate environment.

Key Terms

Leverage

Leveraged loan funds primarily invest in syndicated loans with moderate leverage ratios, typically ranging from 4x to 6x debt-to-EBITDA, offering greater liquidity through secondary markets. Private credit funds, by contrast, often target direct lending opportunities with higher leverage multiples, sometimes exceeding 7x, and customized covenant packages to mitigate risk. Explore the nuances of leverage strategies in private credit versus leveraged loan funds to optimize your investment approach.

Liquidity

Leveraged loan funds primarily invest in syndicated loans with higher liquidity, allowing investors easier access to cash through secondary markets and regular trading volumes. Private credit funds typically engage in direct lending with lower liquidity due to longer lock-up periods and less frequent trading opportunities. Explore the distinctions in liquidity profiles and risk-return trade-offs between these fund types to make informed investment decisions.

Covenant structure

Leveraged loan funds typically feature looser covenant structures, allowing more borrower flexibility but higher risk for lenders, whereas private credit funds often implement tighter, customized covenants to enhance protection and control. Covenant-lite loans dominate leveraged loan markets, reducing financial maintenance requirements and relying more on incurrence-based triggers, while private credit agreements maintain stricter covenants like financial ratios and operational restrictions. Explore the nuanced differences in covenant frameworks between these funds to optimize risk management and investment strategy.

Source and External Links

Leveraged Loan Funds | Investor.gov - Leveraged loan funds are investment vehicles (like mutual funds or ETFs) that hold loans made to borrowers with high debt levels or low credit ratings, offering higher interest rates due to elevated credit and liquidity risks.

Articles For Financial Advisors - Leveraged Loan Funds - These funds are sometimes used as a hedge against rising interest rates, as their loans typically pay a variable rate, but most underlying loans have speculative (junk) credit ratings and carry significant risk of loss.

Investors Pile Into Leveraged Loan Funds at Fastest Clip In Two Years | Morningstar - Leveraged loan fund assets under management surged in 2024, reaching $117 billion by late May, with mutual funds dominating the market and investors drawn by elevated income returns amid higher base rates.

dowidth.com

dowidth.com