Whale watching shares offer investors exposure to the growing eco-tourism industry with potential for high seasonal returns, while REITs provide steady income through diversified real estate holdings and long-term capital appreciation. Both investment options carry distinct risk profiles, with whale watching shares influenced by tourism trends and REITs sensitive to real estate market fluctuations and interest rates. Explore the benefits and challenges of whale watching shares versus REITs to make informed investment decisions.

Why it is important

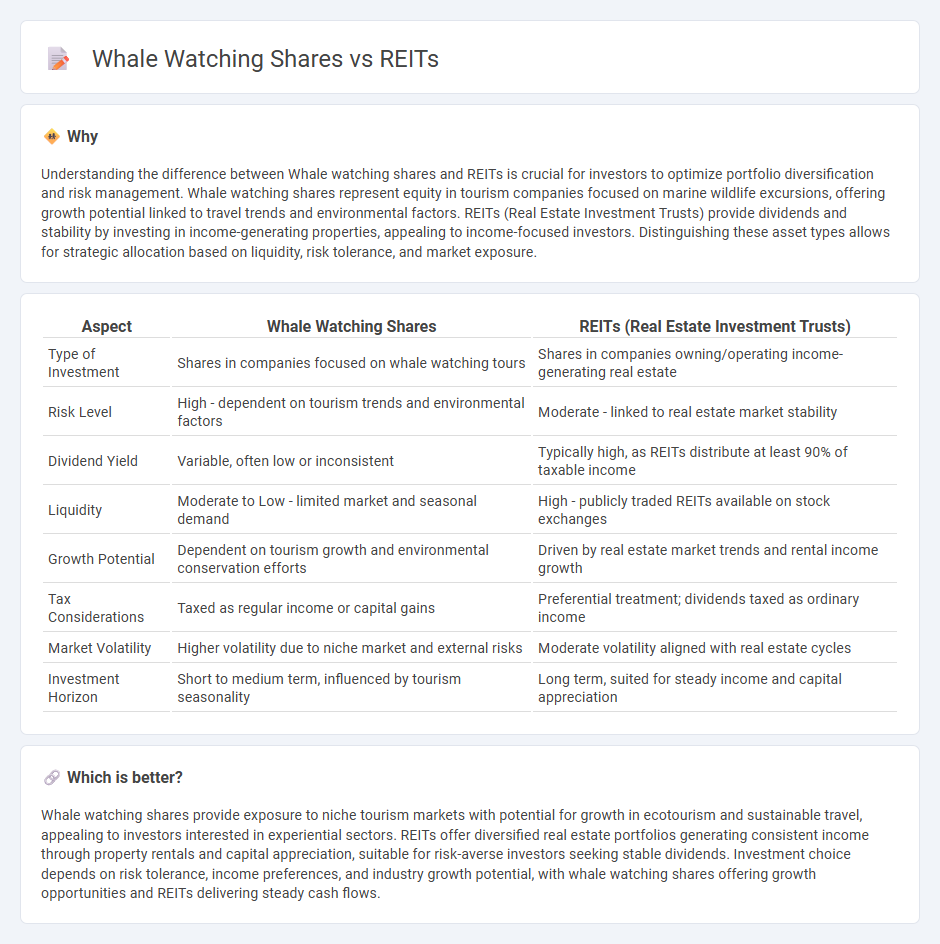

Understanding the difference between Whale watching shares and REITs is crucial for investors to optimize portfolio diversification and risk management. Whale watching shares represent equity in tourism companies focused on marine wildlife excursions, offering growth potential linked to travel trends and environmental factors. REITs (Real Estate Investment Trusts) provide dividends and stability by investing in income-generating properties, appealing to income-focused investors. Distinguishing these asset types allows for strategic allocation based on liquidity, risk tolerance, and market exposure.

Comparison Table

| Aspect | Whale Watching Shares | REITs (Real Estate Investment Trusts) |

|---|---|---|

| Type of Investment | Shares in companies focused on whale watching tours | Shares in companies owning/operating income-generating real estate |

| Risk Level | High - dependent on tourism trends and environmental factors | Moderate - linked to real estate market stability |

| Dividend Yield | Variable, often low or inconsistent | Typically high, as REITs distribute at least 90% of taxable income |

| Liquidity | Moderate to Low - limited market and seasonal demand | High - publicly traded REITs available on stock exchanges |

| Growth Potential | Dependent on tourism growth and environmental conservation efforts | Driven by real estate market trends and rental income growth |

| Tax Considerations | Taxed as regular income or capital gains | Preferential treatment; dividends taxed as ordinary income |

| Market Volatility | Higher volatility due to niche market and external risks | Moderate volatility aligned with real estate cycles |

| Investment Horizon | Short to medium term, influenced by tourism seasonality | Long term, suited for steady income and capital appreciation |

Which is better?

Whale watching shares provide exposure to niche tourism markets with potential for growth in ecotourism and sustainable travel, appealing to investors interested in experiential sectors. REITs offer diversified real estate portfolios generating consistent income through property rentals and capital appreciation, suitable for risk-averse investors seeking stable dividends. Investment choice depends on risk tolerance, income preferences, and industry growth potential, with whale watching shares offering growth opportunities and REITs delivering steady cash flows.

Connection

Whale watching shares and REITs (Real Estate Investment Trusts) intersect through coastal tourism infrastructure investments, where REITs often own and manage properties such as hotels, marinas, and visitor centers that support whale watching activities. This synergy enhances revenue streams as increased whale watching tourism drives demand for lodging and related facilities held by REITs. Investors benefit from diversified exposure to both ecotourism growth and stable real estate income through these interconnected assets.

Key Terms

Liquidity

REITs typically offer higher liquidity compared to whale watching shares due to their listing on major stock exchanges, allowing investors to buy and sell shares with ease and frequent trading volume. Whale watching companies, often smaller and less widely traded, may face lower liquidity, leading to greater price volatility and potential challenges in executing large transactions quickly. Explore detailed liquidity metrics and trading volumes to better understand investment feasibility in these sectors.

Diversification

REITs offer investors exposure to diversified real estate assets, including commercial, residential, and industrial properties, providing steady income through rental yields. Whale watching shares represent niche tourism investments with growth potential linked to eco-tourism trends but generally carry higher market volatility. Explore the benefits and risks of each option to enhance your portfolio diversification strategy.

Market Influence

REITs (Real Estate Investment Trusts) and whale watching shares represent distinct market influences rooted in different economic sectors; REITs impact real estate markets through property ownership and income generation, while whale watching shares reflect the niche tourism industry's growth potential. The market influence of REITs hinges on commercial and residential property trends, offering stability and dividend income, whereas whale watching shares depend on environmental sustainability and fluctuating tourism demand. Explore deeper to understand how these divergent market forces shape investment strategies and sector performance.

Source and External Links

Real estate investment trust - Wikipedia - A REIT (Real Estate Investment Trust) is a company that owns and operates income-producing real estate such as offices, apartments, warehouses, and hospitals; categorized mainly into commercial and residential types, with key financial metrics including NAV and FFO.

Real Estate Investment Trusts (REITs) | Investor.gov - REITs allow individuals to invest in large-scale income-producing real estate like malls, apartments, and warehouses by buying shares, offering an accessible way to earn income from commercial real estate without owning properties directly.

What's a REIT (Real Estate Investment Trust)? - Nareit - REITs are companies that own, operate, or finance income-producing real estate and typically provide investors with regular dividend income, diversification, and long-term capital appreciation, often trading publicly on stock exchanges.

dowidth.com

dowidth.com