Vintage video game investing offers unique opportunities with high-growth potential fueled by nostalgia and limited editions, attracting tech-savvy collectors and enthusiasts. Wine investing provides a more traditional asset, emphasizing provenance, rarity, and aging potential, appealing to connoisseurs seeking long-term value appreciation. Explore the distinct benefits and risks of these niche markets to make informed investment decisions.

Why it is important

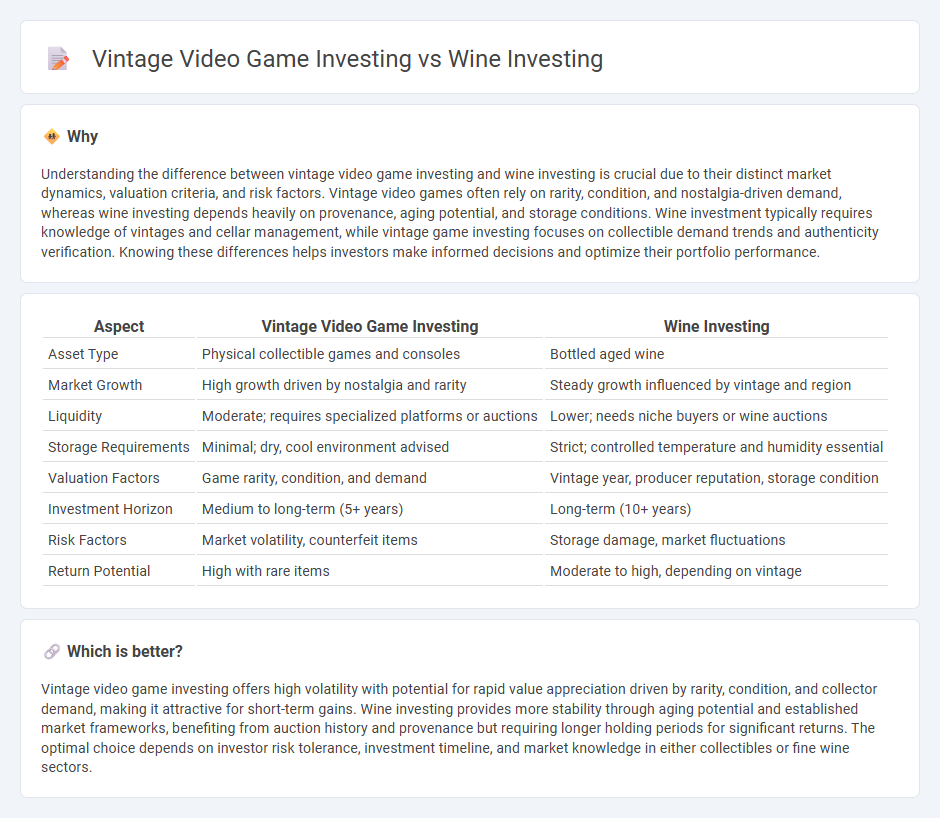

Understanding the difference between vintage video game investing and wine investing is crucial due to their distinct market dynamics, valuation criteria, and risk factors. Vintage video games often rely on rarity, condition, and nostalgia-driven demand, whereas wine investing depends heavily on provenance, aging potential, and storage conditions. Wine investment typically requires knowledge of vintages and cellar management, while vintage game investing focuses on collectible demand trends and authenticity verification. Knowing these differences helps investors make informed decisions and optimize their portfolio performance.

Comparison Table

| Aspect | Vintage Video Game Investing | Wine Investing |

|---|---|---|

| Asset Type | Physical collectible games and consoles | Bottled aged wine |

| Market Growth | High growth driven by nostalgia and rarity | Steady growth influenced by vintage and region |

| Liquidity | Moderate; requires specialized platforms or auctions | Lower; needs niche buyers or wine auctions |

| Storage Requirements | Minimal; dry, cool environment advised | Strict; controlled temperature and humidity essential |

| Valuation Factors | Game rarity, condition, and demand | Vintage year, producer reputation, storage condition |

| Investment Horizon | Medium to long-term (5+ years) | Long-term (10+ years) |

| Risk Factors | Market volatility, counterfeit items | Storage damage, market fluctuations |

| Return Potential | High with rare items | Moderate to high, depending on vintage |

Which is better?

Vintage video game investing offers high volatility with potential for rapid value appreciation driven by rarity, condition, and collector demand, making it attractive for short-term gains. Wine investing provides more stability through aging potential and established market frameworks, benefiting from auction history and provenance but requiring longer holding periods for significant returns. The optimal choice depends on investor risk tolerance, investment timeline, and market knowledge in either collectibles or fine wine sectors.

Connection

Vintage video game investing and wine investing both capitalize on scarcity and cultural nostalgia to drive asset appreciation. Each market relies heavily on provenance and condition verification to authenticate and maintain value, appealing to collectors who seek rare, well-preserved items. The convergence lies in their use of niche communities and online platforms to facilitate trading and enhance market liquidity.

Key Terms

Wine investing:

Wine investing offers a unique blend of aesthetic enjoyment and financial potential, with rare vintages like Bordeaux and Burgundy often appreciating significantly over time due to limited supply and increasing global demand. The wine market is influenced by terroir, vineyard reputation, and vintage quality, making expert knowledge crucial for identifying valuable collectible bottles. Explore more about strategies, risks, and rewards in wine investing to enhance your portfolio.

Provenance

Provenance significantly influences the value of wine investments, as documented history and ownership trace ensure authenticity and quality, directly impacting market demand and price appreciation. In vintage video game investing, provenance entails original packaging, maintenance records, and certification of authenticity, which are crucial for verifying rarity and condition, thereby enhancing collectible value. Discover how provenance shapes investment strategies and valuation in these unique asset classes.

Maturation

Wine investing benefits from the natural maturation process, as age often enhances flavor, rarity, and value, making older vintages particularly desirable. In contrast, vintage video game investing does not rely on physical aging to increase value but on scarcity, condition, and cultural significance over time. Explore the unique mechanisms behind these investments to understand their long-term potential.

Source and External Links

Understanding Online Wine Investments And Investing Platforms - Online wine investing offers diversification and combines tradition with technology, with platforms like Cru Wine providing personalized portfolios, secure storage, and a historically strong return of 11.8% annually.

Getting Started with Wine Investments | Wine Folly - Investment wines typically include fine Bordeaux and Grand Cru Burgundy, often bought by the case for provenance, with other collectible regions including Napa Cabernet and cult US wines offering strong potential returns.

Historic Wine Investment Performance | Wine Reports - Vin-X - Fine wine investments have historically delivered over 10% compound annual growth over the long term, showing low risk and stable growth, even during major financial crises.

dowidth.com

dowidth.com