Collectibles investment involves acquiring rare items such as coins, stamps, or vintage toys that can appreciate due to scarcity and demand, while art investment focuses on purchasing artworks from established or emerging artists with potential for high returns and cultural value. Market trends show that art often benefits from greater liquidity and institutional interest compared to collectibles, which can be more niche and less predictable. Discover comprehensive insights to make informed decisions between collectibles and art investment opportunities.

Why it is important

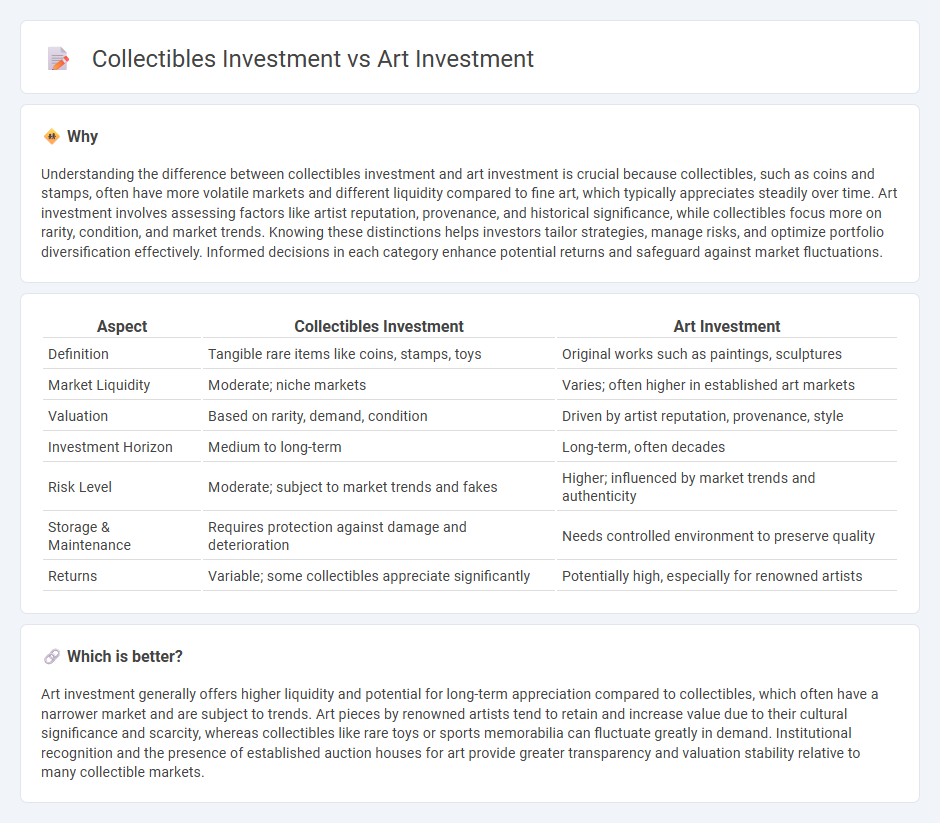

Understanding the difference between collectibles investment and art investment is crucial because collectibles, such as coins and stamps, often have more volatile markets and different liquidity compared to fine art, which typically appreciates steadily over time. Art investment involves assessing factors like artist reputation, provenance, and historical significance, while collectibles focus more on rarity, condition, and market trends. Knowing these distinctions helps investors tailor strategies, manage risks, and optimize portfolio diversification effectively. Informed decisions in each category enhance potential returns and safeguard against market fluctuations.

Comparison Table

| Aspect | Collectibles Investment | Art Investment |

|---|---|---|

| Definition | Tangible rare items like coins, stamps, toys | Original works such as paintings, sculptures |

| Market Liquidity | Moderate; niche markets | Varies; often higher in established art markets |

| Valuation | Based on rarity, demand, condition | Driven by artist reputation, provenance, style |

| Investment Horizon | Medium to long-term | Long-term, often decades |

| Risk Level | Moderate; subject to market trends and fakes | Higher; influenced by market trends and authenticity |

| Storage & Maintenance | Requires protection against damage and deterioration | Needs controlled environment to preserve quality |

| Returns | Variable; some collectibles appreciate significantly | Potentially high, especially for renowned artists |

Which is better?

Art investment generally offers higher liquidity and potential for long-term appreciation compared to collectibles, which often have a narrower market and are subject to trends. Art pieces by renowned artists tend to retain and increase value due to their cultural significance and scarcity, whereas collectibles like rare toys or sports memorabilia can fluctuate greatly in demand. Institutional recognition and the presence of established auction houses for art provide greater transparency and valuation stability relative to many collectible markets.

Connection

Collectibles investment and art investment both focus on acquiring tangible assets that appreciate through rarity, provenance, and historical significance. Market demand for unique items, such as limited-edition collectibles or renowned artworks, drives value growth and diversification benefits. Both investment types require expert knowledge to assess authenticity, condition, and market trends, impacting potential returns significantly.

Key Terms

**Art Investment:**

Art investment offers unique potential for long-term value appreciation by acquiring works from established and emerging artists in the global art market. Unlike collectibles, art often benefits from expert authentication, provenance documentation, and gallery representation, which enhance its market liquidity and historical significance. Explore the dynamics of art investment strategies and market trends to make informed decisions.

Provenance

Provenance is a critical factor distinguishing art investment from collectibles investment, as verified ownership history enhances the value and authenticity of artworks more significantly than many collectibles. Art investors rely on detailed provenance records to reduce the risk of forgery and to establish cultural and historical significance, which directly influences market price. Explore the nuances of provenance in art and collectibles to make informed investment decisions.

Authenticity

Art investment demands rigorous authentication to ensure provenance and avoid forgeries, directly impacting value and liquidity. Collectibles investment also hinges on authenticity, verified through expert grading and certification to preserve rarity and market desirability. Discover deeper insights on how authenticity shapes returns in both art and collectibles markets.

Source and External Links

Basics of Art Funds and their Managers, The Art Fund Association - Art investment funds use strategies like "buy and hold," geographic arbitrage, and focus on specific artists or regions to generate returns and offer diversification benefits with low correlation to traditional stocks and bonds.

Investing in art: What to know about turning a passion into a ... - Art investments can diversify portfolios and provide inflation protection but carry risks including illiquidity, fluctuating cultural trends, and the need for proper care and provenance verification.

How to Invest in Art: A Seven-Point Guide to Help You Understand ... - Art is a superior passion investment compared to luxury cars or wines, offering sustainable appreciation, low maintenance, and is favored by ultra-high-net-worth individuals for portfolio diversification.

dowidth.com

dowidth.com