Digital real estate offers investors passive income through virtual property ownership on platforms like Decentraland and The Sandbox, benefiting from low entry costs and growing market demand. Startup equity involves buying shares in early-stage companies with high growth potential but increased risk and longer return horizons. Explore detailed comparisons to determine which investment aligns best with your financial goals.

Why it is important

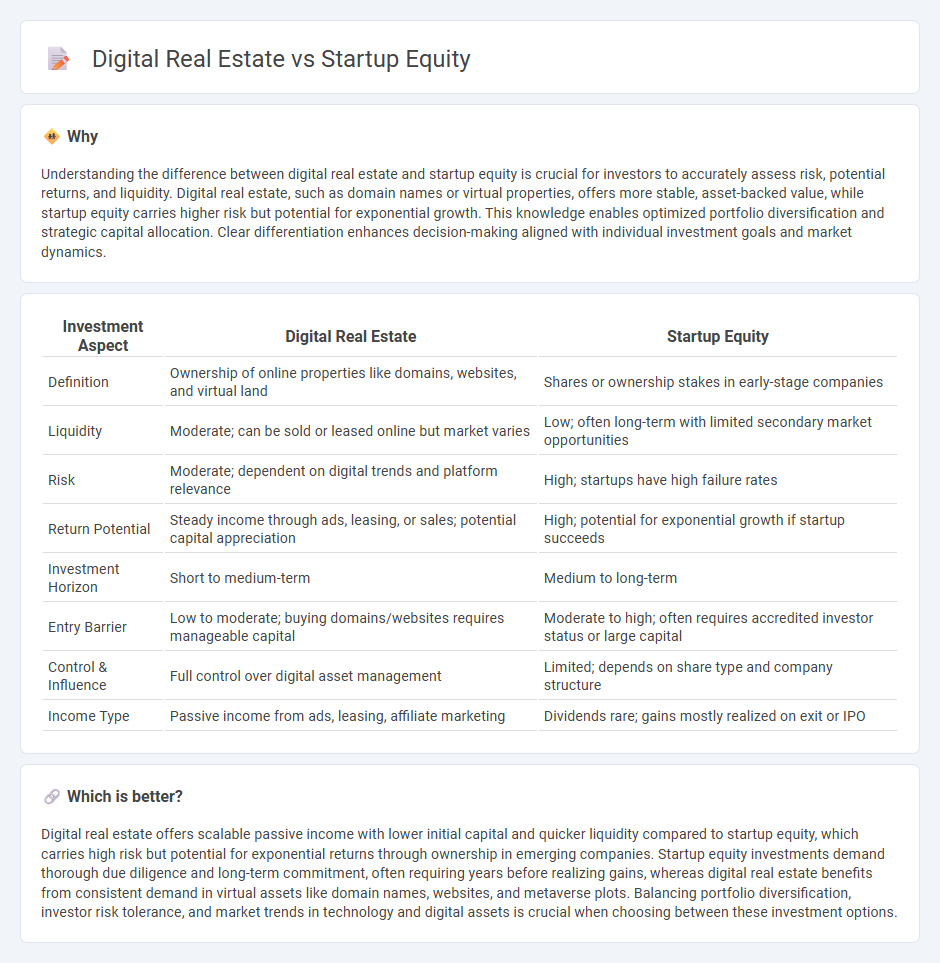

Understanding the difference between digital real estate and startup equity is crucial for investors to accurately assess risk, potential returns, and liquidity. Digital real estate, such as domain names or virtual properties, offers more stable, asset-backed value, while startup equity carries higher risk but potential for exponential growth. This knowledge enables optimized portfolio diversification and strategic capital allocation. Clear differentiation enhances decision-making aligned with individual investment goals and market dynamics.

Comparison Table

| Investment Aspect | Digital Real Estate | Startup Equity |

|---|---|---|

| Definition | Ownership of online properties like domains, websites, and virtual land | Shares or ownership stakes in early-stage companies |

| Liquidity | Moderate; can be sold or leased online but market varies | Low; often long-term with limited secondary market opportunities |

| Risk | Moderate; dependent on digital trends and platform relevance | High; startups have high failure rates |

| Return Potential | Steady income through ads, leasing, or sales; potential capital appreciation | High; potential for exponential growth if startup succeeds |

| Investment Horizon | Short to medium-term | Medium to long-term |

| Entry Barrier | Low to moderate; buying domains/websites requires manageable capital | Moderate to high; often requires accredited investor status or large capital |

| Control & Influence | Full control over digital asset management | Limited; depends on share type and company structure |

| Income Type | Passive income from ads, leasing, affiliate marketing | Dividends rare; gains mostly realized on exit or IPO |

Which is better?

Digital real estate offers scalable passive income with lower initial capital and quicker liquidity compared to startup equity, which carries high risk but potential for exponential returns through ownership in emerging companies. Startup equity investments demand thorough due diligence and long-term commitment, often requiring years before realizing gains, whereas digital real estate benefits from consistent demand in virtual assets like domain names, websites, and metaverse plots. Balancing portfolio diversification, investor risk tolerance, and market trends in technology and digital assets is crucial when choosing between these investment options.

Connection

Digital real estate represents ownership of online assets like websites and domain names, while startup equity involves holding shares in early-stage companies; both serve as alternative investment vehicles with high growth potential. Investors leverage digital real estate for passive income through advertising and leasing, similar to how startup equity offers returns via company growth and potential exits. The convergence emerges as tech startups often develop digital properties to scale, making equity stakes linked to valuable digital real estate assets.

Key Terms

Ownership Stake

Startup equity offers ownership in a high-growth company with potential dividends and voting rights, reflecting direct influence in the business's strategic direction. Digital real estate, such as domain names or virtual properties, provides ownership in online assets that can generate passive income through leasing or advertising, benefiting from increasing digital market value. Explore in-depth comparisons to understand which ownership stake aligns best with your investment goals.

Asset Valuation

Startup equity valuation heavily depends on projected cash flows, market potential, and competitive advantages, often leading to high volatility and speculation. Digital real estate valuation is grounded in metrics such as web traffic, domain authority, and revenue generation through ads or e-commerce, offering more tangible data for asset assessment. Explore comprehensive strategies to accurately assess and maximize your investment value in both startup equity and digital real estate.

Liquidity

Startup equity often faces limited liquidity due to long lock-up periods and dependence on company exit events such as IPOs or acquisitions. Digital real estate, including domains and virtual land, offers greater liquidity through active secondary markets and instant transactions. Explore how liquidity dynamics impact investment strategies in startup equity versus digital real estate to optimize your portfolio.

Source and External Links

Managing startup equity: Answers to key questions - Startup equity represents ownership as a percentage of shares and is calculated by dividing the number of shares owned by the total shares; it is commonly distributed to employees as compensation with varying amounts depending on the startup's stage, role, and growth potential.

How to split equity among startup cofounders - Stripe - Startup equity entails ownership often granted via stock options or shares, serving as financial incentive and compensation for founders and early team members, with equity splits requiring careful planning to avoid conflicts and ensure alignment.

A Guide to Startup Equity Compensation - HubSpot - Startup equity compensation is a way for early-stage companies to attract and retain employees by offering ownership stakes as part of payment, helping manage limited cash budgets while providing potential financial upside if the company exits or goes public.

dowidth.com

dowidth.com