Social token investment allows individuals to purchase digital assets representing ownership or participation in a community, offering liquidity and direct engagement with creators. Crowdfunding investment pools funds from multiple backers to support a project or business, often providing early access or rewards but less liquidity. Discover the key differences and benefits of social token versus crowdfunding investments to make informed financial decisions.

Why it is important

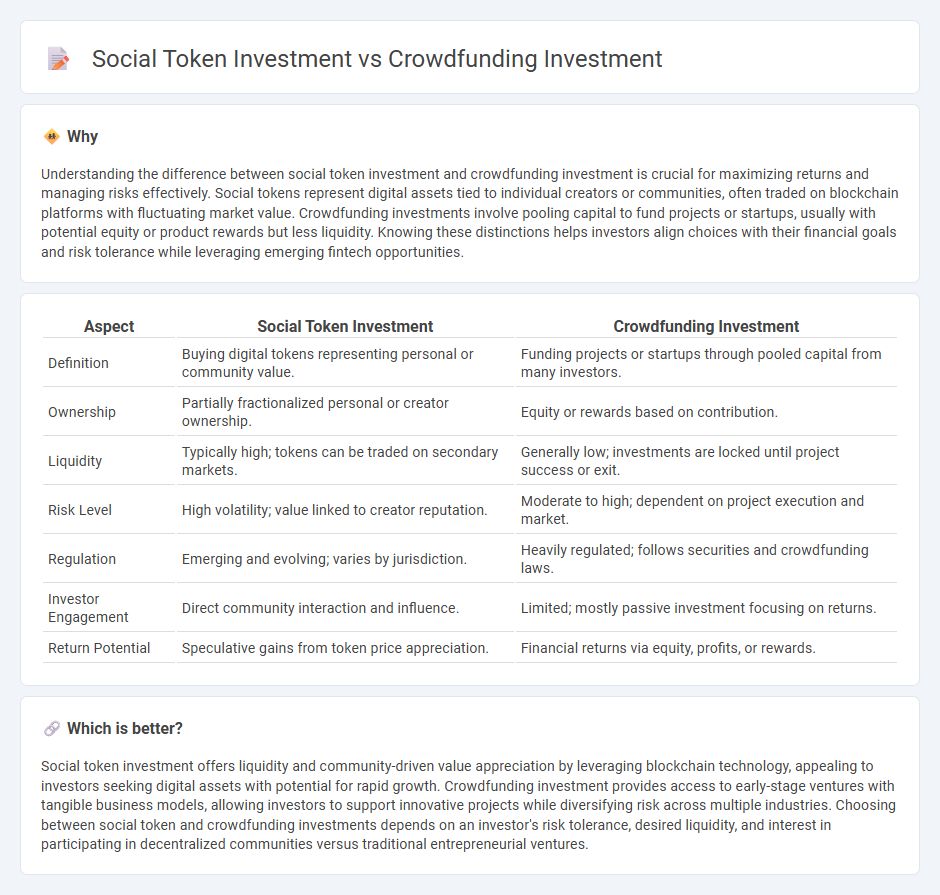

Understanding the difference between social token investment and crowdfunding investment is crucial for maximizing returns and managing risks effectively. Social tokens represent digital assets tied to individual creators or communities, often traded on blockchain platforms with fluctuating market value. Crowdfunding investments involve pooling capital to fund projects or startups, usually with potential equity or product rewards but less liquidity. Knowing these distinctions helps investors align choices with their financial goals and risk tolerance while leveraging emerging fintech opportunities.

Comparison Table

| Aspect | Social Token Investment | Crowdfunding Investment |

|---|---|---|

| Definition | Buying digital tokens representing personal or community value. | Funding projects or startups through pooled capital from many investors. |

| Ownership | Partially fractionalized personal or creator ownership. | Equity or rewards based on contribution. |

| Liquidity | Typically high; tokens can be traded on secondary markets. | Generally low; investments are locked until project success or exit. |

| Risk Level | High volatility; value linked to creator reputation. | Moderate to high; dependent on project execution and market. |

| Regulation | Emerging and evolving; varies by jurisdiction. | Heavily regulated; follows securities and crowdfunding laws. |

| Investor Engagement | Direct community interaction and influence. | Limited; mostly passive investment focusing on returns. |

| Return Potential | Speculative gains from token price appreciation. | Financial returns via equity, profits, or rewards. |

Which is better?

Social token investment offers liquidity and community-driven value appreciation by leveraging blockchain technology, appealing to investors seeking digital assets with potential for rapid growth. Crowdfunding investment provides access to early-stage ventures with tangible business models, allowing investors to support innovative projects while diversifying risk across multiple industries. Choosing between social token and crowdfunding investments depends on an investor's risk tolerance, desired liquidity, and interest in participating in decentralized communities versus traditional entrepreneurial ventures.

Connection

Social token investment and crowdfunding investment are interconnected through their reliance on community-driven funding models that empower individuals to support projects or creators directly. Both approaches utilize blockchain technology to enhance transparency, liquidity, and democratize access to investment opportunities, enabling broader participation beyond traditional financial systems. By leveraging social tokens within crowdfunding platforms, investors gain unique digital assets that represent their stake, encouraging engagement and long-term value creation.

Key Terms

Crowdfunding investment:

Crowdfunding investment allows individuals to contribute capital directly to startups or projects, typically in exchange for equity or rewards, fostering community engagement and early-stage funding opportunities. Platforms like Kickstarter, Indiegogo, and SeedInvest provide structured environments for diverse investor participation, minimizing entry barriers and democratizing access to growth potential. Explore detailed comparisons to understand which investment model aligns best with your financial goals.

Equity

Equity crowdfunding allows investors to acquire ownership shares in startups or growing companies, providing direct financial stakes and potential dividends. Social token investments represent digital assets linked to individuals or communities, often granting access or influence without traditional equity rights. Explore how these distinct investment models impact shareholder value and investor benefits.

Platform

Crowdfunding platforms like Kickstarter and Indiegogo enable investors to fund projects or startups in exchange for early access or rewards, emphasizing transparency and community engagement. Social token platforms such as Rally or Roll focus on decentralized digital assets that represent personal or community value, fostering direct creator-audience financial relationships via blockchain technology. Explore the unique features and benefits of each platform to determine the best fit for your investment strategy.

Source and External Links

5 Best Crowdfunding Platforms For Investing In Startups | Bankrate - Crowdfunding investment allows individuals to invest in startups through reward-based, equity, or debt models, enabling access to ownership or returns without requiring large capital sums, with popular platforms like Wefunder, StartEngine, and Fundrise facilitating these investments.

Crowdfunding Offerings and Investments - Equity crowdfunding lets companies raise capital online by selling shares via an intermediary portal, subject to regulations like SEC's Reg CF, with non-accredited investors facing limits on investment amounts while companies benefit from access to funding without traditional loans.

StartEngine: Invest in Startups Online - StartEngine enables everyday people to securely invest in startups by buying shares, with investment limits based on accreditation and income levels, and even offers integration to invest through self-directed IRAs, making startup investing more accessible and flexible.

dowidth.com

dowidth.com